Money market exchange-traded funds (ETFs) invest in short-term, low-risk, interest-bearing securities like Treasury bills, investment-grade bonds, and commercial paper. These ETFs are considered low risk, making them suitable for preserving capital and providing income during market uncertainty. Investors often use money market ETFs as a cash alternative because they offer slightly higher returns than traditional savings accounts while maintaining low volatility and easy access to funds.

This made them more appealing than bank accounts, where higher savings rates were slower to materialize. Another aspect of safety is the minimization of volatility. Even stable, well-established consumer staples companies experience share price fluctuations due to market dynamics. Similarly, bond values can fluctuate with changes in interest rates and credit conditions.

Money market ETFs prioritize capital preservation, liquidity, and returns closely aligned with the overnight rate. The overnight rate is the interest rate offered to the largest, most secure financial institutions, such as banks, and is usually set by the central bank overseeing the ETF’s target market. The overnight rate heavily influences the interest rates on easy-access bank accounts. However, money market ETFs can surpass the overnight rate because they hold some higher-yielding securities with maturity dates a few months out.

What is the Best Money Market ETF?

- FLTR: VanEck IG Floating Rate ETF

- PULS: PGIM Ultra Short Bond ETF

- JPST: JPMorgan Ultra-Short Income ETF

- GSY: Invesco Ultra Short Duration ETF

- RAVI: FlexShares Ultra-Short Income Fund

- USFR: WisdomTree Floating Rate Treasury Fund

- TFLO: iShares Treasury Floating Rate Bond ETF

- FTSM: First Trust Enhanced Short Maturity ETF

- GBIL: Goldman Sachs Access Treasury 0-1 Year ETF

- BIL: SPDR Bloomberg 1-3 Month T-Bill ETF

| ETF | Name | Inception | MER | AUM | Dividend Yield | 5Y |

|---|---|---|---|---|---|---|

| TFLO | iShares Treasury Floating Rate Bond ETF | 2014-02-04 | 0.15% | $7,017,479,150 | 5.24% | 2.18% |

| FTSM | First Trust Enhanced Short Maturity ETF | 2014-08-05 | 0.45% | $6,740,645,917 | 4.71% | 2.13% |

| RAVI | FlexShares Ultra-Short Income Fund | 2012-10-09 | 0.26% | $1,100,000,000 | 4.53% | 2.32% |

| GBIL | Goldman Sachs Access Treasury 0-1 Year ETF | 2016-09-06 | 0.14% | $5,691,460,000 | 4.75% | 1.99% |

| GSY | Invesco Ultra Short Duration ETF | 2008-02-12 | 0.23% | $2,065,300,000 | 5.45% | 2.35% |

| JPST | JPMorgan Ultra-Short Income ETF | 2017-05-17 | 0.18% | $22,790,000,000 | 4.77% | 2.49% |

| PULS | PGIM Ultra Short Bond ETF | 2018-04-05 | 0.15% | $5,279,880,402 | 5.44% | 2.83% |

| BIL | SPDR Bloomberg 1-3 Month T-Bill ETF | 2007-05-25 | 0.1356% | $32,065,870,000 | 5.13% | 1.98% |

| FLTR | VanEck IG Floating Rate ETF | 2011-04-25 | 0.14% | $1,150,000,000 | 6.02% | 3.17% |

| USFR | WisdomTree Floating Rate Treasury Fund | 2014-02-04 | 0.15% | $18,026,487,300 | 5.20% | 2.22% |

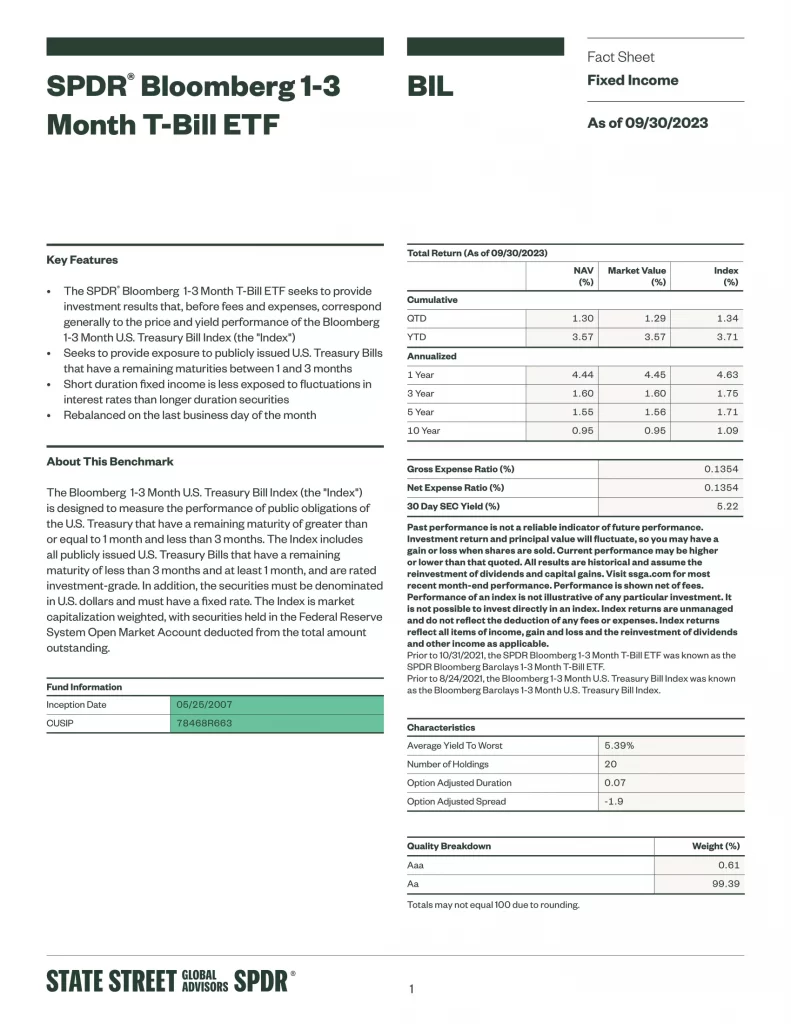

10. SPDR Bloomberg 1-3 Month T-Bill ETF

The SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) is designed to measure the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than or equal to 1 month and less than 3 months. The Index includes all publicly issued U.S. Treasury Bills that have a remaining maturity of less than 3 months and at least 1 month, and are rated investment-grade. In addition, the securities must be denominated in U.S. dollars and must have a fixed rate. The Index is market capitalization weighted, with securities held in the Federal Reserve System Open Market Account deducted from the total amount outstanding.

