Individuals seeking income frequently turn to a dividend ETF in Canada. These investments purchase dividend stocks and offer investors a low-cost way to create passive income. Canadian dividend ETFs focus on stocks offering higher yields, typically comprising established companies that distribute modest income to investors rather than reinvesting profits.

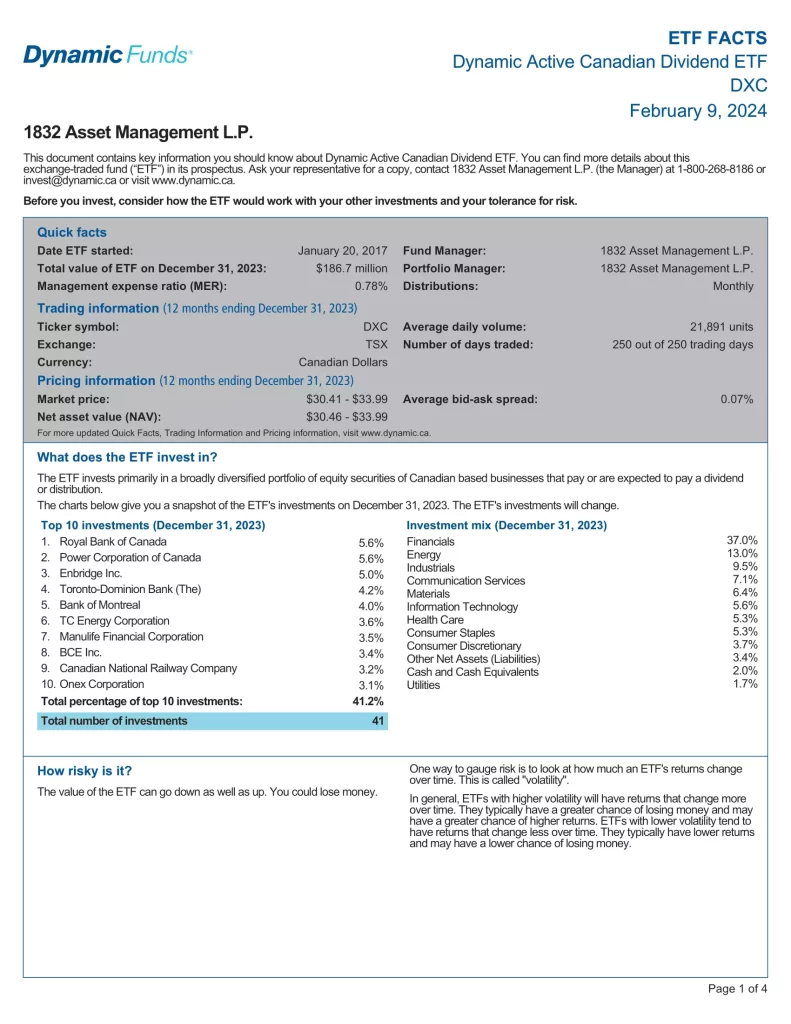

These ETFs deliver a dependable income stream and are viewed as stable long-term investments, occasionally providing monthly dividends. These companies are often well-established blue-chip entities with a history of consistent dividend payouts.

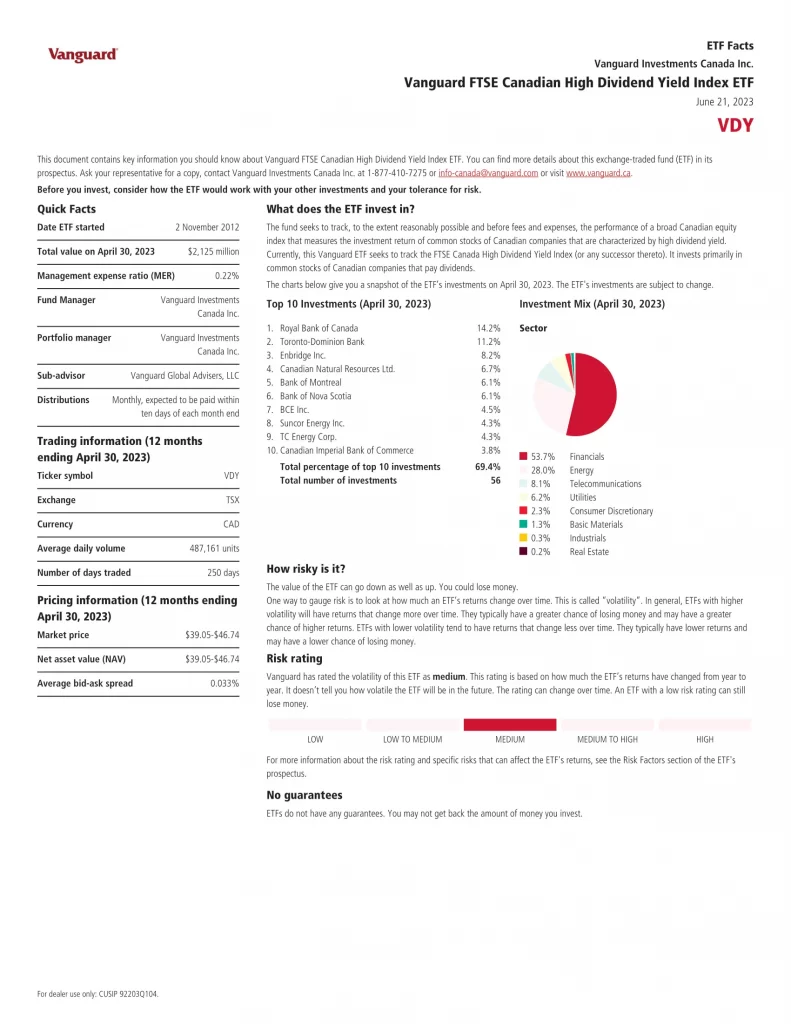

What is the Best Dividend ETF in Canada?

