More information about BMO Canadian High Dividend Covered Call ETF (ZWC) is in its prospectus. Before investing in an Exchange Traded Fund (ETF), it’s important to assess how it fits within your portfolio and aligns with your risk tolerance. ETF prices can also experience higher volatility during market openings and closings and there is always the possibility of losing money. It’s also worth noting that a narrower bid-ask spread generally indicates higher liquidity, meaning you’re more likely to execute trades at expected prices. Always consider these factors carefully when making investment decisions, as even ETFs considered low-risk can experience losses under certain market conditions.

ZWC ETF Review

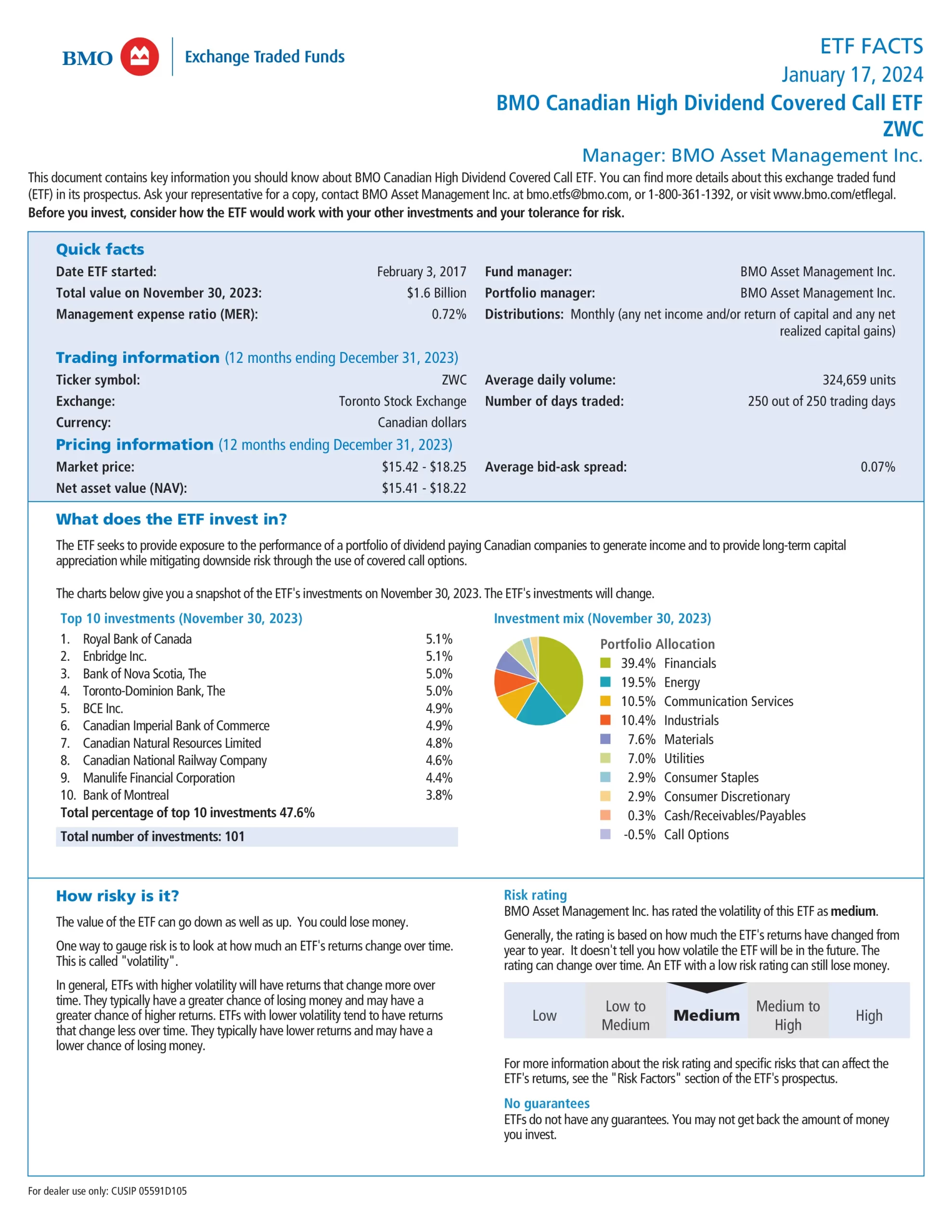

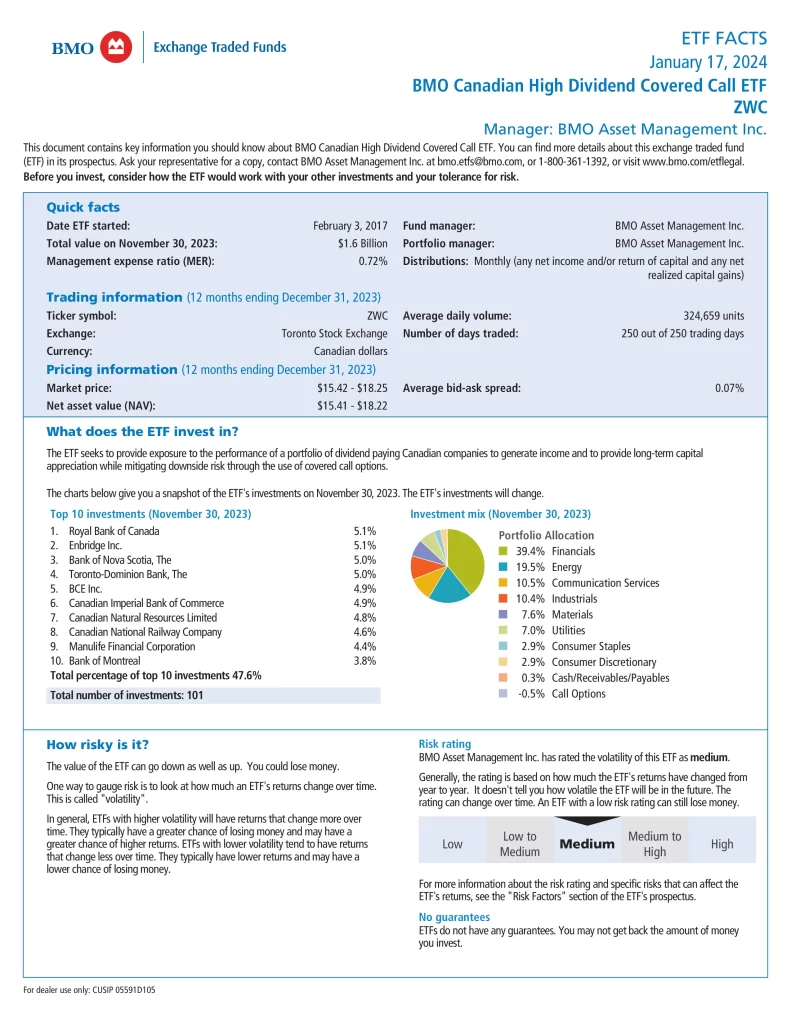

BMO Canadian High Dividend Covered Call ETF (ZWC) seeks to provide exposure to the performance of a portfolio of dividend paying Canadian companies to generate income and to provide long-term capital appreciation while mitigating downside risk through the use of covered call options. ZWC has been designed to provide exposure to a dividend focused portfolio, while earning call option premiums. The underlying portfolio is yield-weighted and broadly diversified across sectors. The Fund utilizes a rules based methodology that considers dividend growth rate, yield, and payout ratio. Securities will also be subject to a liquidity screen process. The ETF also dynamically writes covered call options. The call options are written out of the money and selected based on analyzing the option’s available premium. The option premium provides limited downside protection.

