You can find more details about this exchange traded fund (ETF) in its prospectus. Before you invest, consider how the ETF would work with your other investments and your risk tolerance. The value of the ETF can go down as well as up. You could lose money. ETFs do not have any guarantees. You may not get back the amount of money you invest. You may have to pay a commission every time you buy and sell units of the ETF. Commissions may vary by brokerage firm.

ZID ETF Review

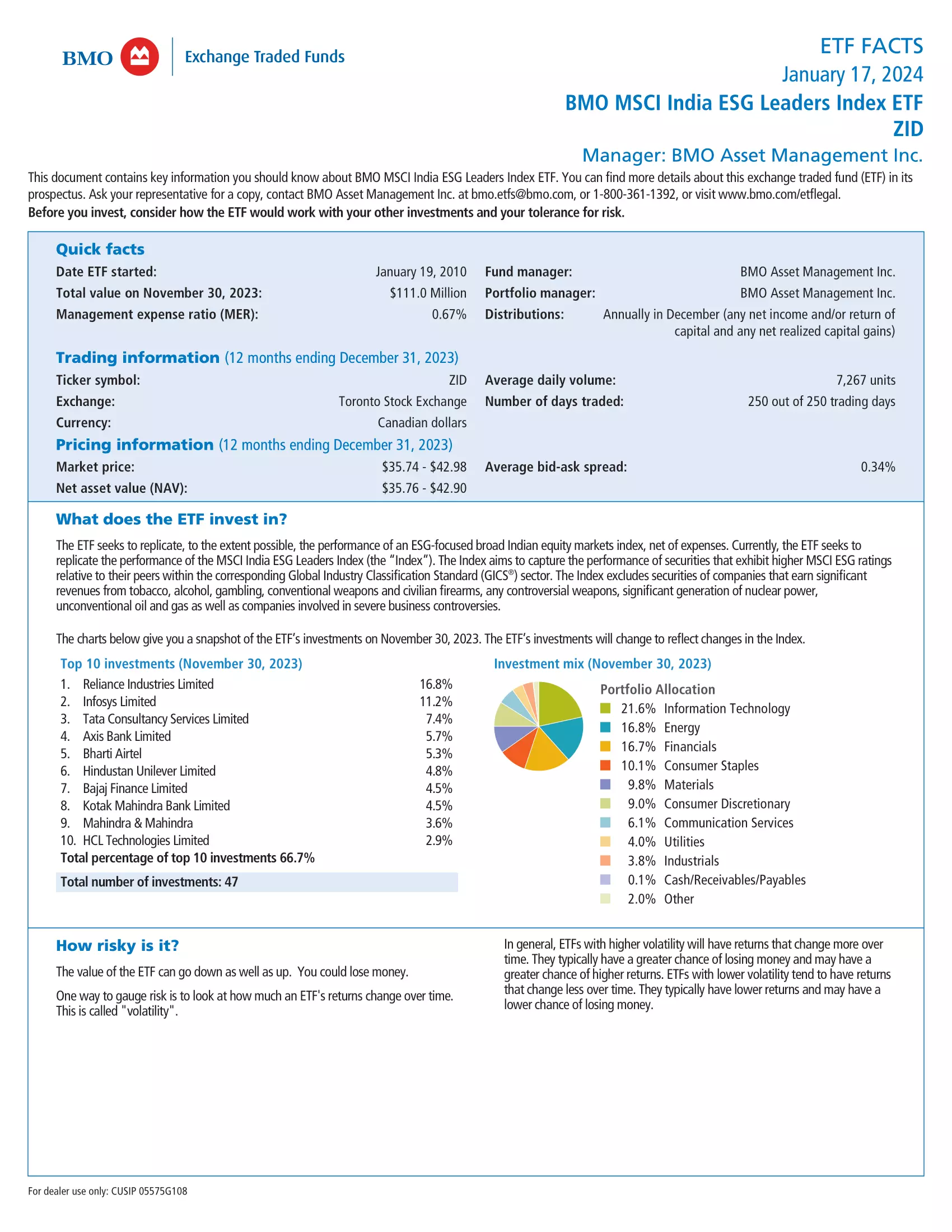

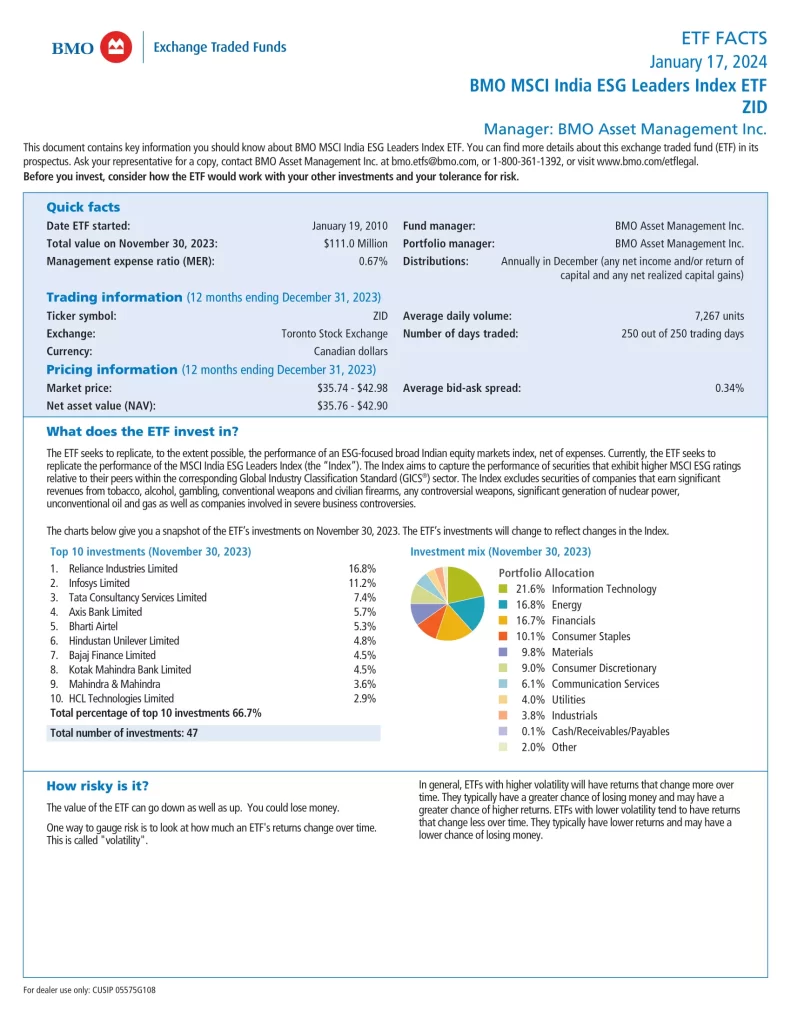

The BMO MSCI India ESG Leaders Index ETF (ZID) has been designed to replicate, to the extent possible, the MSCI India ESG Leaders Index (Index) performance. The ETF invests in Indian companies with higher MSCI ESG ratings than their peers. The ETF invests in and holds the Constituent Securities of the Index in the same proportion as they are reflected in the Index. The MSCI India ESG Leaders Index is based on the MSCI India Index, which includes large and mid-capitalization stocks across India. The Index aims to capture the performance of securities assigned higher ESG ratings by MSCI relative to their peers and targets 50% of the market capitalization within each sector. The Index excludes securities of companies that earn significant revenues from tobacco, alcohol, gambling, conventional weapons and civilian firearms, any controversial weapons, significant generation of nuclear power as well as companies involved in severe business controversies. The portfolio is weighted by market capitalization and is re-balanced quarterly.