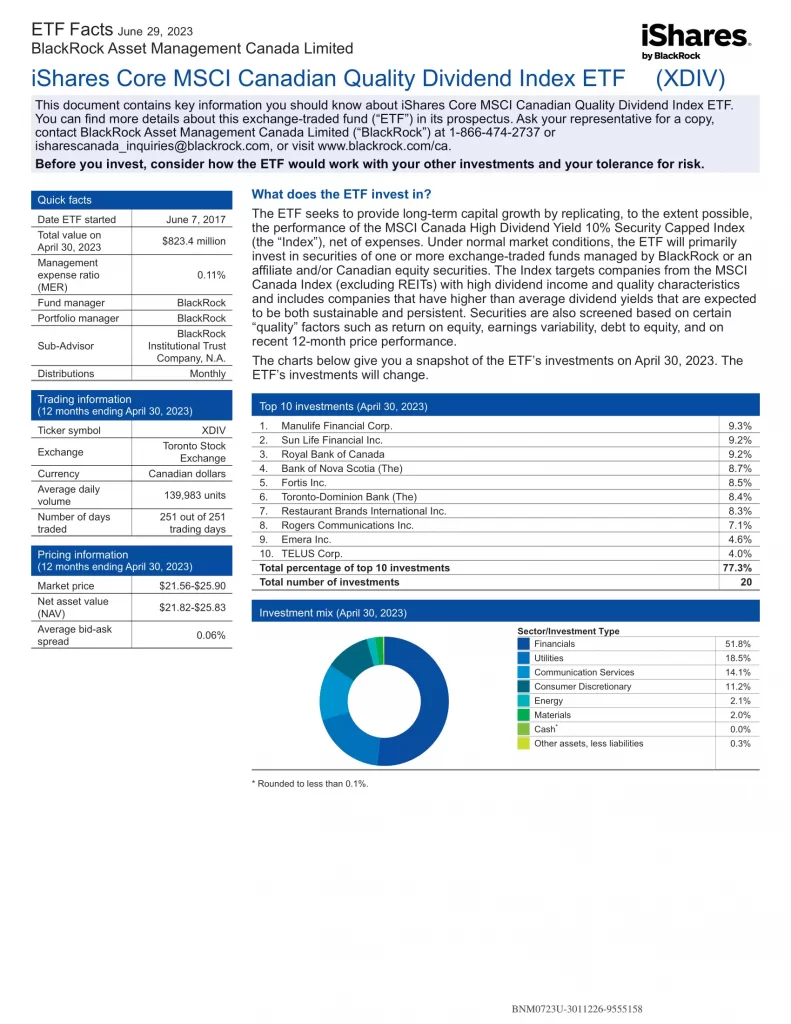

- DXC: Dynamic Active Canadian Dividend ETF

- VDY: Vanguard FTSE Canadian High Dividend Yield Index ETF

- XDIV: iShares Core MSCI Canadian Quality Dividend Index ETF

- RCD: RBC Quant Canadian Dividend Leaders ETF

- DGRC: CI WisdomTree Canada Quality Dividend Growth Index ETF

- XEI: iShares S&P/TSX Composite High Dividend Index ETF

- CDZ: iShares S&P/TSX Canadian Dividend Aristocrats Index ETF

- ZDV: BMO Canadian Dividend ETF

- PDC: Invesco Canadian Dividend Index ETF

- HAL: Horizons Active Cdn Dividend ETF

| Manager | ETF | Name | Holdings | MER | Dividend Yield | Distributions | 5Y |

|---|---|---|---|---|---|---|---|

| BlackRock | CDZ | iShares S&P/TSX Canadian Dividend Aristocrats Index ETF | 91 | 0.66% | 3.95% | Monthly | 8.03% |

| BlackRock | XDIV | iShares Core MSCI Canadian Quality Dividend Index ETF | 17 | 0.11% | 4.73% | Monthly | 9.51% |

| BlackRock | XEI | iShares S&P/TSX Composite High Dividend Index ETF | 75 | 0.22% | 5.26% | Monthly | 8.58% |

| BMO | ZDV | BMO Canadian Dividend ETF | 51 | 0.39% | 4.37% | Monthly | 7.96% |

| CI | DGRC | CI WisdomTree Canada Quality Dividend Growth Index ETF | 51 | 0.23% | 2.46% | Quarterly | 9.00% |

| Dynamic | DXC | Dynamic Active Canadian Dividend ETF | 2.44% | Monthly | 11.36% | ||

| Horizons | HAL | Horizons Active Cdn Dividend ETF | 37 | 0.68% | 3.49% | Quarterly | 7.20% |

| Invesco | PDC | Invesco Canadian Dividend Index ETF | 45 | 0.56% | 4.86% | Monthly | 7.20% |

| RBC | RCD | RBC Quant Canadian Dividend Leaders ETF | 59 | 0.42% | 3.93% | Monthly | 9.02% |

| Vanguard | VDY | Vanguard FTSE Canadian High Dividend Yield Index ETF | 56 | 0.22% | 4.61% | Monthly | 9.76% |

