Dividend ETFs invest in stocks with higher yields. These individual corporations are mature companies that provide modest income to their investors instead of reinvesting profits back into the company. These are usually large blue-chip companies with a long history of dividend payments.

What is a Dividend ETF?

The popularity of ETFs has made investing more accessible and cost-effective for novice investors. However, those seeking income often turn to dividend ETFs, which prioritize high-yield dividend stocks. These ETFs provide a consistent income stream and can be seen as stable long-term investments, sometimes offering monthly dividend income. Despite their convenience, it’s essential to consider the fees associated with ETFs, as they can impact returns.

What is the Best Dividend ETF?

If you’re looking for ETFs with the best historical performance based on their five-year annualized returns, here are a few top performers:

- DGRW: WisdomTree U.S. Quality Dividend Growth Fund

- FDVV: Fidelity High Dividend ETF

- RFDA: RiverFront Dynamic US Dividend Advantage ETF

- DIVB: iShares Core Dividend ETF

- VIG: Vanguard Dividend Appreciation Index Fund

- DIVO: Amplify CWP Enhanced Dividend Income ETF

- UDIV: Franklin U.S. Core Dividend Tilt Index ETF

- YLDE: ClearBridge Dividend Strategy ESG ETF

- FDRR: Fidelity Dividend ETF for Rising Rates

- SCHD: Schwab U.S. Dividend Equity ETF

- DLN: WisdomTree U.S. LargeCap Dividend Fund

- QDEF: FlexShares Quality Dividend Defensive Index Fund

- PFM: Invesco Dividend Achievers ETF

- DGRO: iShares Core Dividend Growth ETF

- QDF: FlexShares Quality Dividend Index Fund

- DTD: WisdomTree U.S. Total Dividend Fund

- VYM: Vanguard High Dividend Yield Index Fund

- OUSA: O’Shares U.S. Quality Dividend ETF

- VSDA: VictoryShares Dividend Accelerator ETF

- FDL: First Trust Morningstar Dividend Leaders Index Fund

- DJD: Invesco Dow Jones Industrial Average Dividend ETF

- TPHD: Timothy Plan’s High Dividend Stock ETF

- DVY: iShares Select Dividend ETF

- SDOG: ALPS Sector Dividend Dogs ETF

- DHS: WisdomTree U.S. High Dividend Fund

- SDY: SPDR S&P Dividend ETF

- PEY: Invesco High Yield Equity Dividend Achievers ETF

- SPYD: SPDR Portfolio S&P 500 High Dividend ETF

- HDV: iShares Core High Dividend ETF

- SPHD: Invesco S&P 500 High Dividend Low Volatility ETF

- LVHD: Franklin U.S. Low Volatility High Dividend Index ETF

- DIVG: Invesco S&P 500 High Dividend Growers ETF

- SNPD: Xtrackers S&P ESG Dividend Aristocrats ETF

- COWS: Amplify Cash Flow Dividend Leaders ETF

- TDVG: T. Rowe Price Dividend Growth ETF

- HIDV: AB US High Dividend ETF

- UDI: USCF ESG Dividend Income Fund

- BGDV: Bahl & Gaynor Dividend ETF

- BDIV: AAM Brentview Dividend Growth ETF

| Manager | ETF | Name | MER | Dividend Yield | Distributions | 5Y |

|---|---|---|---|---|---|---|

| AllianceBernstein | HIDV | AB US High Dividend ETF | 0.45% | 2.30% | Quarterly | N/A |

| ALPS | OUSA | O’Shares U.S. Quality Dividend ETF | 0.48% | 1.50% | Monthly | 9.73% |

| ALPS | RFDA | RiverFront Dynamic US Dividend Advantage ETF | 0.52% | 2.21% | Monthly | 12.46% |

| ALPS | SDOG | ALPS Sector Dividend Dogs ETF | 0.36% | 3.84% | Quarterly | 8.16% |