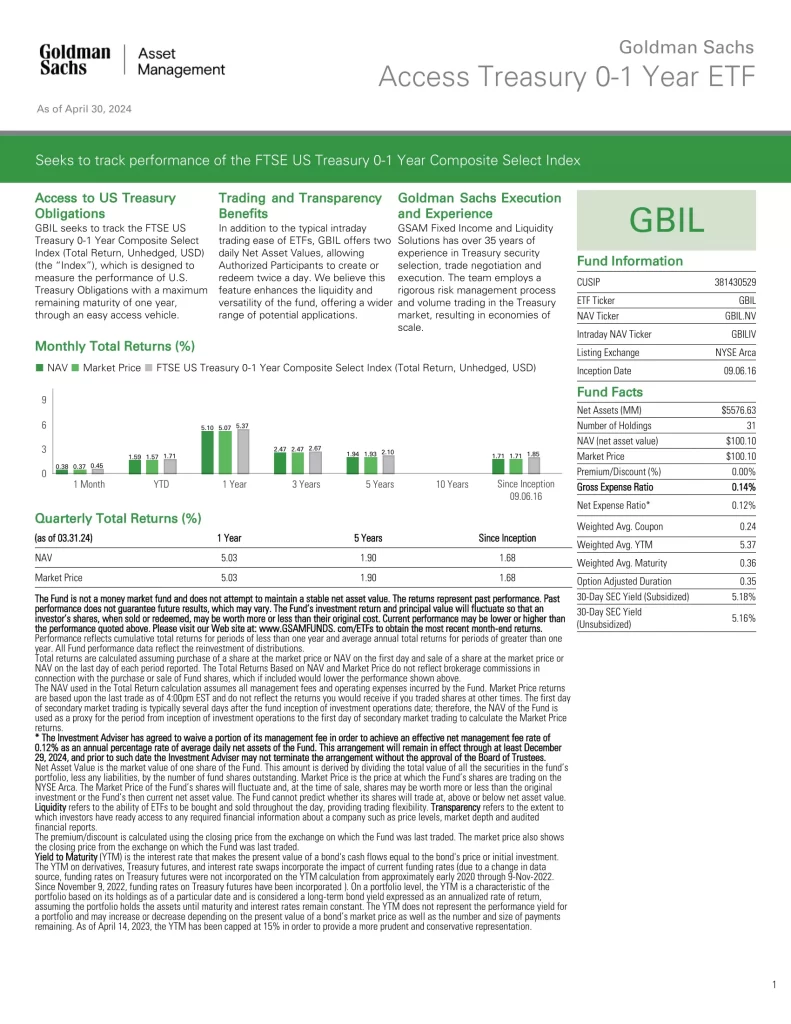

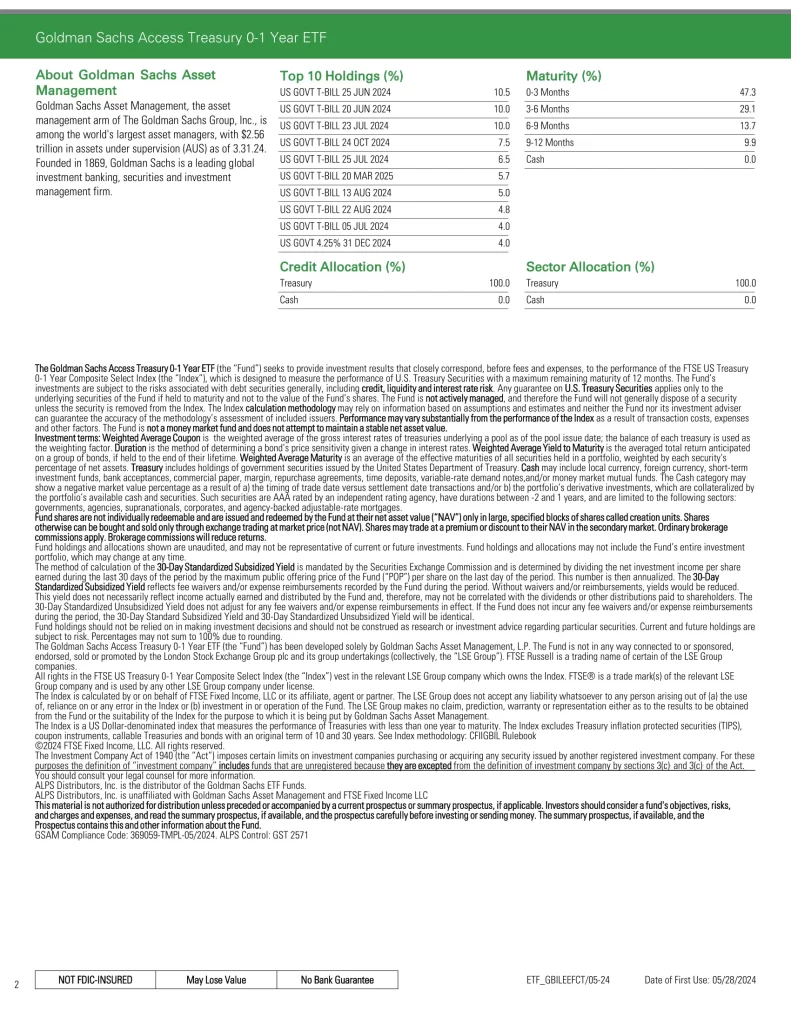

9. Goldman Sachs Access Treasury 0-1 Year ETF

Goldman Sachs Access Treasury 0-1 Year ETF (GBIL) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE US Treasury 0-1 Year Composite Select Index (Total Return, Unhedged, USD) (the “Index”).