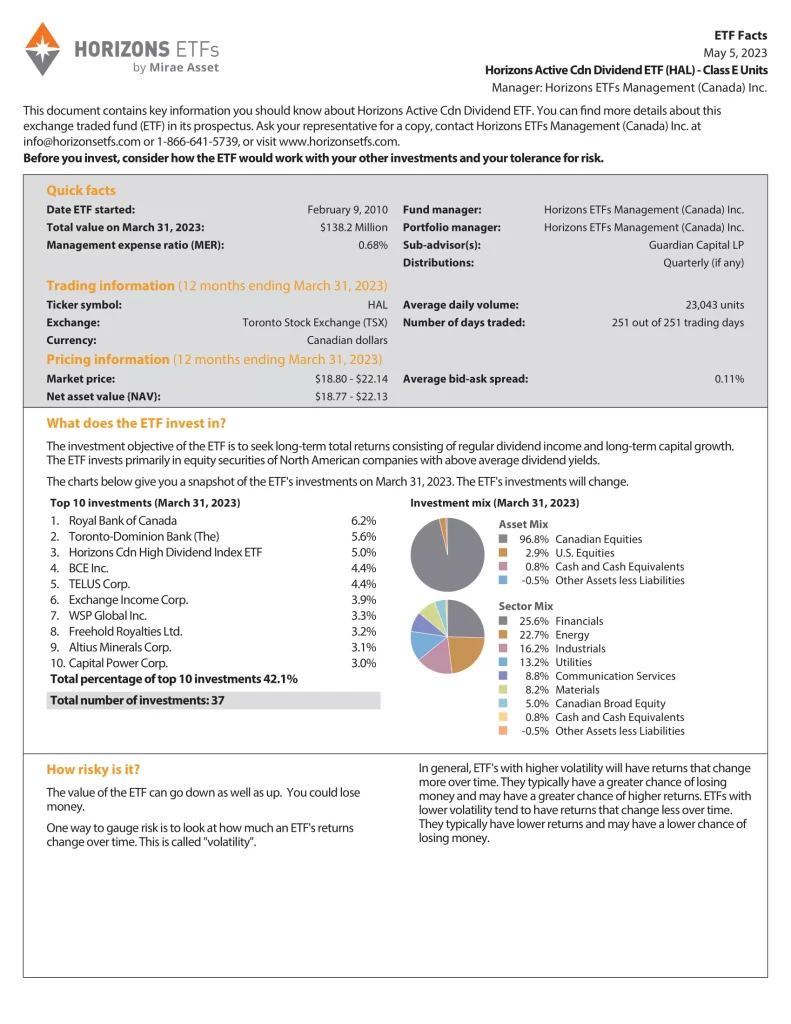

10. Horizons Active Cdn Dividend ETF

Horizons Active Cdn Dividend ETF (HAL) seeks long-term total returns consisting of regular dividend income and long-term capital growth. HAL invests primarily in equity securities of North American companies with above-average dividend yields.

- Inception: 2010-02-09

- MER: 0.68%

- AUM: $121,664,966

- Holdings: 37

- Beta: 0.91

- P/E: 10.47

- Yield: 3.49%

- Distributions: Quarterly

Top 10 HAL Holdings

| Name | Weight |

|---|---|

| Royal Bank of Canada | 6.71% |

| Canadian Natural Resources Ltd | 4.67% |

| WSP Global Inc | 4.03% |

| Exchange Income Corp | 3.48% |

| Waste Connections Inc | 3.29% |

| Tourmaline Oil Corp | 3.28% |

| Altius Minerals Corp | 3.17% |

| Freehold Royalties Ltd | 3.13% |

| Aecon Group Inc | 3.10% |

| Power Corp of Canada | 3.04% |

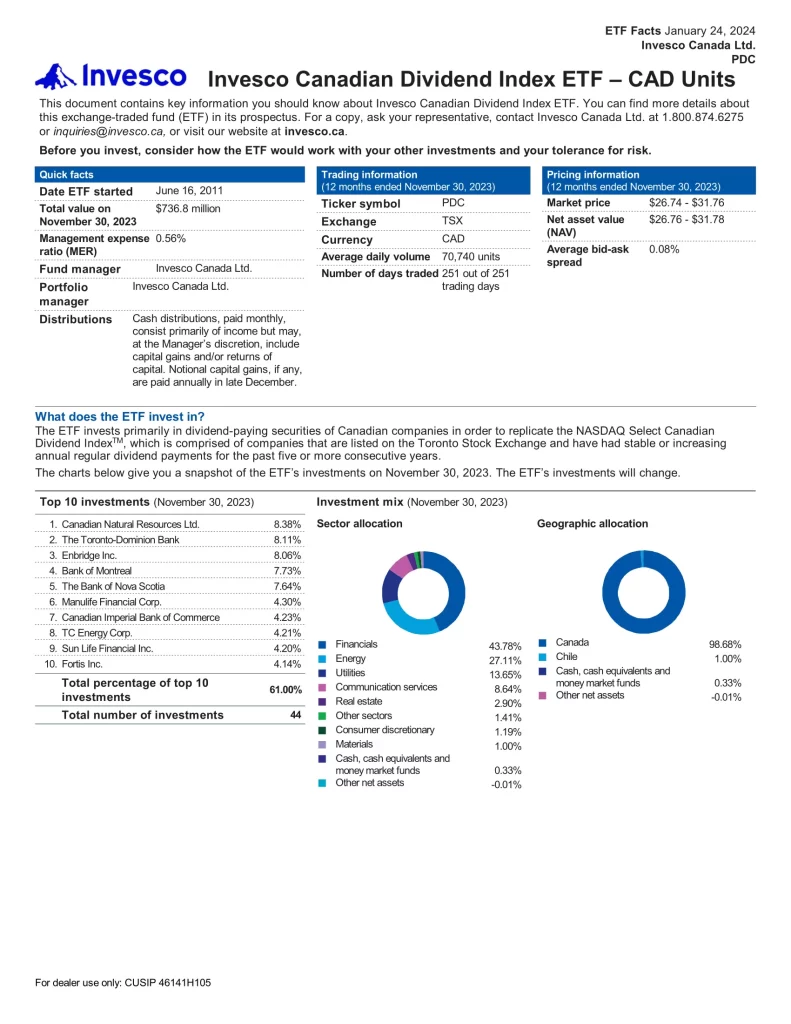

9. Invesco Canadian Dividend Index ETF

Invesco Canadian Dividend Index ETF (PDC) invests in dividend-paying securities of Canadian companies to replicate the NASDAQ Select Canadian Dividend Index, which is comprised of companies that are listed on the Toronto Stock Exchange and have had stable or increasing annual regular dividend payments for the past five or more consecutive years.