| Amplify | COWS | Amplify Cash Flow Dividend Leaders ETF | 0.39% | 1.83% | Monthly | N/A |

| Amplify | DIVO | Amplify CWP Enhanced Dividend Income ETF | 0.56% | 4.89% | Monthly | 11.21% |

| Bahl & Gaynor | BGDV | Bahl & Gaynor Dividend ETF | 0.45% | N/A | N/A | N/A |

| BlackRock | DGRO | iShares Core Dividend Growth ETF | 0.08% | 2.45% | Quarterly | 10.45% |

| BlackRock | DIVB | iShares Core Dividend ETF | 0.05% | 2.42% | Quarterly | 11.81% |

| BlackRock | DVY | iShares Select Dividend ETF | 0.38% | 3.26% | Quarterly | 8.43% |

| BlackRock | HDV | iShares Core High Dividend ETF | 0.08% | 3.28% | Quarterly | 6.79% |

| Fidelity | FDRR | Fidelity Dividend ETF for Rising Rates | 0.16% | 2.18% | Quarterly | 11.04% |

| Fidelity | FDVV | Fidelity High Dividend ETF | 0.15% | 3.77% | Quarterly | 12.85% |

| First Trust | FDL | First Trust Morningstar Dividend Leaders Index Fund | 0.45% | 4.59% | Quarterly | 9.07% |

| FlexShares | QDEF | FlexShares Quality Dividend Defensive Index Fund | 0.37% | 1.79% | Quarterly | 10.53% |

| FlexShares | QDF | FlexShares Quality Dividend Index Fund | 0.37% | 1.81% | Quarterly | 10.32% |

| Franklin Templeton | LVHD | Franklin U.S. Low Volatility High Dividend Index ETF | 0.27% | 3.23% | Quarterly | 6.04% |

| Franklin Templeton | UDIV | Franklin U.S. Core Dividend Tilt Index ETF | 0.06% | 2.30% | Quarterly | 11.06% |

| Franklin Templeton | YLDE | ClearBridge Dividend Strategy ESG ETF | 0.47% | 2.27% | Quarterly | 10.82% |

| Invesco | DIVG | Invesco S&P 500 High Dividend Growers ETF | 0.39% | 4.04% | Monthly | N/A |

| Invesco | DJD | Invesco Dow Jones Industrial Average Dividend ETF | 0.07% | 2.98% | Quarterly | 8.82% |

| Invesco | PEY | Invesco High Yield Equity Dividend Achievers ETF | 0.53% | 4.27% | Monthly | 7.01% |

| Invesco | PFM | Invesco Dividend Achievers ETF | 0.52% | 1.58% | Quarterly | 10.50% |

| Invesco | SPHD | Invesco S&P 500 High Dividend Low Volatility ETF | 0.30% | 3.38% | Monthly | 6.26% |

| Schwab | SCHD | Schwab U.S. Dividend Equity ETF | 0.06% | 3.49% | Quarterly | 11.03% |

| State Street | SDY | SPDR S&P Dividend ETF | 0.35% | 2.64% | Quarterly | 7.14% |

| State Street | SPDG | SPDR Portfolio S&P Sector Neutral Dividend ETF | 0.05% | 2.55% | Quarterly | N/A |

| State Street | SPYD | SPDR Portfolio S&P 500 High Dividend ETF | 0.07% | 4.33% | Quarterly | 6.82% |

| T. Rowe Price | TDVG | T. Rowe Price Dividend Growth ETF | 0.50% | 1.04% | Quarterly | N/A |

| Timothy Plan | TPHD | Timothy Plan’s High Dividend Stock ETF | 0.52% | 1.95% | N/A | 8.70% |

| USCF | UDI | USCF Dividend Income Fund | 0.65% | 2.92% | Monthly | N/A |

| Vanguard | VIG | Vanguard Dividend Appreciation Index Fund | 0.06% | 1.88% | Quarterly | 11.52% |

| Vanguard | VYM | Vanguard High Dividend Yield Index Fund | 0.06% | 3.12% | Quarterly | 9.74% |