- Designed for investors looking for higher income from equity portfolios

- Invested in a diversified portfolio of high dividend Canadian companies

- Call option writing reduces volatility

Top 10 ZWC Holdings

The top 10 holdings of ZWC account for 47.6% of the total fund which consists of 101 diversified investments. This table shows the investment names of the individual holdings that are subject to change.

| Ticker | Name | Weight |

|---|---|---|

| TD | TORONTO-DOMINION BANK/THE | 5.37% |

| ENB | ENBRIDGE INC | 5.09% |

| BNS | BANK OF NOVA SCOTIA/THE | 5.08% |

| RY | ROYAL BANK OF CANADA | 5.05% |

| CM | CANADIAN IMPERIAL BANK OF COMMERCE | 5.01% |

| CNR | CANADIAN NATIONAL RAILWAY CO | 4.62% |

| MFC | MANULIFE FINANCIAL CORP | 4.35% |

| CNQ | CANADIAN NATURAL RESOURCES LTD | 4.05% |

| BCE | BCE INC | 3.98% |

| BMO | BANK OF MONTREAL | 3.81% |

ZWC Dividend History

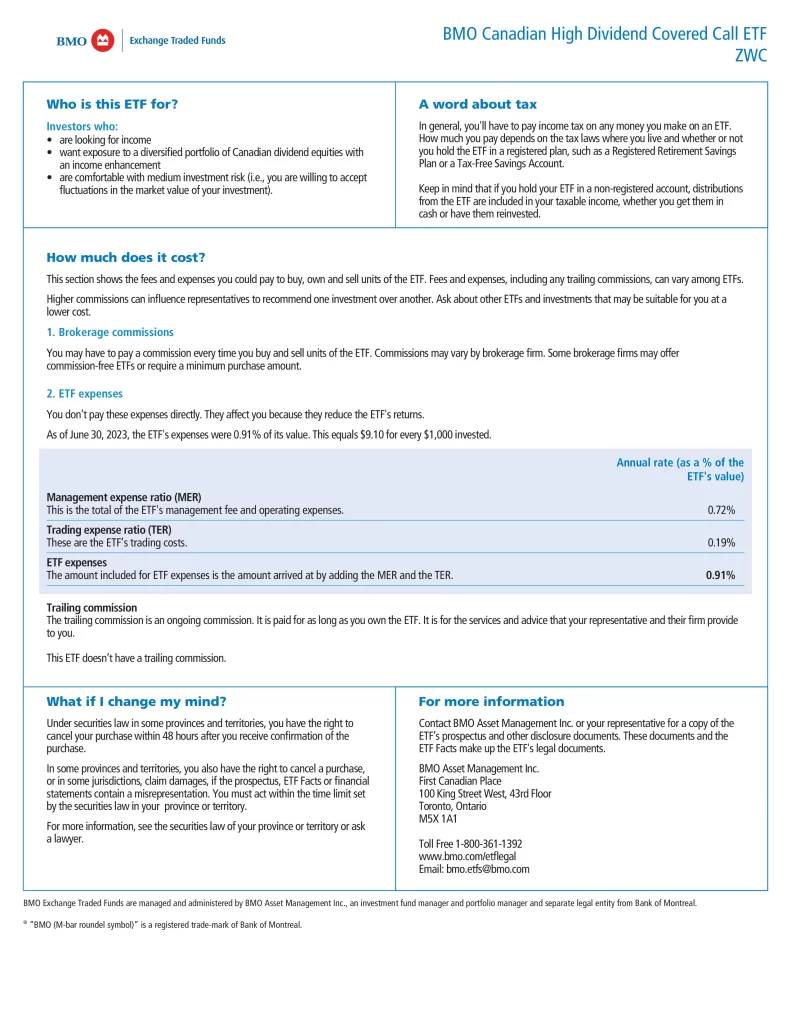

ZWC currently has a yield of 6.48% and pays distributions semi-annually. Most ETFs will distribute net taxable income to investors at least once a year. This is taxable income if generated from interest, dividends and capital gains by the securities within the ETF. The distributions will either be paid in cash or reinvested in the ETF at the discretion of the manager. This information will be reported in an official tax receipt provided to investors by their broker.