- Inception: 2011-06-16

- MER: 0.54%

- AUM: $778,376,303

- Holdings: 43

- Beta: 0.94

- P/E: 11.08

- Yield: 4.86%

- Distributions: Monthly

Top 10 PDC Holdings

| Name | Ticker | Weight |

|---|---|---|

| Enbridge Inc | ENB | 8.3561% |

| Bank of Montreal | BMO | 8.2638% |

| Royal Bank of Canada | RY | 8.0695% |

| Toronto-Dominion Bank/The | TD | 7.8687% |

| Bank of Nova Scotia/The | BNS | 7.4433% |

| Canadian Natural Resources Ltd | CNQ | 4.4475% |

| National Bank of Canada | NA | 4.2082% |

| Canadian Imperial Bank of Commerce | CM | 4.0456% |

| Nutrien Ltd | NTR | 4.0325% |

| Manulife Financial Corp | MFC | 3.9832% |

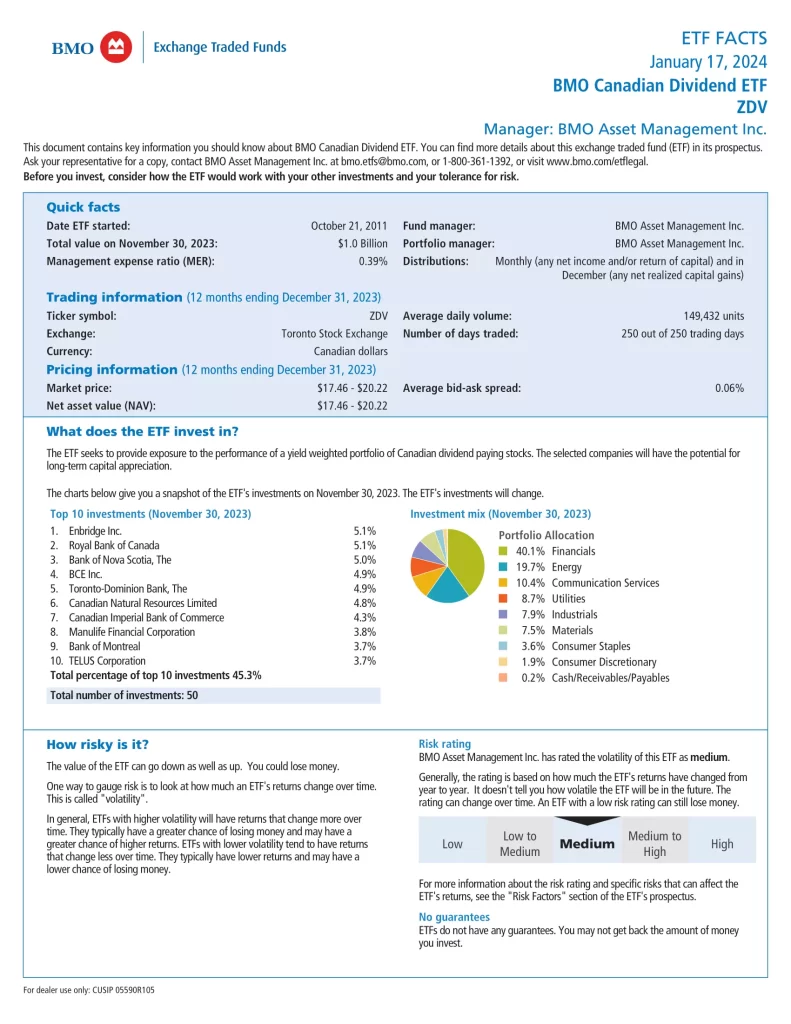

8. BMO Canadian Dividend ETF

BMO Canadian Dividend ETF (ZDV) has been designed to provide exposure to a yield-weighted portfolio of Canadian dividend-paying stocks. ZDV uses a rules-based methodology considering the three-year dividend growth rate, yield, and payout ratio to invest in Canadian equities. Securities will also be subject to a liquidity screening process. The underlying portfolio is rebalanced in May and reconstituted in November.