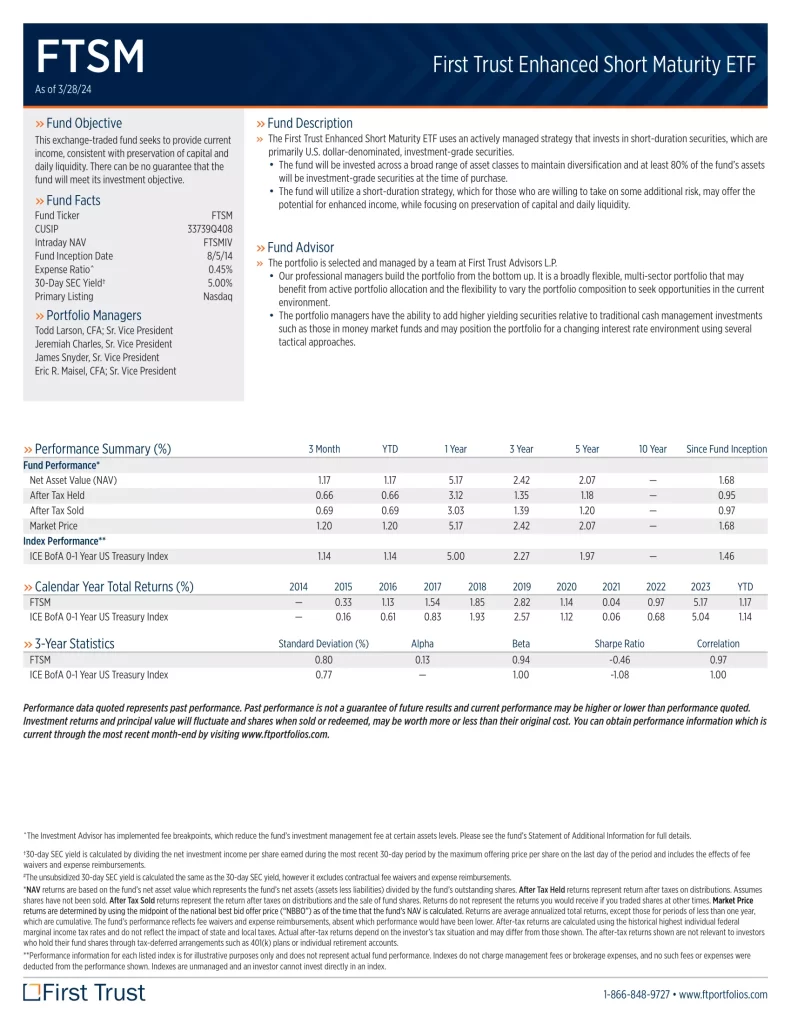

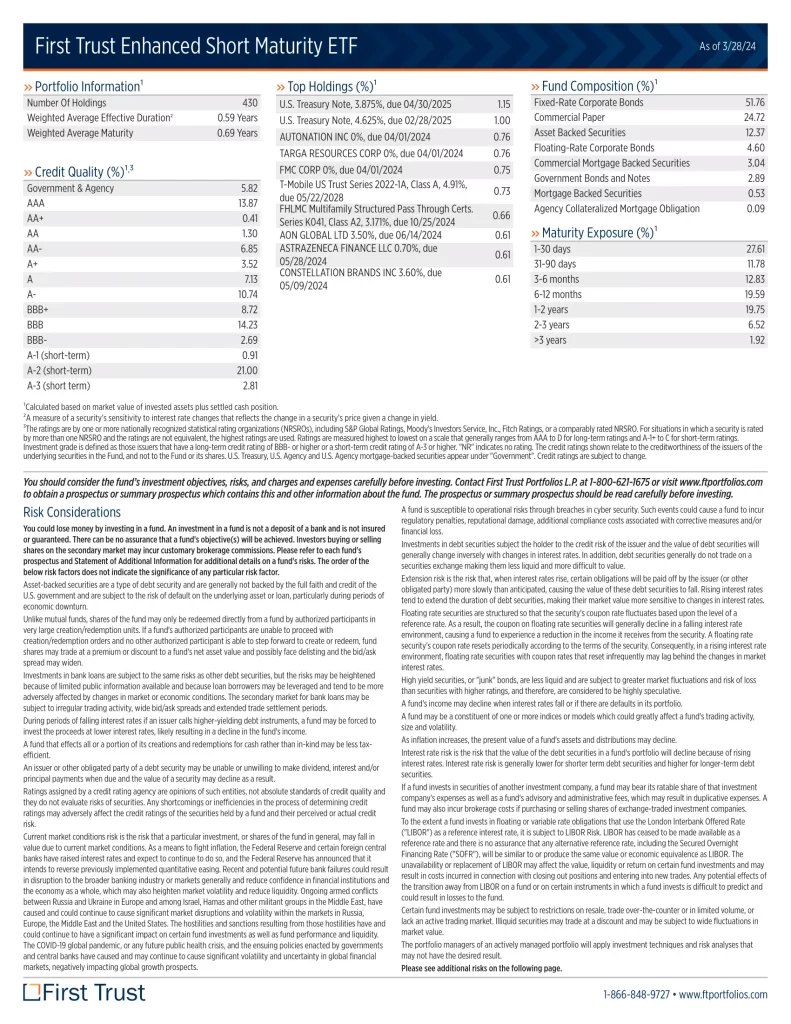

8. First Trust Enhanced Short Maturity ETF

First Trust Enhanced Short Maturity ETF (FTSM) is an actively managed exchange-traded fund. The fund’s investment objective is to seek current income, consistent with preserving capital and daily liquidity. There can be no assurance that the Fund’s investment objectives will be achieved.

- The First Trust Enhanced Short Maturity ETF uses an actively managed strategy that invests in short-duration securities, which are primarily U.S. dollar-denominated, investment-grade securities

- The fund will be invested across a broad range of asset classes to maintain diversification and at least 80% of the fund’s assets will be investment-grade securities at the time of purchase

- The fund will utilize a short-duration strategy that may offer the potential for enhanced income, while focusing on preservation of capital and daily liquidity