| VictoryCapital | VSDA | VictoryShares Dividend Accelerator ETF | 0.40% | 2.56% | Monthly | 9.33% |

| WisdomTree | DGRW | WisdomTree U.S. Quality Dividend Growth Fund | 0.28% | 1.74% | Monthly | 12.98% |

| WisdomTree | DHS | WisdomTree U.S. High Dividend Fund | 0.38% | 3.69% | Monthly | 8.08% |

| WisdomTree | DLN | WisdomTree U.S. LargeCap Dividend Fund | 0.28% | 2.43% | Monthly | 10.68% |

| WisdomTree | DTD | WisdomTree U.S. Total Dividend Fund | 0.28% | 2.43% | Monthly | 10.30% |

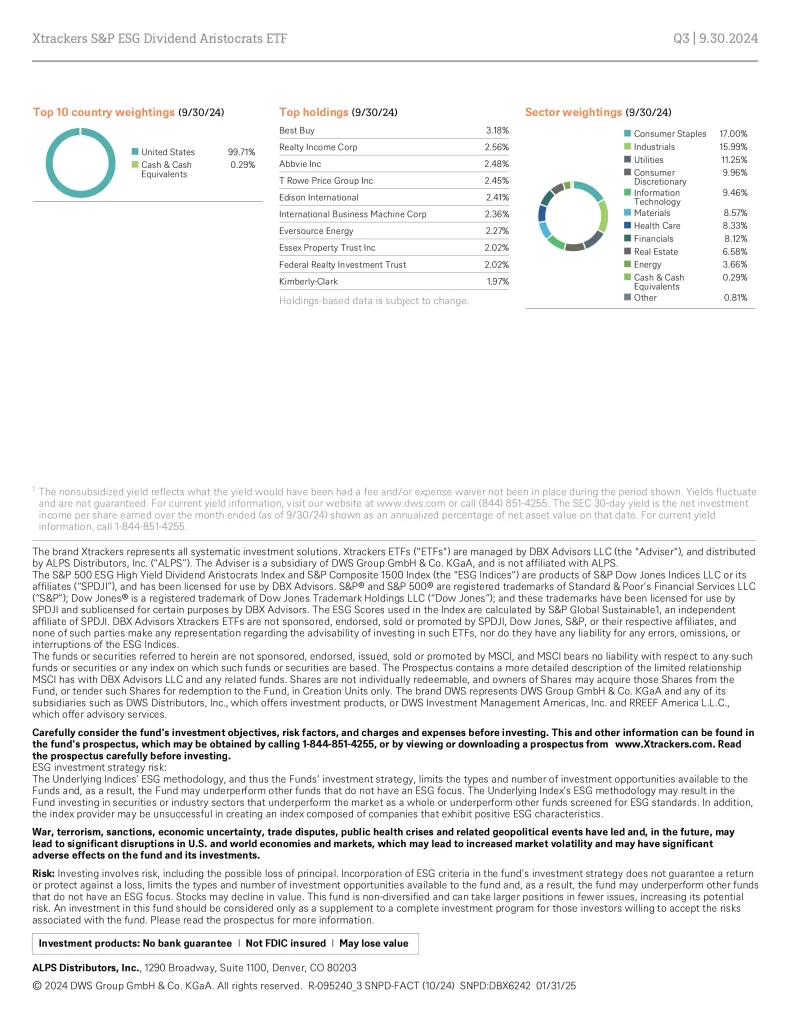

| Xtrackers | SNPD | Xtrackers S&P ESG Dividend Aristocrats ETF | 0.15% | 3.83% | Quarterly | N/A |