- Inception: 2011-10-21

- MER: 0.39%

- AUM: $1,009,290,000

- Holdings: 51

- Beta: 0.94

- P/E: N/A

- Yield: 4.37%

- Distributions: Monthly

Top 10 ZDV Holdings

| Weight | Name | Ticker |

|---|---|---|

| 5.33% | CANADIAN NATURAL RESOURCES LTD | CNQ |

| 5.25% | ROYAL BANK OF CANADA | RY |

| 5.08% | ENBRIDGE INC | ENB |

| 4.91% | BANK OF NOVA SCOTIA/THE | BNS |

| 4.70% | CANADIAN IMPERIAL BANK OF COMMERCE | CM |

| 4.51% | TORONTO-DOMINION BANK/THE | TD |

| 4.27% | MANULIFE FINANCIAL CORP | MFC |

| 3.96% | BANK OF MONTREAL | BMO |

| 3.89% | BCE INC | BCE |

| 3.68% | CANADIAN NATIONAL RAILWAY CO | CNR |

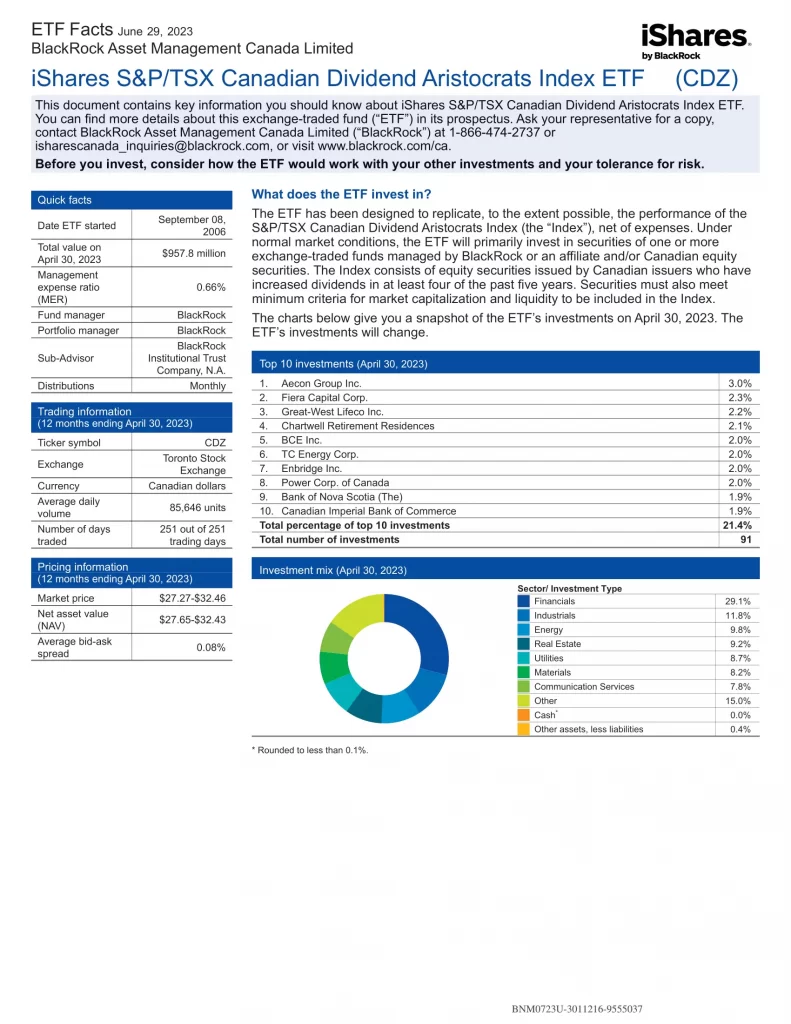

7. iShares S&P/TSX Canadian Dividend Aristocrats Index ETF

iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (CDZ) seeks to replicate the S&P/TSX Canadian Dividend Aristocrats Index, less fees and expenses.

- Inception: 2006-09-08

- MER: 0.66%

- AUM: 892,062,817

- Holdings: 91

- Beta: 0.89

- P/E: 12.06

- Yield: 3.95%

- Distributions: Monthly

Top 10 CDZ Holdings

| Ticker | Name | Weight |

|---|---|---|

| FSZ | FIERA CAPITAL CORP CLASS A | 2.81% |

| ENB | ENBRIDGE INC | 2.53% |

| AP.UN | ALLIED PROPERTIES REAL ESTATE INVT | 2.44% |

| BNS | BANK OF NOVA SCOTIA | 2.24% |

| ARE | AECON GROUP INC | 2.22% |

| TRP | TC ENERGY CORP | 2.19% |

| CPX | CAPITAL POWER CORP | 2.03% |

| PPL | PEMBINA PIPELINE CORP | 2.02% |

| BCE | BCE INC | 1.97% |

| FN | FIRST NATIONAL FINANCIAL CORP | 1.97% |

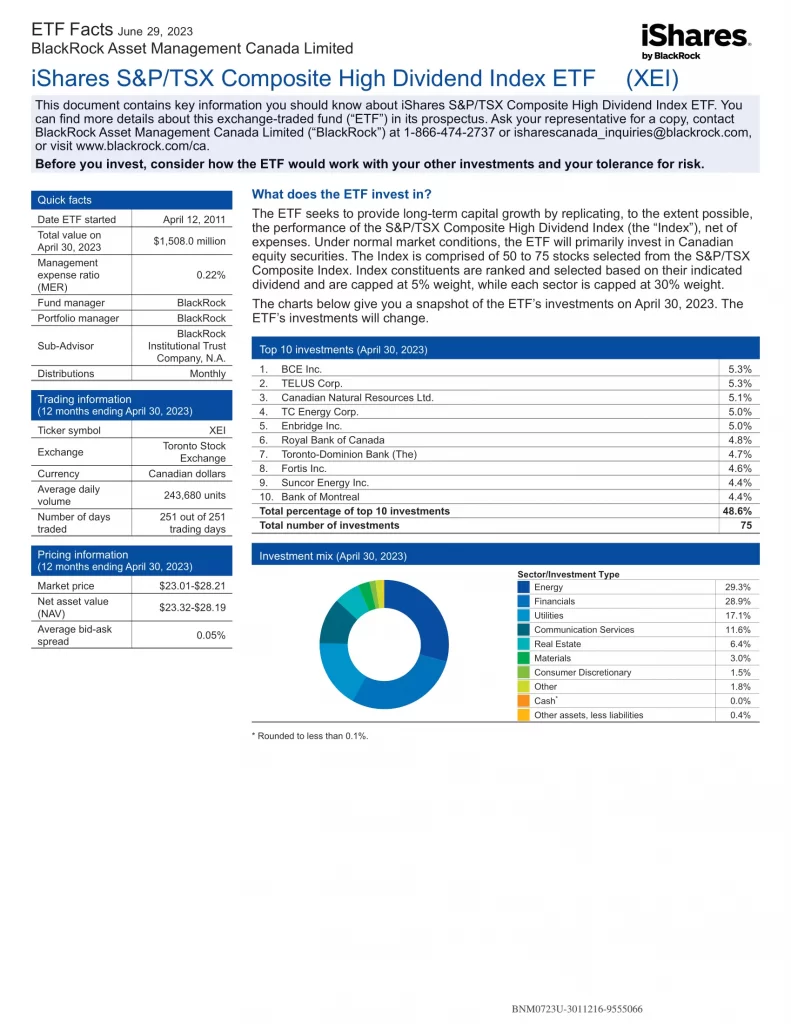

6. iShares S&P/TSX Composite High Dividend Index ETF

iShares S&P/TSX Composite High Dividend Index ETF (XEI) seeks long-term capital growth by replicating the performance of the S&P/TSX Composite High Dividend Index, net of expenses.