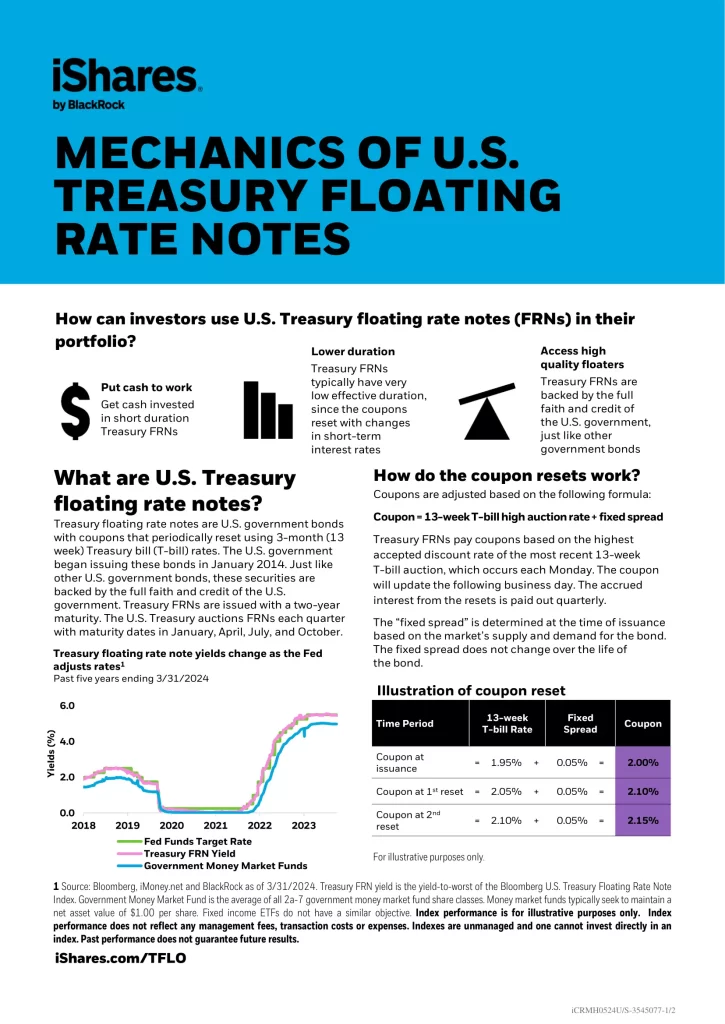

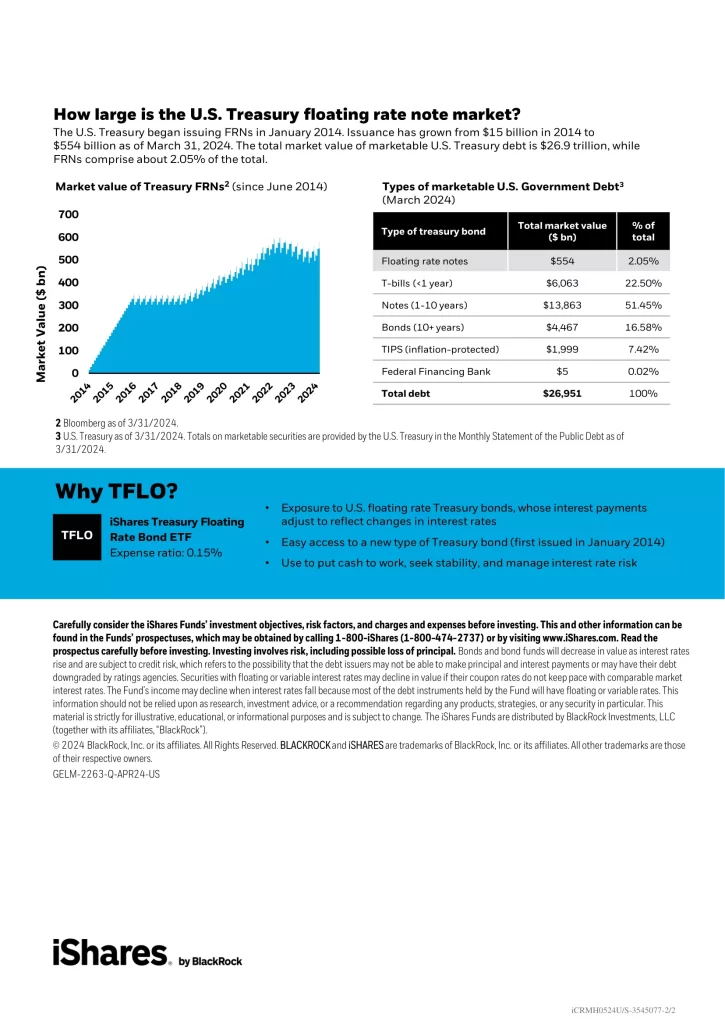

7. iShares Treasury Floating Rate Bond ETF

iShares Treasury Floating Rate Bond ETF (TFLO) seeks to track the investment results of an index composed of U.S. Treasury floating rate bonds.

- Exposure to U.S. floating rate Treasury bonds, whose interest payments adjust to reflect changes in interest rates

- Easy access to a new type of Treasury bond (first issued in January 2014)