| Ex-Dividend Date | Record Date | Payable Date | Dividend |

|---|---|---|---|

| Jan 29, 2024 | Jan 30, 2024 | Feb 2, 2024 | $0.100000 |

| Feb 27, 2024 | Feb 28, 2024 | Mar 4, 2024 | $0.100000 |

| Mar 27, 2024 | Mar 28, 2024 | Apr 2, 2024 | $0.100000 |

| Apr 26, 2024 | Apr 29, 2024 | May 2, 2024 | $0.100000 |

| May 30, 2024 | May 30, 2024 | Jun 4, 2024 | $0.100000 |

| Jun 27, 2024 | Jun 27, 2024 | Jul 3, 2024 | $0.100000 |

| Jul 30, 2024 | Jul 30, 2024 | Aug 2, 2024 | $0.100000 |

| Aug 29, 2024 | Aug 29, 2024 | Sep 4, 2024 | $0.100000 |

| Sep 27, 2024 | Sep 27, 2024 | Oct 2, 2024 | $0.100000 |

| Oct 30, 2024 | Oct 30, 2024 | Nov 4, 2024 | $0.100000 |

| Nov 27, 2024 | Nov 27, 2024 | Dec 3, 2024 | $0.100000 |

| Dec 30, 2024 | Dec 30, 2024 | Jan 3, 2025 | $0.100000 |

Is ZWC a Good ETF?

