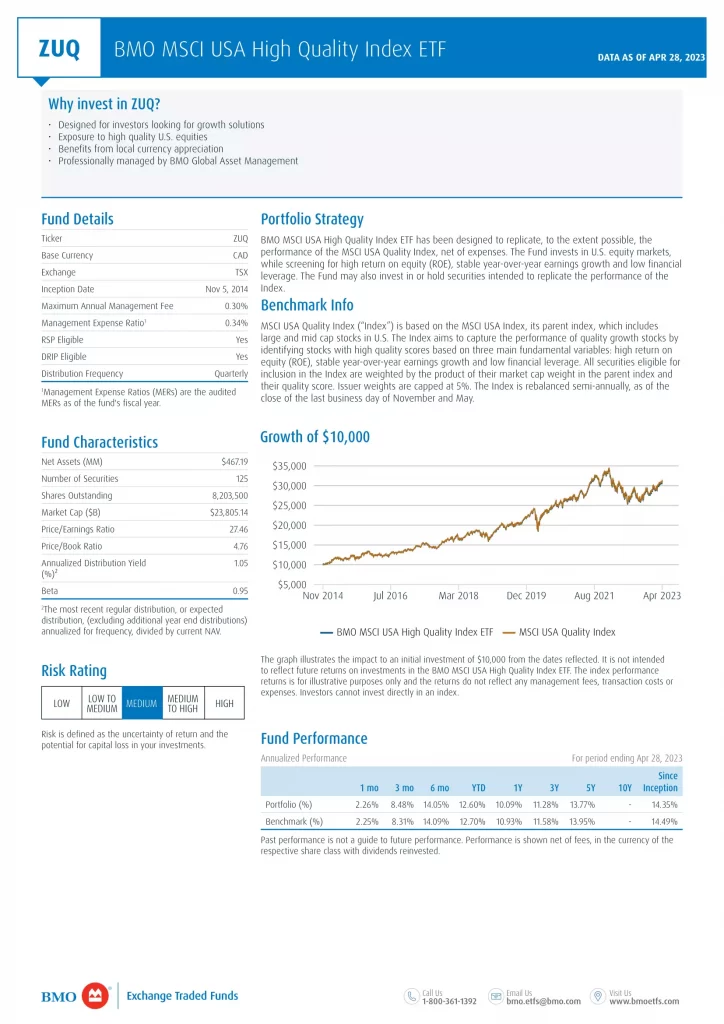

BMO MSCI USA High Quality Index ETF (ZUQ.TO) has been designed to replicate, to the extent possible, the performance of the MSCI USA Quality Index, net of expenses. The Fund invests in U.S. equity markets, while screening for high return on equity (ROE), stable year-over-year earnings growth and low financial leverage. The Fund may also invest in or hold securities intended to replicate the performance of the Index.

An Exchange Traded Fund (ETF) is a collection of hundreds or thousands of stocks or bonds in a single fund that trades on major stock exchanges. ETFs combine the diversification of mutual funds with lower investment minimum and real-time pricing.