- Use to put cash to work, seek stability, and manage interest rate risk

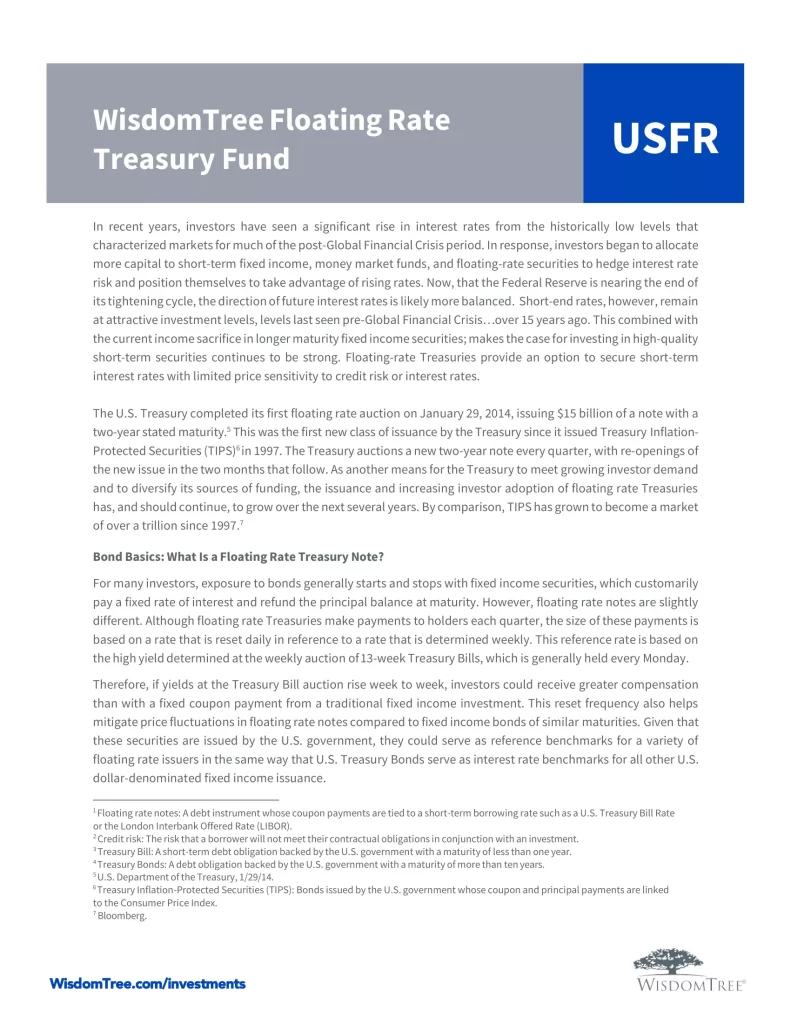

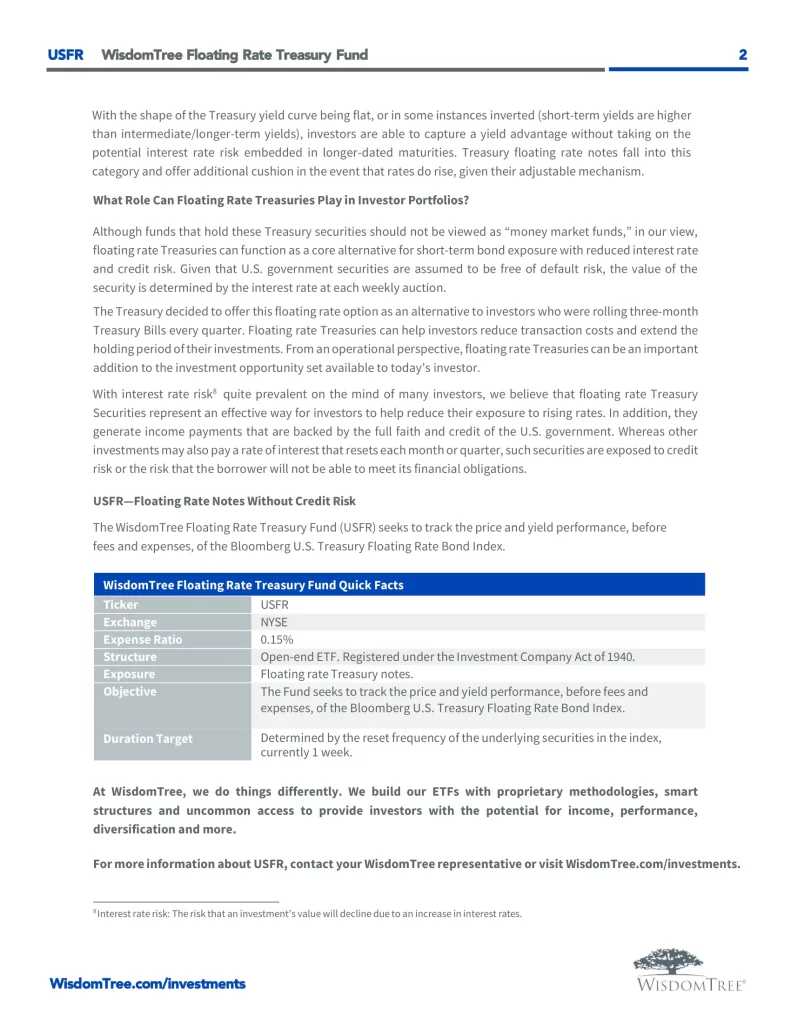

6. WisdomTree Floating Rate Treasury Fund

WisdomTree Floating Rate Treasury Fund (USFR) seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Treasury Floating Rate Bond Index.

- Provides cost-effective access to newly issued US government floating rate notes

- Designed to fluctuate with short-term rates and are priced at a spread over 3-mo Treasury Bills

- Short-term government bond solution that fluctuates with most recent 3-mo Treasury Bills

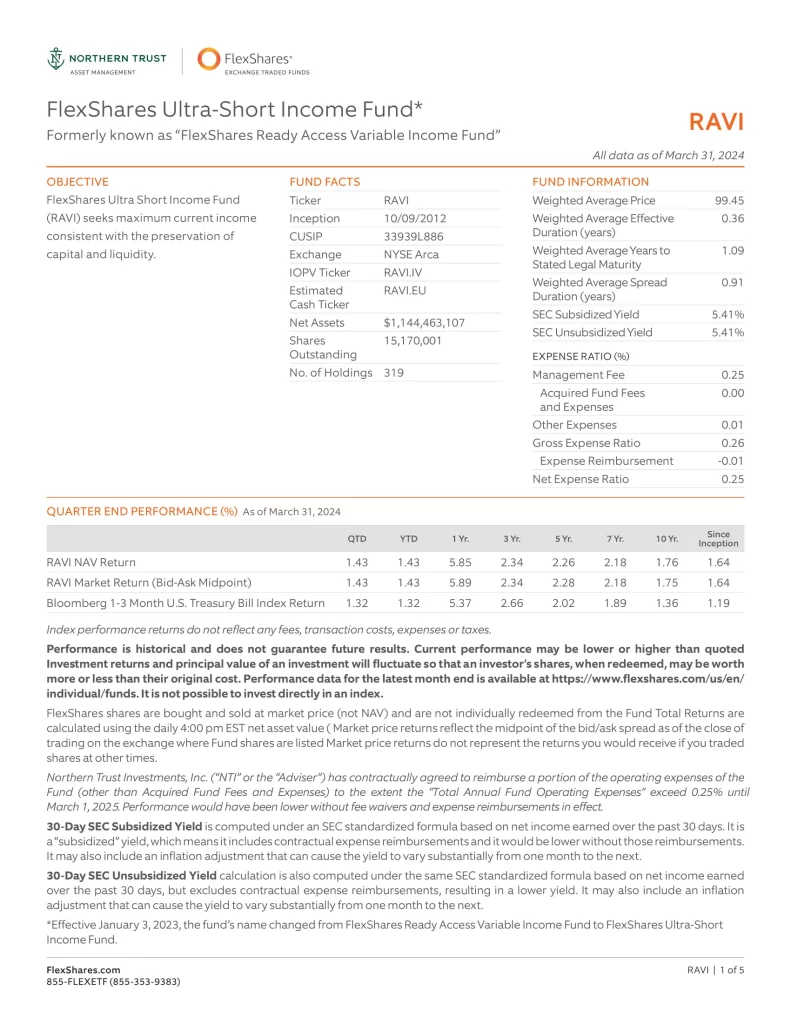

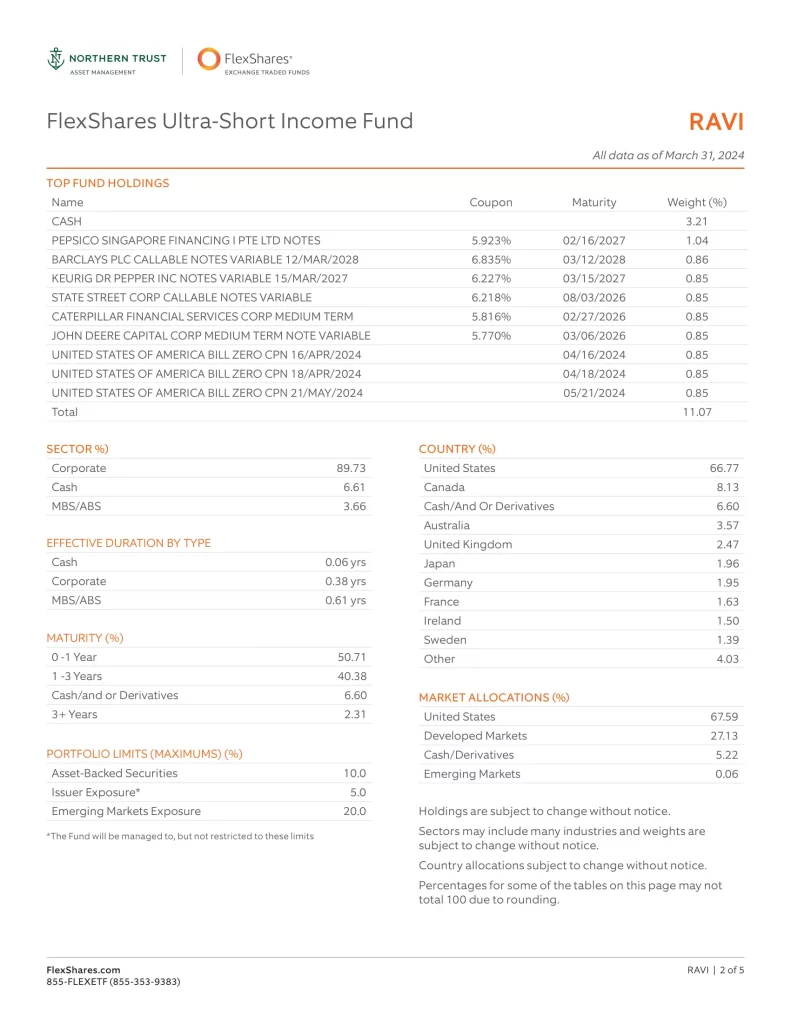

5. FlexShares Ultra-Short Income Fund

FlexShares Ultra-Short Income Fund (RAVI) seeks maximum current income consistent with preserving capital and liquidity for investors seeking current income combined with minimal NAV variability.