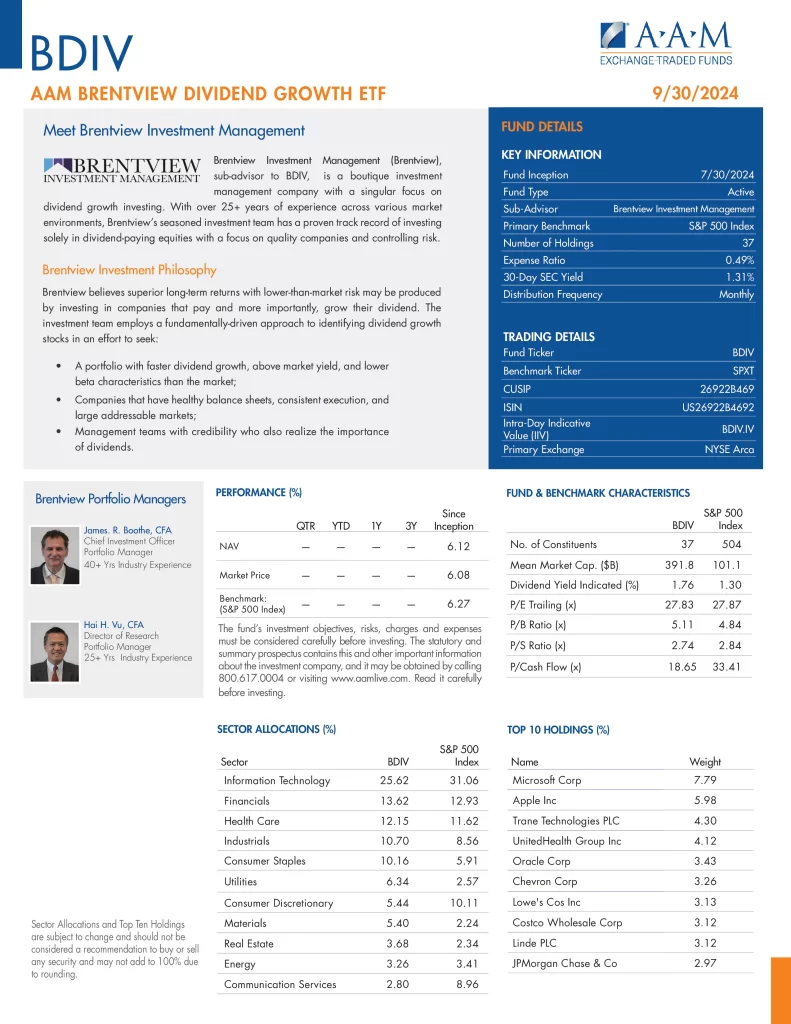

39. AAM Brentview Dividend Growth ETF

AAM Brentview Dividend Growth ETF (BDIV) is an actively managed dividend growth ETF sub-advised by Brentview Investment Management. BDIV employs a fundamentally driven approach to identifying dividend growth stocks in an effort to provide:

- Lower Portfolio Beta: Targets high-quality companies with favourable risk-adjusted returns in seeking to manage risk and control volatility.

- Above Market Yield: Seeks to provide current income with an aggregate yield that is equal to or greater than the S&P 500 Index.

- Faster Dividend Growth: Aims to provide a dividend growth rate greater than the S&P 500.

38. Bahl & Gaynor Dividend ETF

Bahl & Gaynor Dividend ETF (BGDV) is an actively managed ETF that invests primarily in dividend-paying U.S.-listed equity securities of large capitalization companies.

