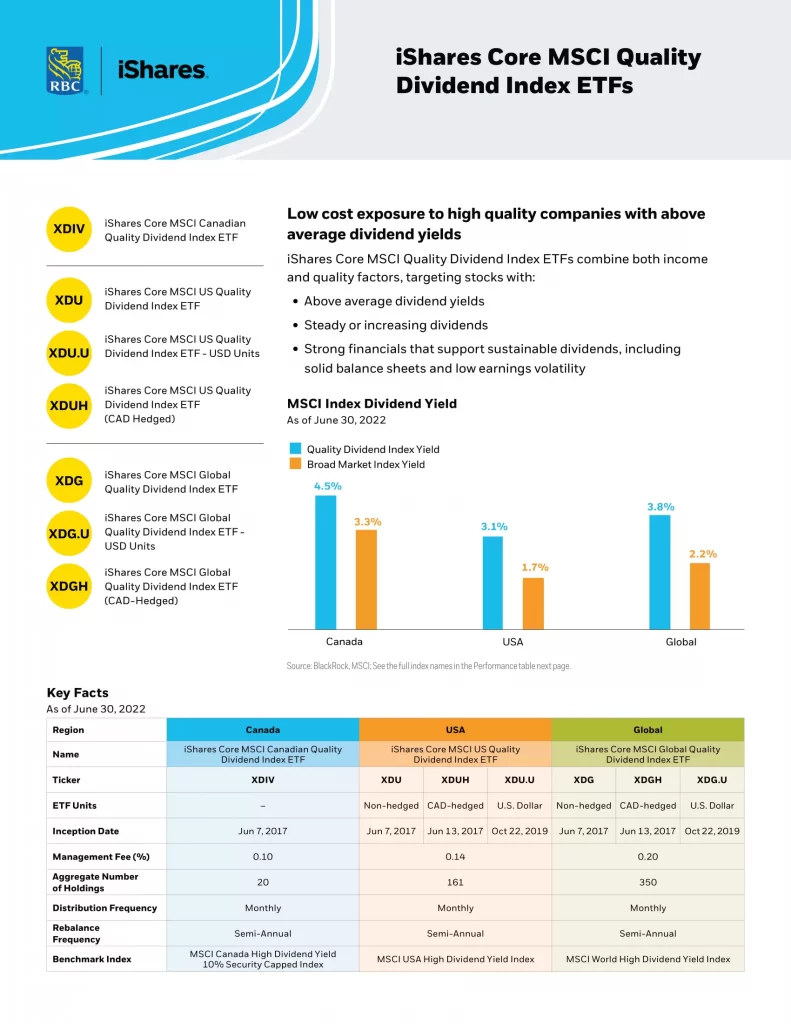

iShares Core MSCI Canadian Quality Dividend Index ETF (XDIV.TO) seeks to provide long-term capital growth by replicating the performance of the MSCI Canada High Dividend Yield 10% Security Capped Index, net of expenses.

An Exchange Traded Fund (ETF) is a collection of hundreds or thousands of stocks or bonds in a single fund that trades on major stock exchanges. ETFs combine the diversification of mutual funds with lower investment minimum and real-time pricing.

|  |  |  |  |

|---|---|---|---|---|

| InvestCAN | InvestRESP | InvestUSA | RetireCAN | RetireMGN |

| $99.99 CAD | $12.99 CAD | $79.99 USD | $99.99 CAD | $9.99 USD |

XDIV ETF Review

- Low cost portfolio of Canadian stocks with above- average dividend yields and steady or increasing dividends

- Selects securities with strong overall financials, including solid balance sheets and less volatile earnings

- Designed to be a long-term core holding

What is the Best Canadian Dividend ETF in Canada?

- VDY.TO: Vanguard FTSE Canadian High Dividend Yield Index ETF

- XDIV.TO: iShares Core MSCI Canadian Quality Dividend Index ETF

- XMV.TO: iShares MSCI Min Vol Canada Index ETF

- ZDV.TO: BMO Canadian Dividend ETF

Here is a table comparing Canadian dividend ETFs as of February 28, 2023.