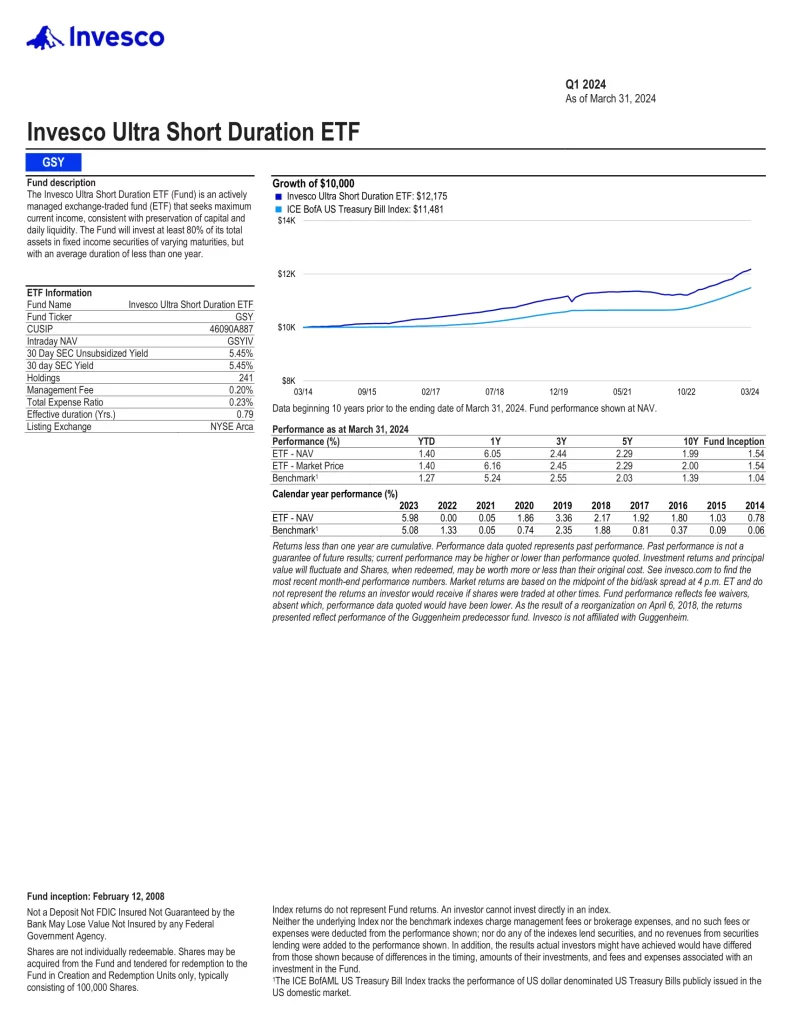

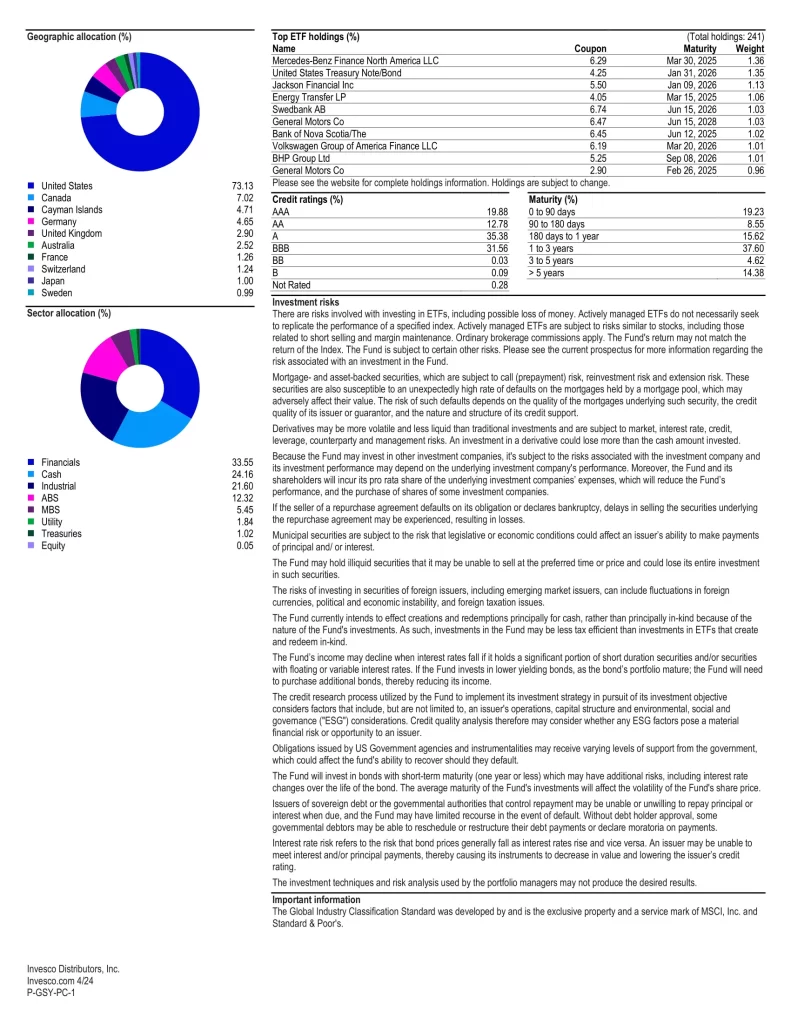

4. Invesco Ultra Short Duration ETF

Invesco Ultra Short Duration ETF (GSY) is an actively managed exchange-traded fund (ETF) that seeks to provide returns above cash equivalents while also seeking to provide preservation of capital and daily liquidity. The Fund will invest at least 80% of its total assets in fixed-income securities of varying maturities but with an average duration of less than one year.