ZUQ ETF Review

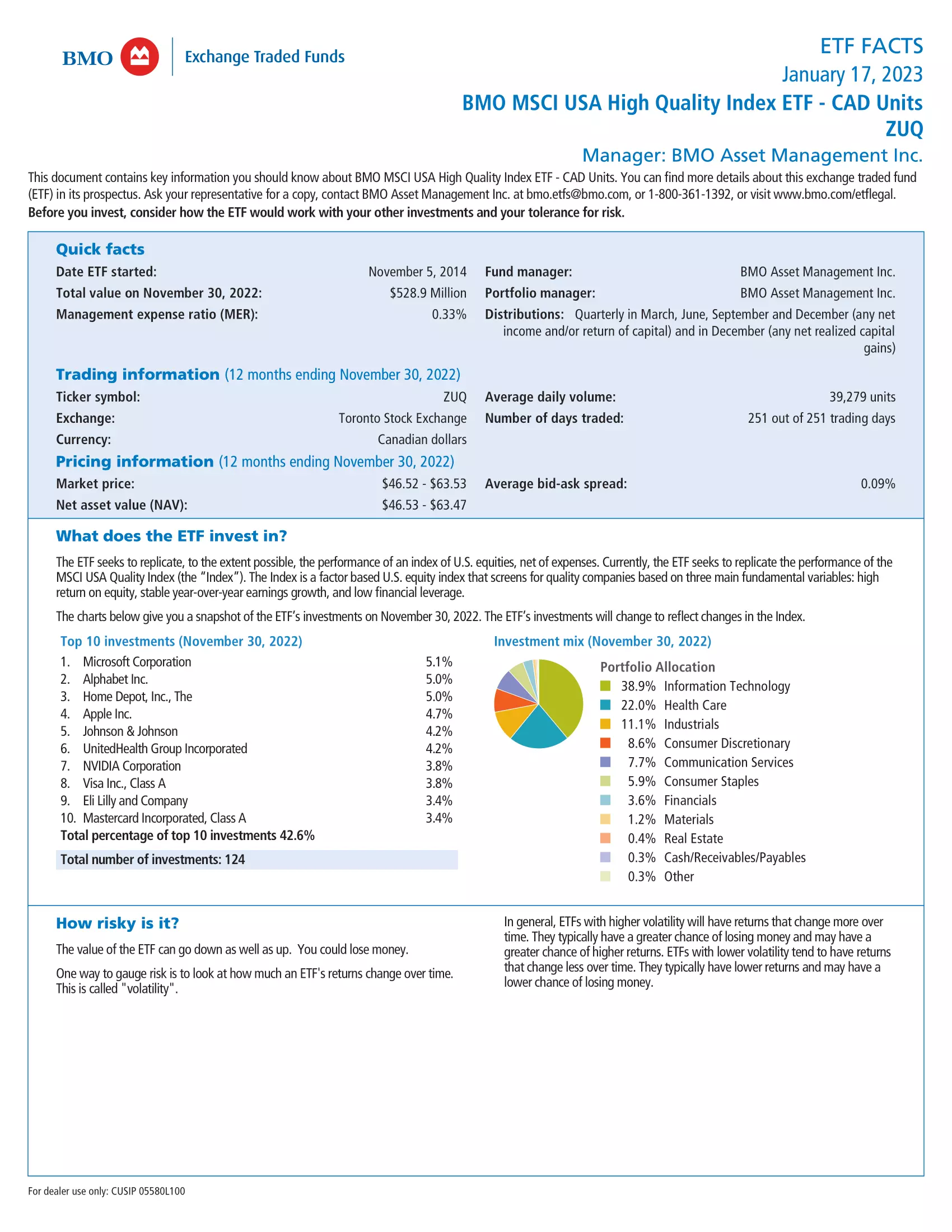

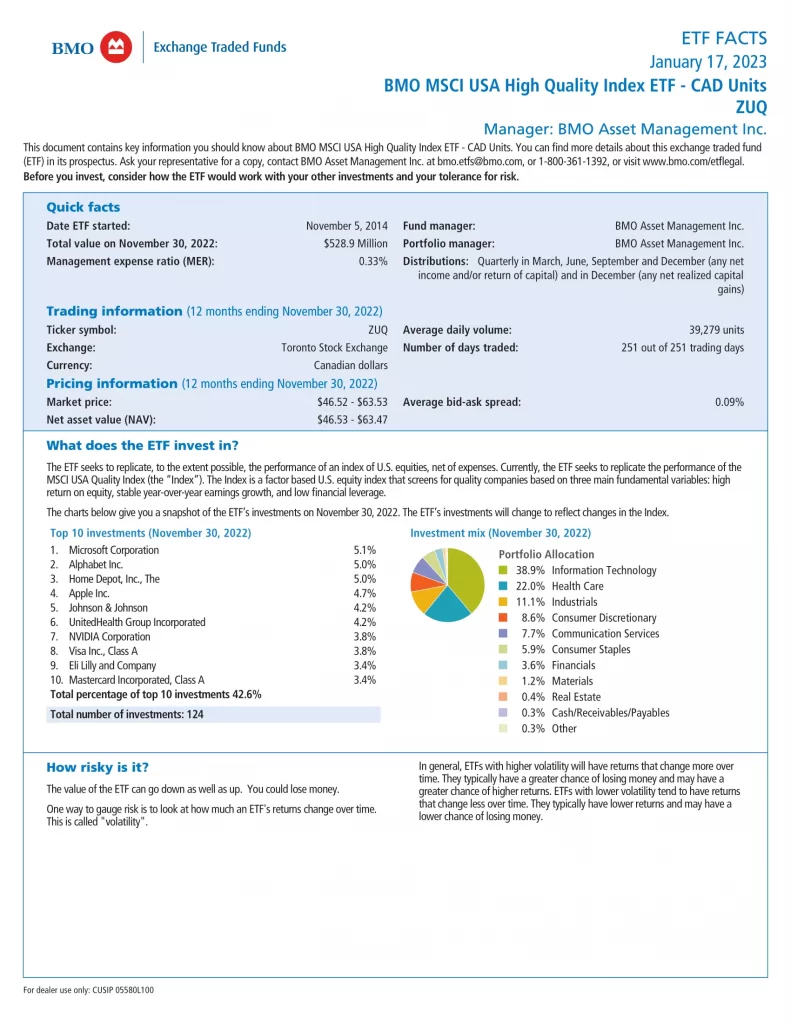

BMO MSCI USA High Quality Index ETF (ZUQ) invests in the MSCI USA Quality Index (“Index”) is based on the MSCI USA Index, its parent index, which includes large and mid cap stocks in U.S. The Index aims to capture the performance of quality growth stocks by identifying stocks with high quality scores based on three main fundamental variables: high return on equity (ROE), stable year-over-year earnings growth and low financial leverage. All securities eligible for inclusion in the Index are weighted by the product of their market cap weight in the parent index and their quality score. Issuer weights are capped at 5%. The Index is rebalanced semi-annually, as of the close of the last business day of November and May.

ZUQ vs. Requested and Similar ETFs

- DGR-B.TO: CI WisdomTree U.S. Quality Dividend Growth Index ETF

- HXS.TO: Horizons S&P 500 Index ETF

- VFV.TO: Vanguard S&P 500 Index ETF

- XUS.TO: iShares Core S&P 500 Index ETF

- ZSP.TO: BMO S&P 500 Index ETF (USD)

- ZUQ.TO: BMO MSCI USA High Quality Index ETF

Here is a table comparing similar American Equity ETFs as of April 30, 2023.

| Manager |  |  |  |  |  |  |

| ETF | XUS.TO | ZUQ.TO | ZSP.TO | DGR-B.TO | HXS.TO | VFV.TO |

| Inception | 2013-04-10 | 2014-11-05 | 2012-11-14 | 2016-07-12 | 2010-11-30 | 2012-11-02 |

| AUM | $4,718,155,285 | $492,290,000 | $9,236,230,000 | $138,500,000 | $2,470,906,143 | $7,330,000,000 |

| Holdings | 503 | 127 | 504 | 300 | 16 | 506 |

| MER | 0.10% | 0.34% | 0.09% | 0.38% | 0.10% | 0.09% |

| Risk | Medium | Medium | Medium | Medium | Medium | Medium |