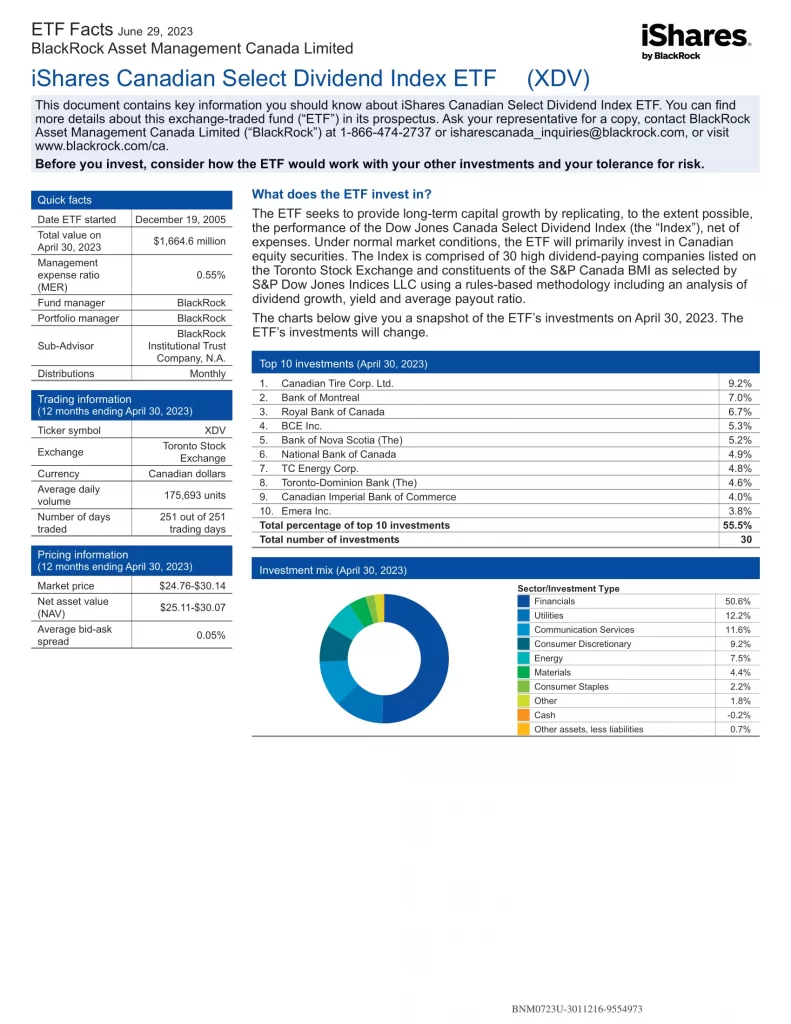

| Manager |  |  |  |  |

| ETF | VDY | XEI | XDIV | ZDV |

| Inception | 2012-11-02 | 2011-04-12 | 2017-06-07 | 2001-11-21 |

| AUM | $1,988,000,000 | $1,432,473,689 | $752,725,487 | $963,870,000 |

| Holdings | 47 | 75 | 21 | 52 |

| MER | 0.22% | 0.22% | 0.11% | 0.39% |

| Risk | Medium | Medium | Medium | Medium |

| Yield | 4.35% | 4.93% | 4.28% | 4.35% |

| Distributions | Monthly | Monthly | Monthly | Monthly |

| 1M | -1.75% | -3.04% | -1.16% | -2.35% |

| 3M | 0.58% | -0.07% | 4.13% | -0.58% |

| YTD | 5.26% | 4.18% | 5.69% | 4.52% |

| 1Y | -2.38% | -2.43% | 1.27% | -1.55% |

| 3Y | 13.91% | 11.42% | 10.78% | 10.32% |

| 5Y | 10.07% | 9.32% | 9.06% | 8.44% |

| 10Y | 8.90% | 7.11% | N/A | 6.38% |

| P/E | 11.9 | 10.69 | 12.09 | 14.81 |

| P/B | 1.7 | 1.45 | 1.60 | 2.01 |

| Beta | 0.88 | 1.06 | 0.81 | 0.97 |