- Inception: 2011-04-12

- MER: 0.22%

- AUM: $1,578,899,386

- Holdings: 75

- Beta: 0.93

- P/E: 10.81

- Yield: 5.26%

- Distributions: Monthly

Top 10 XEI Holdings

| Ticker | Name | Weight |

|---|---|---|

| SU | SUNCOR ENERGY INC | 5.77% |

| CNQ | CANADIAN NATURAL RESOURCES LTD | 5.46% |

| ENB | ENBRIDGE INC | 5.11% |

| RY | ROYAL BANK OF CANADA | 5.00% |

| NTR | NUTRIEN LTD | 4.97% |

| TD | TORONTO DOMINION | 4.93% |

| T | TELUS CORP | 4.65% |

| BCE | BCE INC | 4.60% |

| TRP | TC ENERGY CORP | 4.55% |

| BMO | BANK OF MONTREAL | 4.45% |

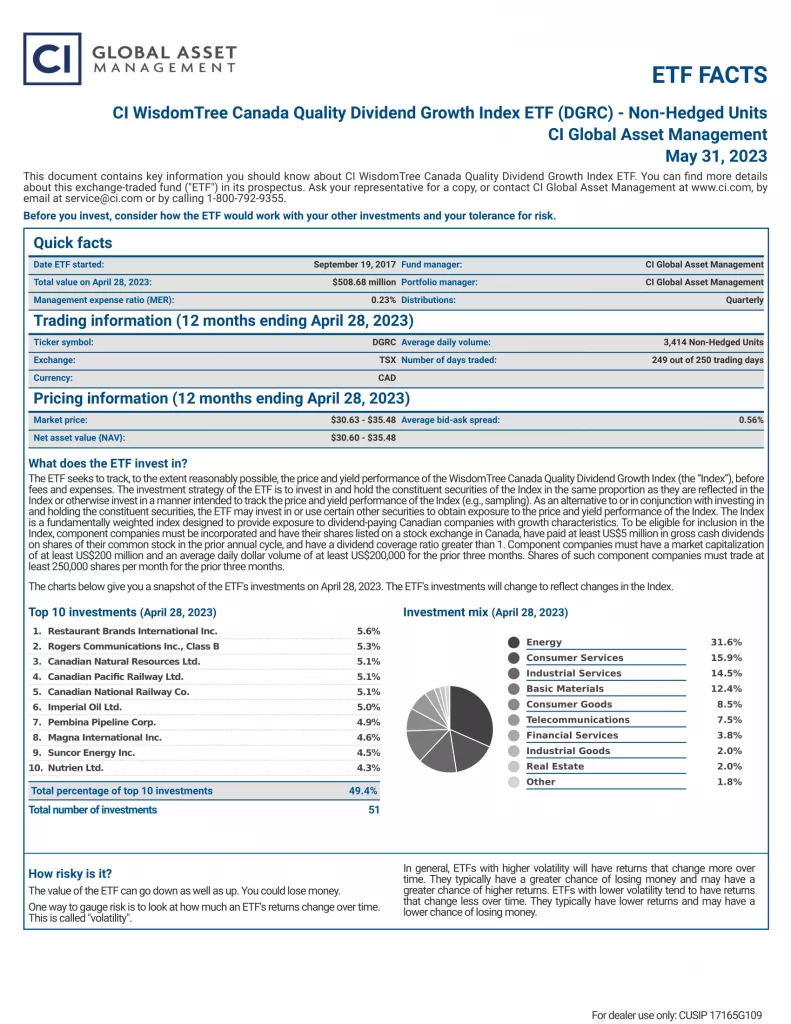

5. CI WisdomTree Canada Quality Dividend Growth Index ETF

CI WisdomTree Canada Quality Dividend Growth Index ETF (DGRC) seeks to track, to the extent possible, the price and yield performance of the WisdomTree Canada Quality Dividend Growth Index.

