ZLB ETF Review

BMO Low Volatility Canadian Equity ETF (ZLB) seeks to provide exposure to the performance of a portfolio of Canadian equities that have lower sensitivity to market movements with the potential for long-term capital appreciation. ZLB has been designed to provide exposure to a low-beta-weighted portfolio of Canadian stocks. Beta measures the security’s sensitivity to market movements. ZLB utilizes a rules-based methodology to build a portfolio of less market-sensitive stocks from a universe of Canadian large-cap stocks. The underlying portfolio is rebalanced every June and reconstituted in December.

- Designed for investors looking for growth solutions

- Holdings consist of Canadian equities with lower volatility than the market

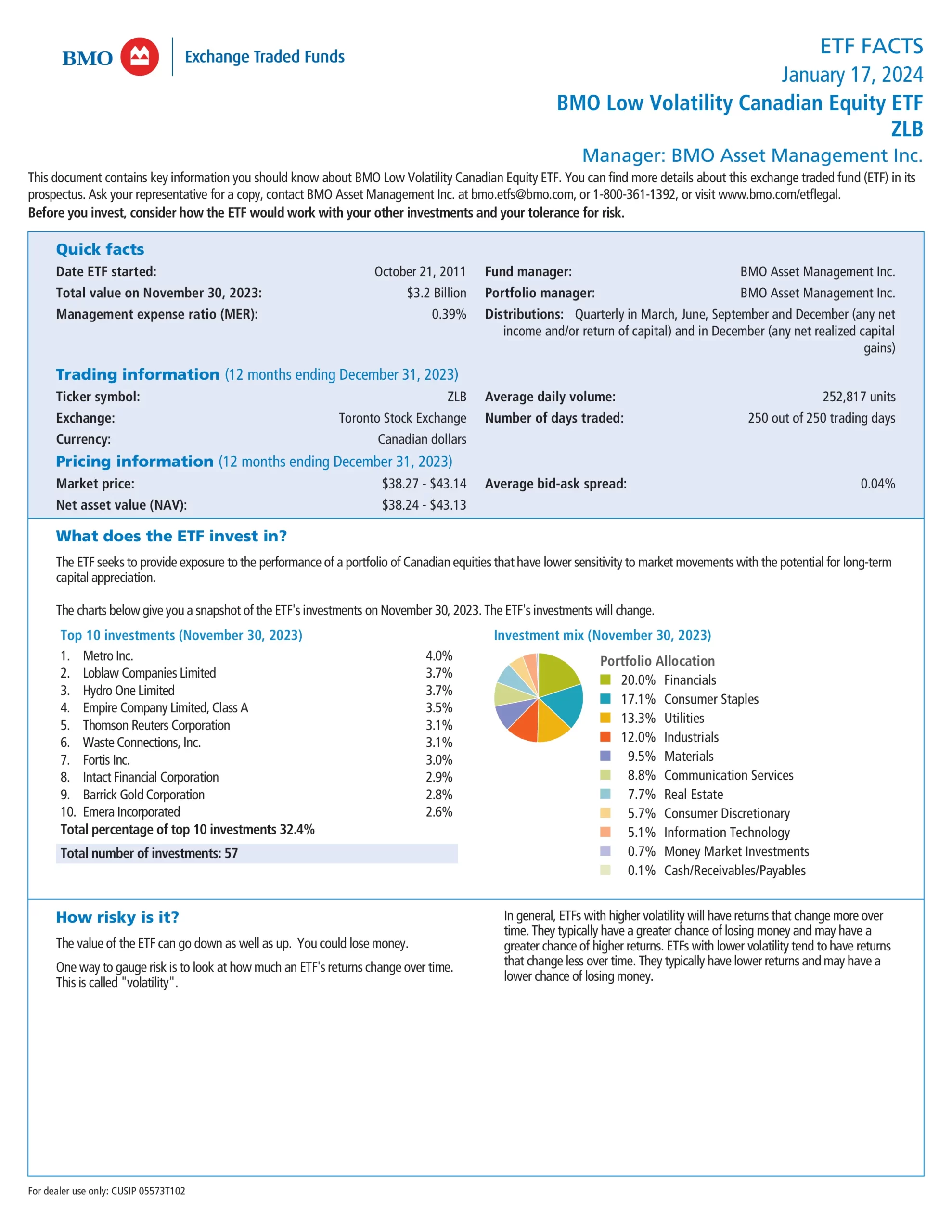

Top 10 ZLB Holdings

The top 10 investments of ZLB account for 32.4% of the total holdings.

| Ticker | Name | Weight |

|---|---|---|

| L | Loblaw Companies Ltd | 4.42% |

| MRU | Metro Inc. | 3.99% |

| WCN | Waste Connections, Inc. | 3.62% |

| H | Hydro One Limited | 3.61% |

| TRI | Thomson Reuters Corporation | 3.29% |

| EMP.A | Empire Company Limited | 2.98% |

| IFC | Intact Financial Corporation | 2.89% |

| FTS | Fortis Inc. | 2.79% |

| X | TMX Group Limited | 2.78% |

| FFH | Fairfax Financial Holdings Limited | 2.65% |

ZLB vs Similar ETFs

Quickly compare and contrast ZLB to other investments focused on Canadian equities by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager | ETF | Inception | MER | AUM | Holdings | Beta | P/E | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BlackRock | XIU | 1999-09-28 | 0.18% | $10,898,997,158 | 61 | 1.00 | 13.24 | 3.15% | Quarterly | 4.68% | 10.54% | 9.77% | 8.08% | 9.20% |

| BlackRock | XMV | 2012-07-24 | 0.33% | $198,498,565 | 66 | 0.80 | 17.64 | 2.72% | Quarterly | 11.31% | 12.54% | 9.62% | 8.31% | N/A |

| BMO | ZLB | 2011-10-21 | 0.39% | $3,414,440,000 | 52 | 0.70 | N/A | 2.64% | Quarterly | 5.42% | 11.26% | 9.54% | 10.18% | N/A |

| Vanguard | VDY | 2012-11-02 | 0.22% | $2,360,000,000 | 52 | 0.95 | N/A | 2.64% | Monthly | 0.76% | 13.25% | 10.07% | 8.01% | N/A |

ZLB vs XIU

ZLB is the superior performing and less volatile ETF than XIU which is the older, less expensive, more popular, more diversified and higher yielding. Both ETFs have quarterly distributions.

ZLB vs VCN

ZLB is the superior performing, older and less volatile ETF than VCN which is less expensive, more popular, more diversified and higher yielding. Both ETFs have quarterly distributions.

ZLB vs XMV

ZLB is the superior performing, older, more diversified and less volatile ETF than XMV which is less expensive and higher yielding. Both ETFs have quarterly distributions.

ZLB vs VDY

ZLB is the superior performing, older, more popular and less volatile ETF than VDY which is less expensive, higher yielding and has monthly distributions.

Conclusion

BMO Low Volatility Canadian Equity ETF (ZLB) is a great long-term growth and income investment to gain exposure to Canadian equities. ZLB is a convenient and low-cost way to invest in low-volatility stocks that have outperformed many other similar ETFs.