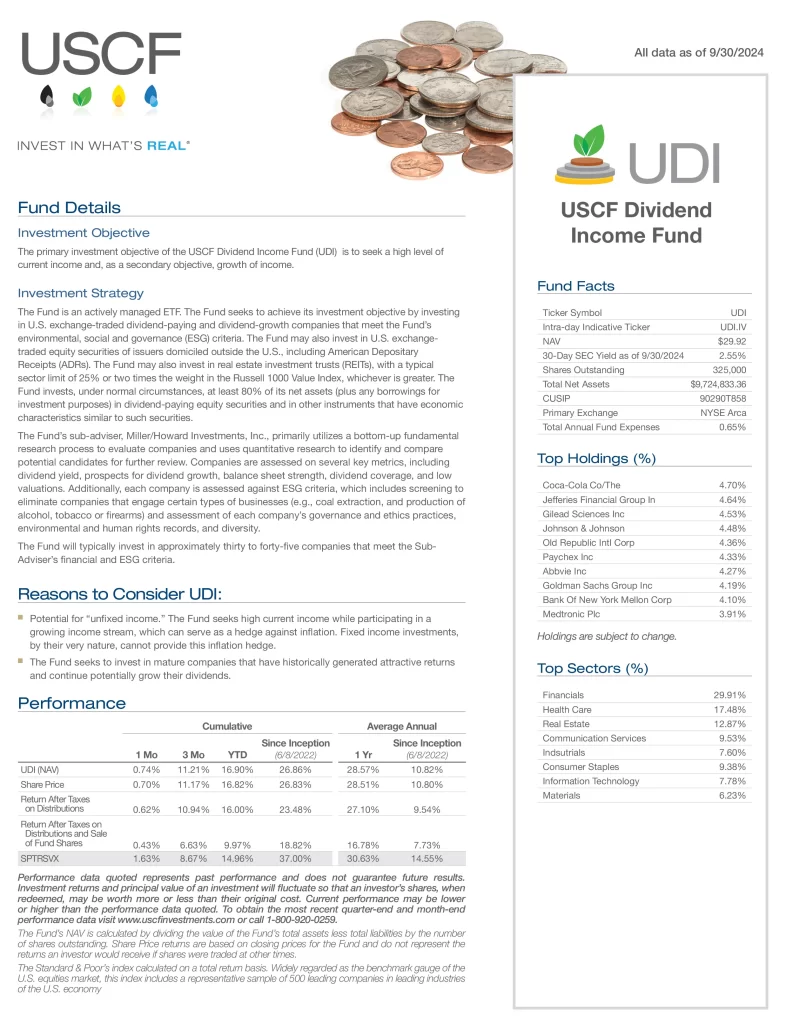

37. USCF ESG Dividend Income Fund

USCF ESG Dividend Income Fund (UDI) is an actively managed ETF. The Fund seeks to achieve its investment objective by investing in U.S. exchange-traded dividend-paying and dividend-growth companies that meet the Fund’s environmental, social and governance (ESG) criteria. The Fund may also invest in U.S. exchange-traded equity securities of issuers domiciled outside the U.S., including American Depositary Receipts (ADRs). The Fund may also invest in real estate investment trusts (REITs), with a typical sector limit of 25% or two times the weight in the Russell 1000 Value Index, whichever is greater. The Fund invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in dividend-paying equity securities and in other instruments that have economic characteristics similar to such securities.

The Fund’s sub-adviser, Miller/Howard Investments, Inc., primarily utilizes a bottom-up fundamental research process to evaluate companies and uses quantitative research to identify and compare potential candidates for further review. Companies are assessed on several key metrics, including dividend yield, prospects for dividend growth, balance sheet strength, dividend coverage, and low valuations. Additionally, each company is assessed against ESG criteria, which includes screening to eliminate companies that engage certain types of businesses (e.g., coal extraction, and production of alcohol, tobacco or firearms) and assessment of each company’s governance and ethics practices, environmental and human rights records, and diversity.

The Fund will typically invest in approximately thirty to forty-five companies that meet the Sub-Adviser’s financial and ESG criteria.

The Fund seeks to invest in mature companies that have historically generated attractive returns and continue potentially grow their dividends.