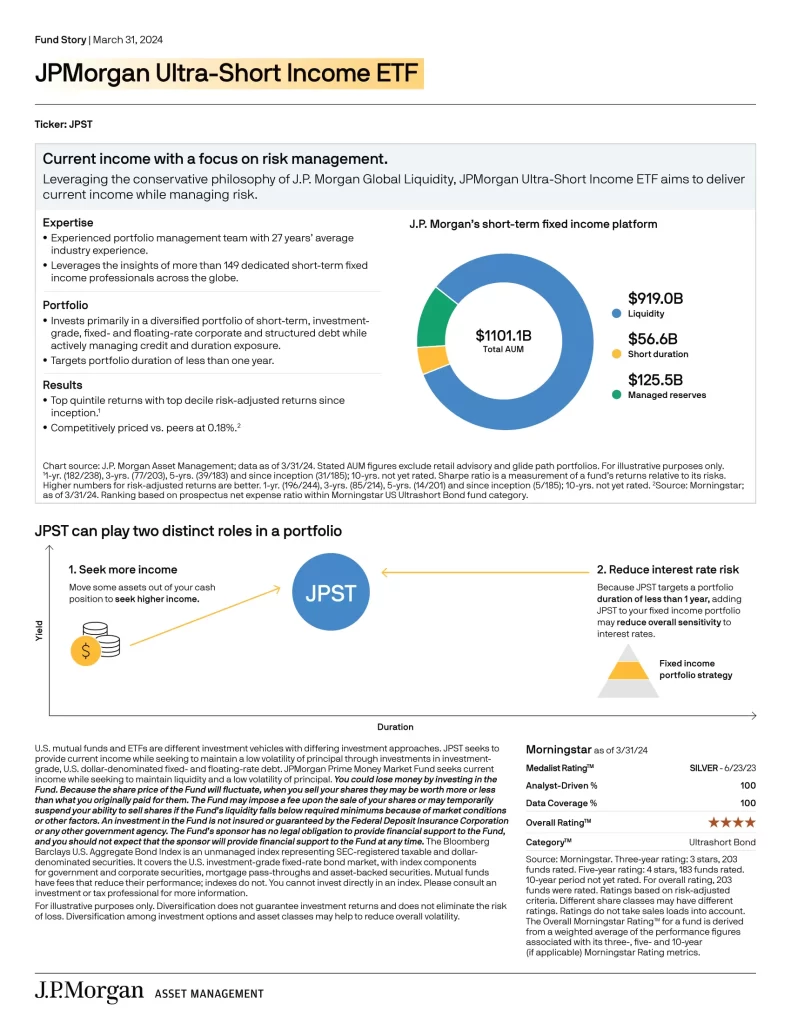

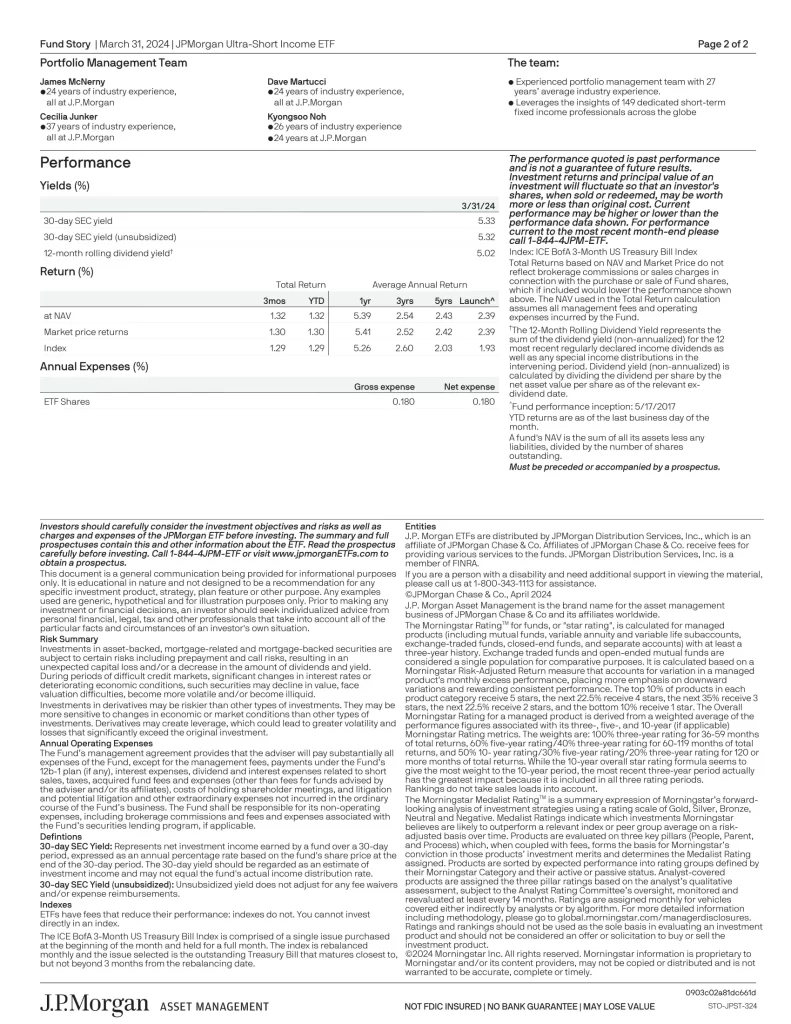

3. JPMorgan Ultra-Short Income ETF

JPMorgan Ultra-Short Income ETF (JPST) invests primarily in a diversified portfolio of short-term, investment-grade fixed- and floating-rate corporate and structured debt while actively managing credit and duration exposure.

- Targets portfolio duration of less than one year

2. PGIM Ultra Short Bond ETF

PGIM Ultra Short Bond ETF (PULS) seeks total return through a combination of current income and capital appreciation, consistent with the preservation of capital.