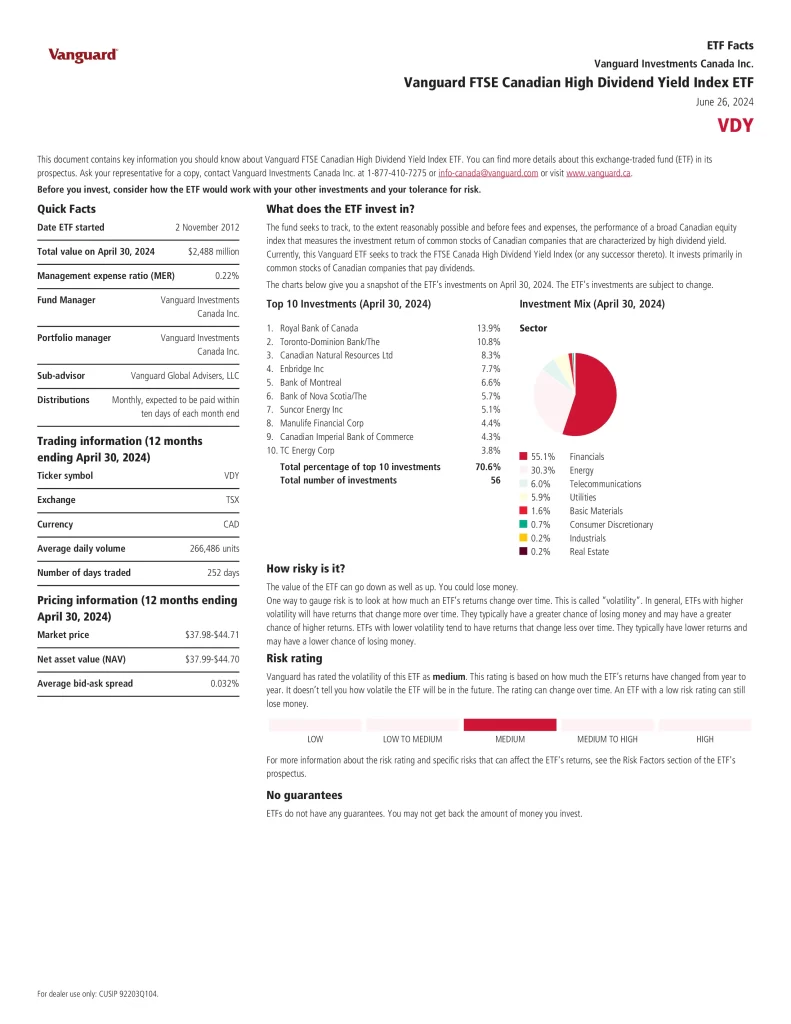

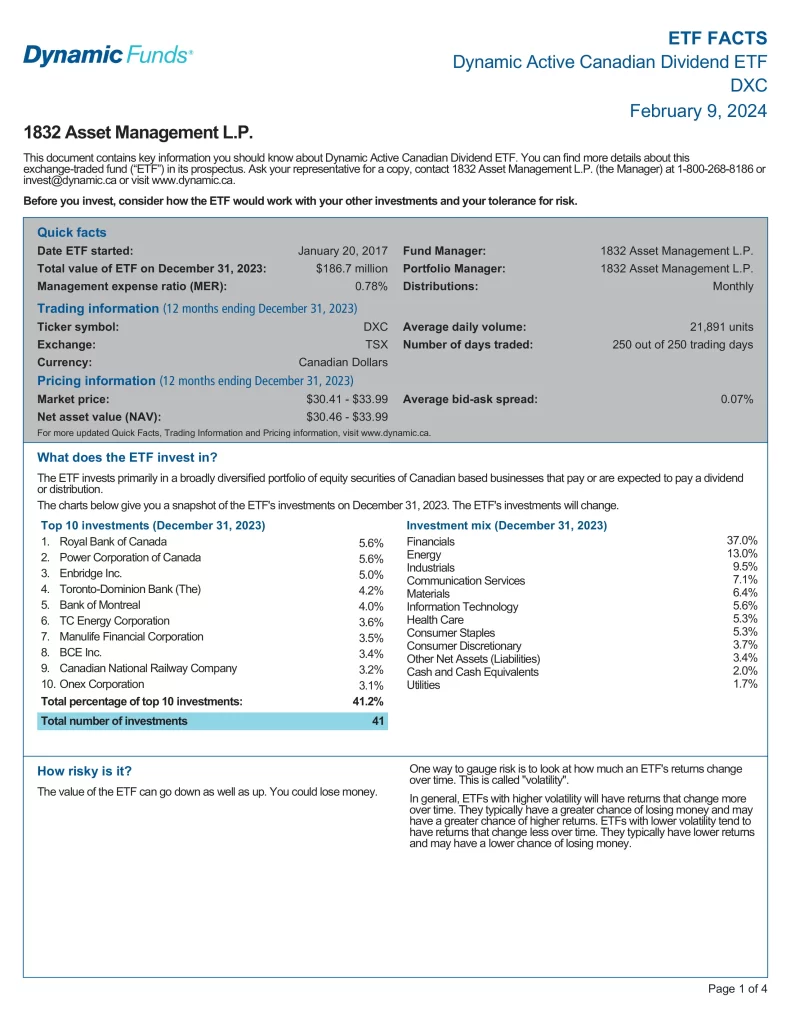

Quickly compare and contrast ZWC to other investments focused on Canadian equities by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager | ETF | Name | Risk | Inception | AUM | MER | P/E | Yield | Beta | Distributions | Holdings | 5Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BlackRock | XEI | iShares S&P/TSX Composite High Dividend Index ETF | Medium | 2011-04-12 | $1,730,180,828 | 0.22% | 11.72 | 4.87% | 0.91 | Monthly | 75 | 9.17% |

| BMO | ZCN | BMO S&P/TSX Capped Composite Index ETF | Medium | 2009-05-29 | $9,332,800,000 | 0.06% | 24.74 | 2.67% | 1.00 | Quarterly | 224 | 11.05% |

| BMO | ZDV | BMO Canadian Dividend ETF | Medium | 2011-11-21 | $1,134,600,000 | 0.39% | 19.36 | 3.76% | 0.93 | Monthly | 53 | 9.10% |

| BMO | ZWC | BMO Canadian High Dividend Covered Call ETF | Medium | 2017-02-03 | $1,605,920,000 | 0.72% | 18.35 | 6.48% | 0.88 | Monthly | 101 | 6.29% |

| Vanguard | VDY | Vanguard FTSE Canadian High Dividend Yield Index ETF | Medium | 2012-11-02 | $3,320,000,000 | 0.22% | 12.45 | 4.25% | 0.94 | Monthly | 56 | 12.14% |

Conclusion

BMO Canadian High Dividend Covered Call ETF (ZWC) is a convenient way to invest in Canadian stocks with a covered call strategy. The Fund’s return may not match the return of the underlying index. Growth stocks tend to be more sensitive to changes in their earnings and can be more volatile. Investments focused on a particular sector, such as healthcare, are subject to greater risk, and are more greatly impacted by market volatility than more diversified investments. A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets. Beta is a measure of risk representing how a security is expected to respond to general market movements.