- Seeks high current income while participating in a growing income stream, which can serve as a hedge against inflation

- Seeks to invest in mature companies that have historically generated attractive returns and continue potentially grow their dividends

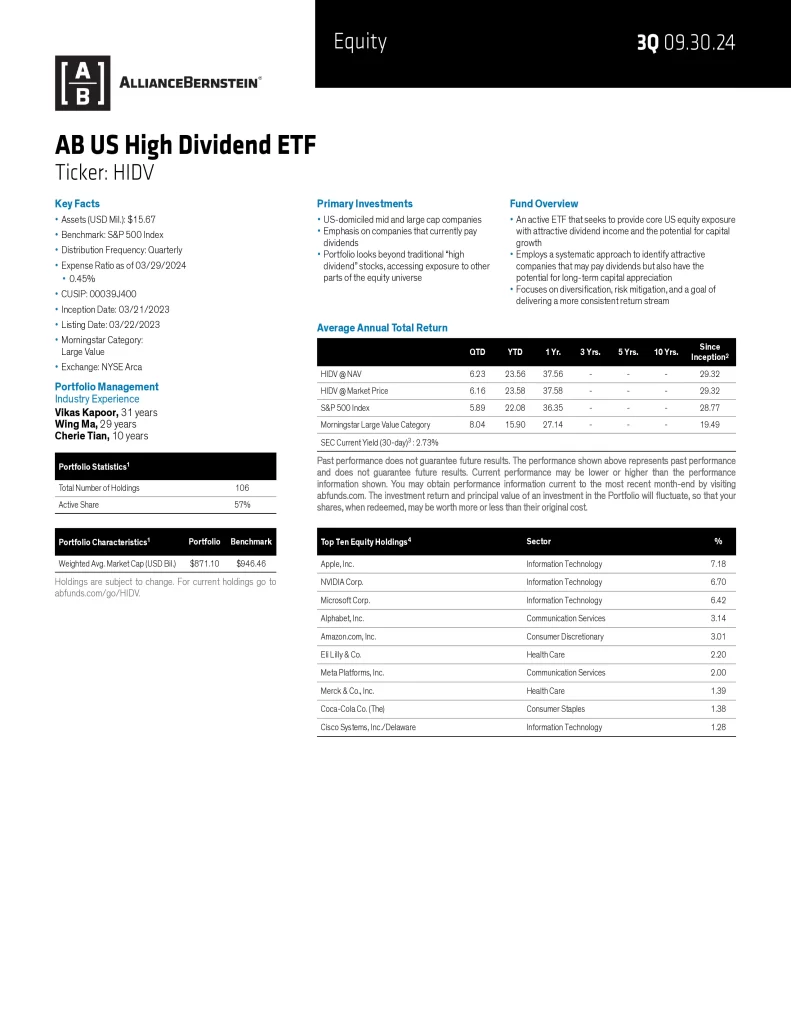

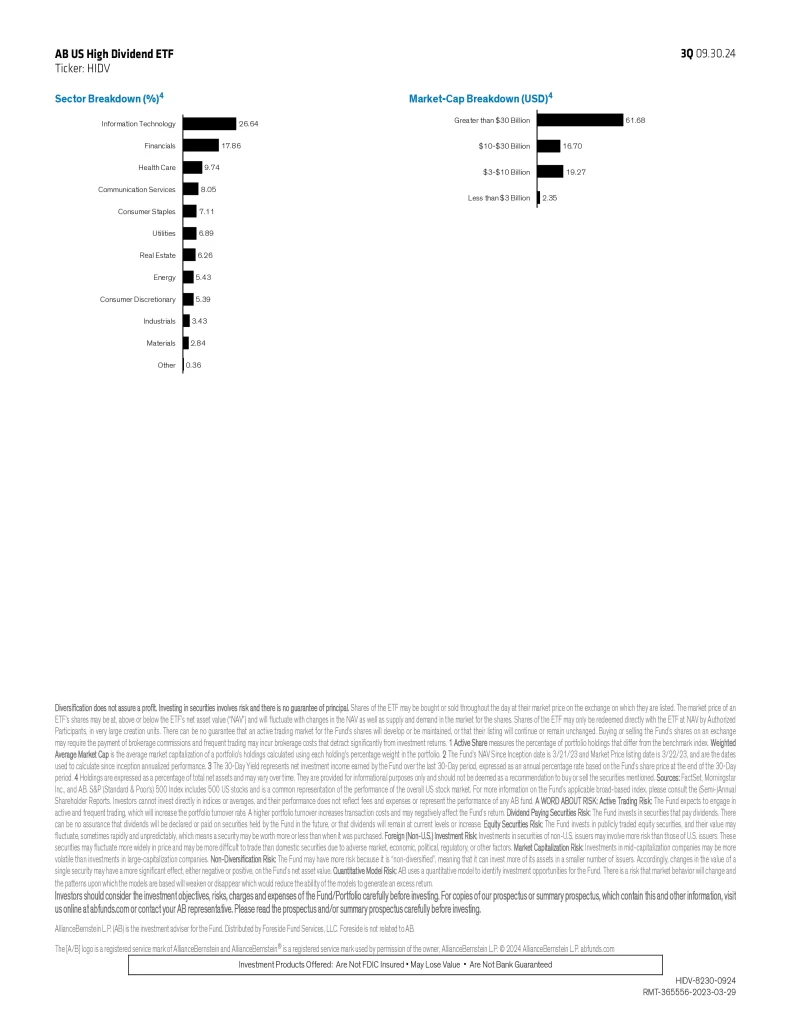

36. AB US High Dividend ETF (HIDV)

AB US High Dividend ETF (HIDV) is an active ETF that seeks to provide core US equity exposure with attractive dividend income and the potential for capital growth.

- Employs a systematic approach to identify attractive companies that may pay dividends but also have the potential for long-term capital appreciation

- Focuses on diversification, risk mitigation, and a goal of delivering a more consistent return stream