- Inception: 2017-09-19

- MER: 0.23

- AUM: $747.30

- Holdings: 51

- Beta: 0.87

- P/E: 12.81

- Yield: 2.46%

- Distributions: Quarterly

Top 10 DGRC Holdings

| Name | Weight |

|---|---|

| Imperial Oil Ltd | 5.28% |

| Cenovus Energy Inc | 5.23% |

| Suncor Energy Inc | 5.20% |

| Canadian Natural Resources Ltd | 5.20% |

| Nutrien Ltd | 5.19% |

| Canadian National Railway Co | 4.94% |

| Thomson Reuters Corp | 4.82% |

| Barrick Gold Corp | 4.81% |

| Rogers Communications Inc Cl B | 4.55% |

| Restaurant Brands International Inc | 4.33% |

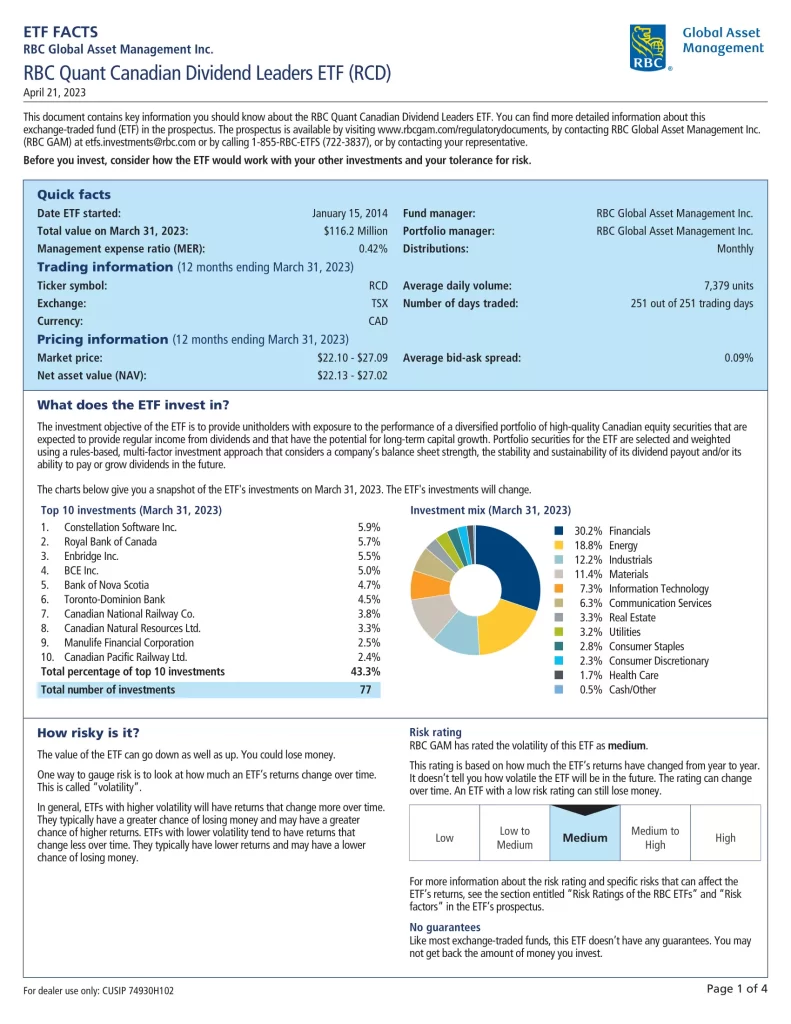

4. RBC Quant Canadian Dividend Leaders ETF

RBC Quant Canadian Dividend Leaders ETF (RCD) seeks to provide unitholders with exposure to the performance of a diversified portfolio of high-quality Canadian equity securities that are expected to provide regular income from dividends and that have the potential for long-term capital growth.

- Inception: 2014-01-09

- MER: 0.42%

- AUM: $140,520,000

- Holdings:

- Beta: 0.93

- P/E: 13.24

- Yield: 3.98%

- Distributions: Monthly

Top 10 RCD Holdings

| Name | Weight |

|---|---|

| CONSTELLATION SOFTWARE INC/CANADA | 9.1% |

| ENBRIDGE INC | 6.4% |

| BANK OF NOVA SCOTIA | 5.4% |

| TORONTO-DOMINION BANK | 4.8% |

| CANADIAN NATIONAL RAILWAY CO | 4.1% |

| BCE INC | 3.9% |

| SUNCOR ENERGY INC | 3.7% |

| CANADIAN IMPERIAL BANK OF COMMERCE | 3.2% |

| ROYAL BANK OF CANADA | 3.1% |

| TOURMALINE OIL CORP | 3.0% |

3. iShares Core MSCI Canadian Quality Dividend Index ETF

iShares Core MSCI Canadian Quality Dividend Index ETF (XDIV) seeks to provide long-term capital growth by replicating the performance of the MSCI Canada High Dividend Yield 10% Security Capped Index, net of expenses.

- Inception: 2017-06-07

- MER: 0.11%

- AUM: 1,073,853,600

- Holdings: 17

- Beta: 0.79

- P/E: 13.17

- Yield: 4.73%

- Distributions: Monthly

Top 10 XDIV Holdings

| Ticker | Name | Weight |

|---|---|---|

| SU | SUNCOR ENERGY INC | 10.56% |

| PPL | PEMBINA PIPELINE CORP | 9.77% |

| FTS | FORTIS INC | 8.87% |

| RY | ROYAL BANK OF CANADA | 8.84% |

| TD | TORONTO DOMINION | 8.70% |

| SLF | SUN LIFE FINANCIAL INC | 8.52% |

| MFC | MANULIFE FINANCIAL CORP | 8.45% |

| EMA | EMERA INC | 6.36% |

| GWO | GREAT WEST LIFECO INC | 5.42% |

| T | TELUS CORP | 5.10% |

2. Vanguard FTSE Canadian High Dividend Yield Index ETF

Vanguard FTSE Canadian High Dividend Yield Index ETF (VDY) seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a broad Canadian equity index that measures the investment return of common stocks of Canadian companies that are characterized by high dividend yield. Currently, this Vanguard ETF seeks to track the FTSE Canada High Dividend Yield Index (or any successor thereto). It invests primarily in common stocks of Canadian companies that pay dividends.

- Inception: 2011-10-21

- MER: 0.22%

- AUM: $2,360,000,000

- Holdings:

- Beta: 0.95

- P/E: N/A

- Yield: 2.64%

- Distributions: Monthly

Top 10 VDY Holdings

| Name | Weight |

|---|---|

| Royal Bank of Canada | 14% |

| Toronto-Dominion Bank | 10.6% |

| Canadian Natural Resources Ltd. | 8.07% |

| Enbridge Inc. | 7.56% |

| Bank of Montreal | 6.97% |

| Bank of Nova Scotia | 6.17% |

| Suncor Energy Inc. | 4.75% |

| Canadian Imperial Bank of Commerce | 4.54% |

| Manulife Financial Corp. | 4.49% |

| TC Energy Corp. | 4.09% |

1. Dynamic Active Canadian Dividend ETF

Dynamic Active Canadian Dividend ETF (DXC) invests primarily in a broadly diversified portfolio of equity securities of Canadian based businesses that pay or are expected to pay a dividend or distribution.