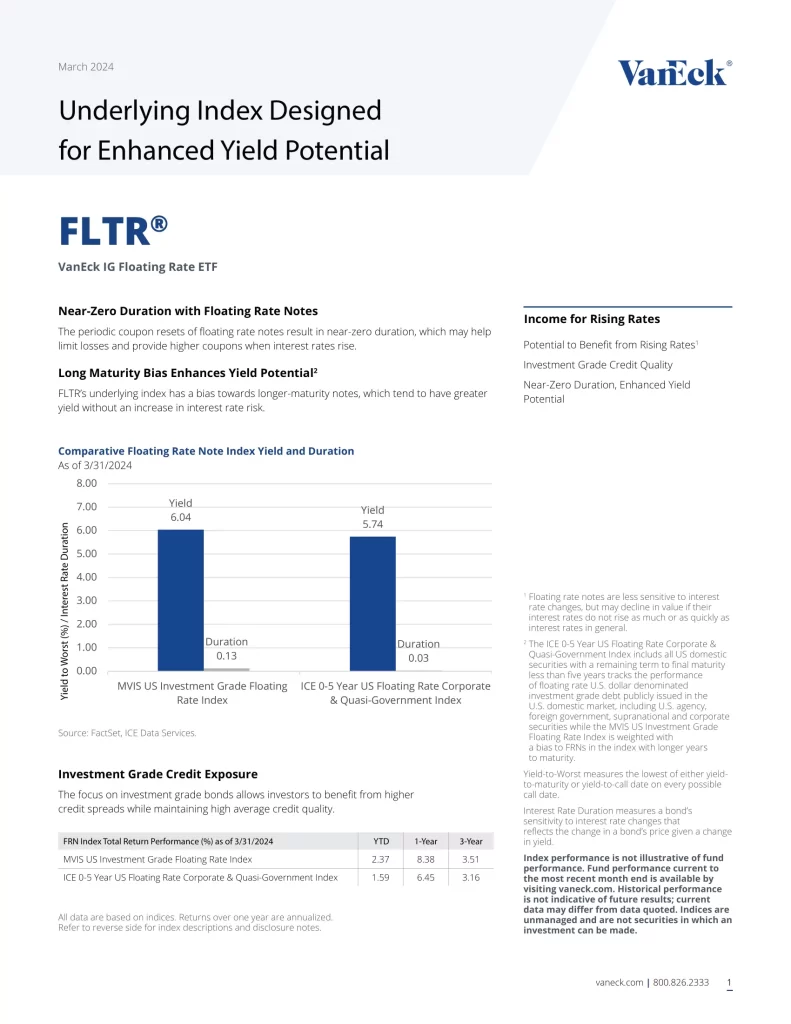

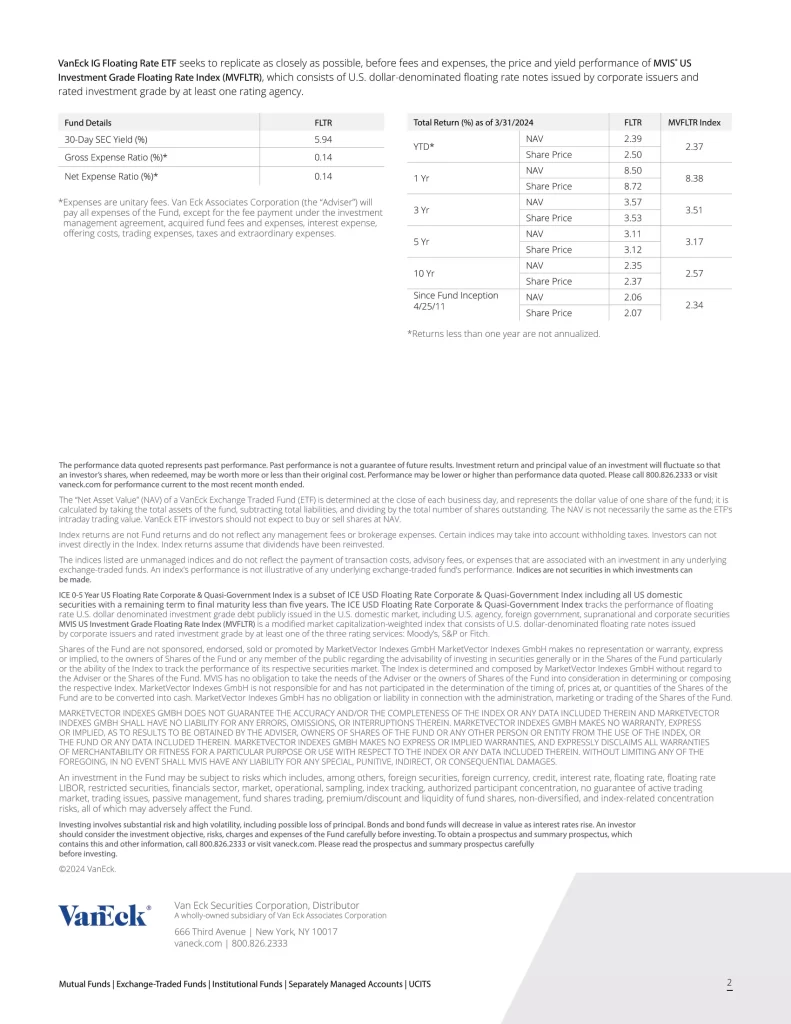

1. VanEck IG Floating Rate ETF

VanEck IG Floating Rate ETF (FLTR) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS US Investment Grade Floating Rate Index (MVFLTR), which consists of U.S. dollar denominated floating rate notes issued by corporate issuers and rated investment grade.

- Potential to Benefit from Rising Rates: Floating rate notes have variable coupons that reset periodically

- Investment Grade Credit Quality: Underlying index is comprised of a non-leveraged portfolio of investment grade floating rate corporate bonds

- Near-Zero Duration with Enhanced Yield Potential: Floating rate notes may offer higher yields than other short-duration instruments

What Are Money Market ETFs?

Money Market Exchange-Traded Funds (ETFs) are investment funds that aim to replicate the performance of money market instruments, which are short-term, highly liquid and low-risk securities. These ‘safe assets’ typically include Treasury bills, commercial paper, certificates of deposit and other similar assets.

In essence, money market ETFs offer investors an opportunity to invest in a diversified portfolio of these low-risk, short-term instruments. They are designed to provide stability and preservation of capital, making them a popular choice for individuals and institutions seeking a safe place to park idle funds while earning a small amount of interest that will combat the effects of inflation.

Properties of Money Market ETFs

- Low Risk: Money market ETFs invest in very safe and highly liquid securities, typically issued by governments, municipalities, and well-established corporations. As a result, they may be considered low-risk investments compared to other types of ETFs or stocks with holdings that can include everything from volatile growth stocks to commodities.

- Highly Stable: The main goal of money market ETFs is to maintain a stable net asset value (NAV) of $1 per share. This means that investors should not expect significant fluctuations in the value of their investment.

- High Liquidity: Unlike their mutual fund counterparts, money market ETFs are highly liquid, meaning investors can buy and sell shares on the stock exchange throughout the trading day. This makes them a convenient option for those who may need access to their funds quickly.

- Modest Yields: While money market ETFs are considered low-risk, they also tend to offer lower yields compared to riskier investments. The yields are influenced by prevailing interest rates and the types of securities held within the fund, which tend to be safer assets that offer lower yields.

- Diversification: Money market ETFs provide diversification by holding a variety of money market instruments. From corporate bonds to treasury bills, this diversification helps mitigate the risk associated with individual securities and can be especially helpful for those holding spare funds in between investment decisions or covering unexpected expenses.

In the realm of investment choices, money market ETFs have risen to prominence, often regarded as a safe haven for investors seeking stability and liquidity. These financial instruments are designed to mirror the performance of money market indexes, comprising short-term, low-risk debt securities. Referred to as “cash equivalents,” these ETFs have recently gained popularity because they can weather the storm of volatility and provide value in times when markets are declining. Let’s explore some examples of these top money market ETFs and find out how they can aid in your capital preservation efforts.

Conclusion

In conclusion, thanks to the sudden rise of market fluctuations and economic uncertainties, these money market ETFs present a case for staying on the sidelines and choosing to hold cash while earning a decent yield. While they might not promise explosive growth, they offer a steadfast sanctuary for funds, allowing investors to navigate volatile periods without compromising on liquidity or capital preservation. The allure of these top money market ETFs lies in their ability to provide a stable haven amid a sea of financial options. Thanks to their liquidity, these money market ETFs allow investors and traders to have readily available funds to deploy when there arises an opportunity. However, it’s crucial to remember that while money market ETFs are generally low risk, they are not entirely risk-free. There is still a possibility that the value could decline or that interest rates could affect the yield. Ultimately, traders and investors should consider this before deciding to allocate part of their diversified portfolio towards money market ETFs for capital preservation.