ZID vs Similar ETFs

Quickly compare ZID to other investments focused on Indian equities by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager | ETF | Inception | MER | AUM | Holdings | Beta | P/E | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BMO | ZID | 2010-01-19 | 0.67% | $96,420,000 | 53 | 0.56 | N/A | 1.13% | Annually | 25.50% | 12.57% | 11.14% | 13.46% | N/A |

Conclusion

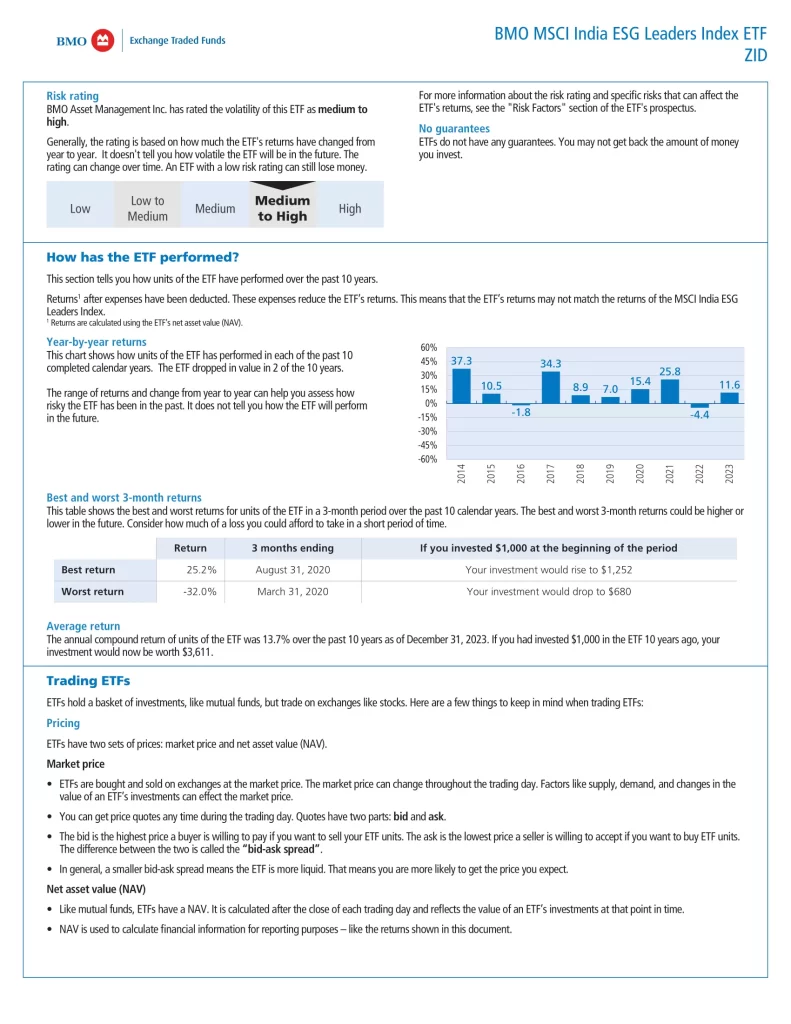

One way to gauge risk is to look at how much an ETF’s returns change over time. This is called volatility. In general, ETFs with higher volatility will have returns that change more over time. They typically have a greater chance of losing money and may have a greater chance of higher returns. ETFs with lower volatility tend to have returns that change less over time. They typically have lower returns and may have a lower chance of losing money. An ETF with a low-risk rating can still lose money. The bid is the highest price a buyer is willing to pay if you want to sell your ETF units. The ask is the lowest price a seller is willing to accept if you want to buy ETF units. The difference between the two is called the bid-ask spread. In general, a smaller bid-ask spread means the ETF is more liquid. That means you are more likely to get the price you expect. In general, market prices of ETFs can be more volatile around the start and end of the trading day.