- Inception: 2017-01-20

- MER: 0.84%

- AUM: $220,200,000

- Holdings: 40

- Beta: N/A

- P/E: 0.86

- Yield: 2.44%

- Distributions: Monthly

DXC Holdings

| Name | Weight |

|---|---|

| Royal Bank of Canada | 5.7% |

| Power Corporation of Canada | 5.5% |

| Enbridge Inc. | 5.1% |

| Manulife Financial Corporation | 4.0% |

| TC Energy Corporation | 3.8% |

| Bank of Montreal | 3.6% |

| Toronto-Dominion Bank | 3.6% |

| Canadian National Railway Company | 3.4% |

| Onex Corporation | 3.0% |

| Restaurant Brands International Inc. | 2.9% |

Do Canadian ETFs Pay Dividends?

Most ETFs pay dividends, but some are solely focused on purchasing Canadian dividend stocks. Using ETFs to target is a practical strategy, providing exposure to dividend investing while maintaining diversification. These dividend ETFs mirror indexes comprised of dividend-paying stocks, employing diverse dividend strategies centred around yield, market capitalization, or geographical location. Publicly traded companies in Canada that pay dividends are heavily invested in the financial and energy sectors. Investors approaching, and in retirement, often favour dividend ETFs for their consistent income, risk mitigation, and inflation hedging.

Which Canadian ETF has the Highest Dividend?

iShares S&P/TSX Composite High Dividend Index ETF (XEI) is currently the highest Canadian dividend-paying ETF. When these dividends are reinvested it is in 7th place for total return compared to similar ETFs. With the number of Canadian dividend ETFs growing, it’s essential to align your choice with your specific goals, considering factors like investment style, past performance, sector diversity, and fees.

Top 10 Canadian Dividend ETF Sector Diversification

Below is a sector diversification overview for the leading Canadian dividend ETFs. Given the significant representation of the financial and energy sectors in the S&P/TSX Composite Index, it’s expected that these Canadian dividend ETFs mirror this exposure with considerable weight in these sectors.

| Sector | VDY | ZDV | CDZ | XEI | DXC | PDC | DGRC | XDIV | RCD | HAL |

|---|---|---|---|---|---|---|---|---|---|---|

| Communication | 8.80% | 11.63% | 6.71% | 13.98% | 6.60% | 11.21% | 13.89% | 10.11% | 4.10% | 6.93% |

| Discretionary | 0.10% | 6.36% | 9.67% | 2.57% | 4.10% | 2.06% | 23.34% | 0.00% | 3.90% | 0.00% |

| Energy | 22.70% | 13.70% | 16.57% | 31.00% | 13.80% | 20.12% | 0.00% | 9.87% | 19.80% | 25.32% |

| Financials | 58.30% | 40.59% | 29.47% | 30.26% | 36.30% | 53.60% | 28.59% | 59.83% | 28.80% | 23.60% |

| Health Care | 0.00% | 0.00% | 1.81% | 0.42% | 5.90% | 0.28% | 0.08% | 0.00% | 0.00% | 2.88% |

| Industrials | 0.20% | 8.09% | 10.13% | 0.87% | 10.40% | 0.00% | 24.95% | 0.00% | 13.50% | 18.61% |

| Materials | 0.00% | 6.99% | 4.11% | 1.92% | 7.80% | 0.24% | 9.14% | 8.16% | 11.30% | 6.07% |

| Real Estate | 0.20% | 0.00% | 11.50% | 5.04% | 0.00% | 3.17% | 0.00% | 0.00% | 2.50% | 11.91% |

| Staples | 0.00% | 3.74% | 7.35% | 0.27% | 5.50% | 0.42% | 5.00% | 0.00% | 3.40% | 1.97% |

| Technology | 0.00% | 0.00% | 1.34% | 0.00% | 5.60% | 11.21% | 13.89% | 10.11% | 9.00% | 0.87% |

| Utilities | 5.80% | 12.32% | 9.68% | 13.24% | 2.00% | 9.32% | 0.00% | 11.36% | 3.60% | 4.10% |

Conclusion

Investing in Canadian Dividend ETFs comes with instant diversification in dividends that a single dividend ETF offers. The best-performing Canadian Dividend ETF is Dynamic Active Canadian Dividend ETF (DXC) which offers superior diversification and reliable income, but it’s crucial to note that not all dividend ETFs are equal. This is an active ETF strategy and has outperformed the passive index strategies in the comparison.

|  |  |  |  |  | |

|---|---|---|---|---|---|---|

| Advice | InvestCAN | InvestRESP | RetireCAN | Virtual Meeting | Robo- Advisor | Financial Advisor |

| Purpose | DIY Portfolio | DIY Portfolio | DIY Pension | Personal Relationship | Automated Investing | Personal Relationship |

| Fees *Not including MERs and trading fees | $19.99 CAD | $12.99 CAD | $19.99 CAD | $250/Meeting | 0.40%- 0.50% | 0.50%- 1.50% |

| $100,000 Account Costs *Not including MERs and trading fees | One Time Fee | One Time Fee | One Time Fee | $250- $500/Year | $400- $500/Year | $500- $1,500/Year |

| Access to Advice | 24/7 | 24/7 | 24/7 | 1-2 Virtual Meetings | N/A | Approx. 2 Hours/Year |

| Recommended Investments | Unbiased Data Driven | Unbiased Data Driven | Unbiased Data Driven | Unbiased Data Driven | Often Proprietary (Company Owned) | Often Proprietary (Company Owned) |

| Relationship | Digital | Digital | Digital | Personal | Phone/Email | Personal |