| Yield | 1.28% | 1.02% | 1.49% | 1.47% | 1.66% | 1.6% |

| Distributions | Semi-Annual | Quarterly | Quarterly | Quarterly | N/A | Quarterly |

| P/E | 20.45 | 27.46 | 25.90 | N/A | N/A | 20.9 |

| P/B | 3.82 | 4.76 | 4.01 | N/A | N/A | 3.8 |

| Beta | 0.97 | 1.03 | 0.97 | 0.75 | 0.95 | 0.97 |

| Manager |  |  |  |  |  |  |

| ETF | XUS.TO | ZUQ.TO | ZSP.TO | DGR-B.TO | HXS.TO | VFV.TO |

| YTD | 9.17% | -23.04% | 9.11% | 5.6% | 9.09% | 9.08% |

| 1MO | 1.77% | -4.91% | 1.79% | 2.1% | 1.78% | 1.79% |

| 3MO | 4.32% | -0.76% | 4.49% | 3.9% | 4.49% | N/A |

| 6MO | 7.83% | -14.47% | 7.81% | 6.7% | 7.81% | N/A |

| 1YR | 8.59% | 10.09% | 7.88% | 11.6% | 7.83% | 8.03% |

| 2YR | N/A | 5.65% | 6.16% | 11.2% | N/A | N/A |

| 3YR | 13.24% | 11.28% | 13.11% | 14.6% | 13.03% | 13.06% |

| 5YR | 12.28% | 13.77% | 12.25% | 12.8% | 12.19% | 12.23% |

| 10YR | 15.17% | N/A | 15.11% | N/A | 15.08% | 15.14% |

Download an ETF Portfolio Builder for Canadians & Americans!

Discover exactly whch Exchange Traded Funds (ETFs) to buy for a diversified and risk-adjusted portfolio. Take advantage of irregularities in the market using tactical asset allocation (TAA) instead of purchasing a one-fits-all investment from a financial institution. By making a one-time purchase of this inexpensive app below, you’ll have the recommendations of a financial advisor for the rest of your life. This will avoid you paying management expenses of approximately 0.4 – 1.25%.

HINT: Make sure to adjust your portfolio with each update provided throughout the year.

Book a Coaching Session Today!

For more tips and advice you can book a coaching session with me for assistance building a portfolio and retirement planning.