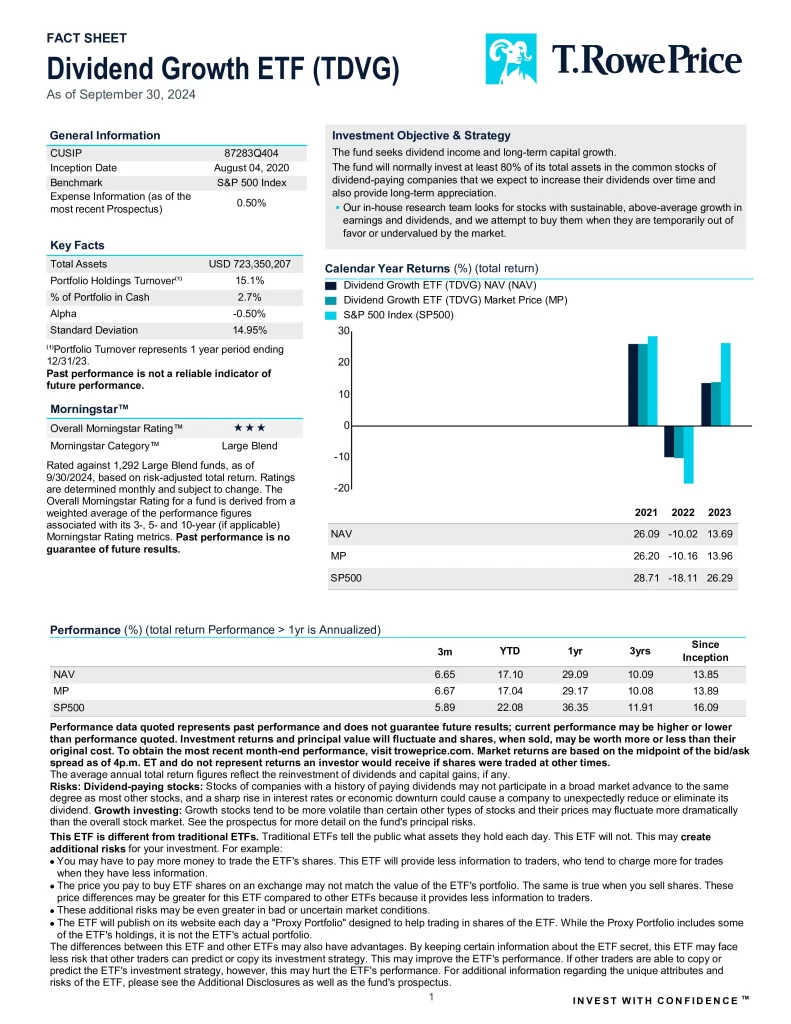

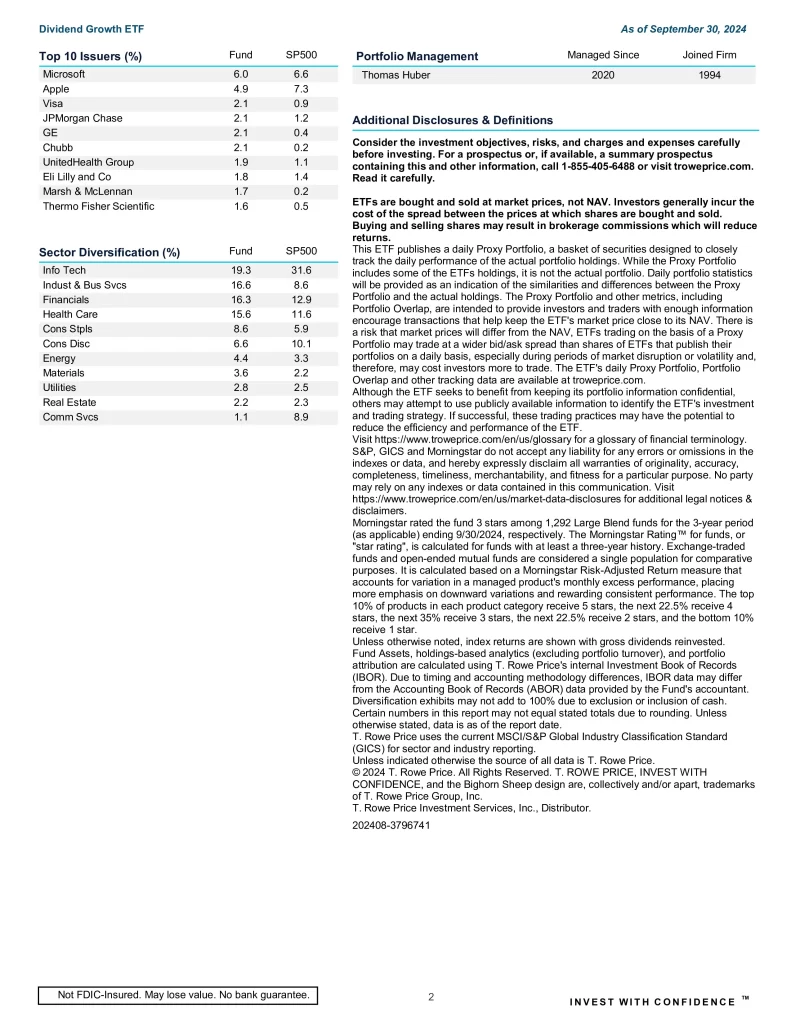

35. T. Rowe Price Dividend Growth ETF

T. Rowe Price Dividend Growth ETF (TDVG) invests at least 80% of the fund’s assets in stocks that have a strong track record of paying dividends or are expected to pay dividends over time (even if not currently paying dividends) (or futures that have similar economic characteristics). The adviser believes that a track record of dividend increases can be an excellent indicator of financial health and growth prospects, and that over the long term, income can contribute significantly to total return. Dividends can also help reduce the fund’s volatility during periods of market turbulence and help offset losses when stock prices are falling.

34. Amplify Cash Flow Dividend Leaders ETF

Amplify Cash Flow Dividend Leaders ETF (COWS) is a strategy driven ETF investing in companies with a blend of high trailing and future free cash flow yields that have a history of growing and paying dividends. The portfolio aims to provide long-term capital appreciation and monthly income distributions. COWS seeks investment results that correspond generally to the Kelly US Cash Flow Dividend Leaders Index.

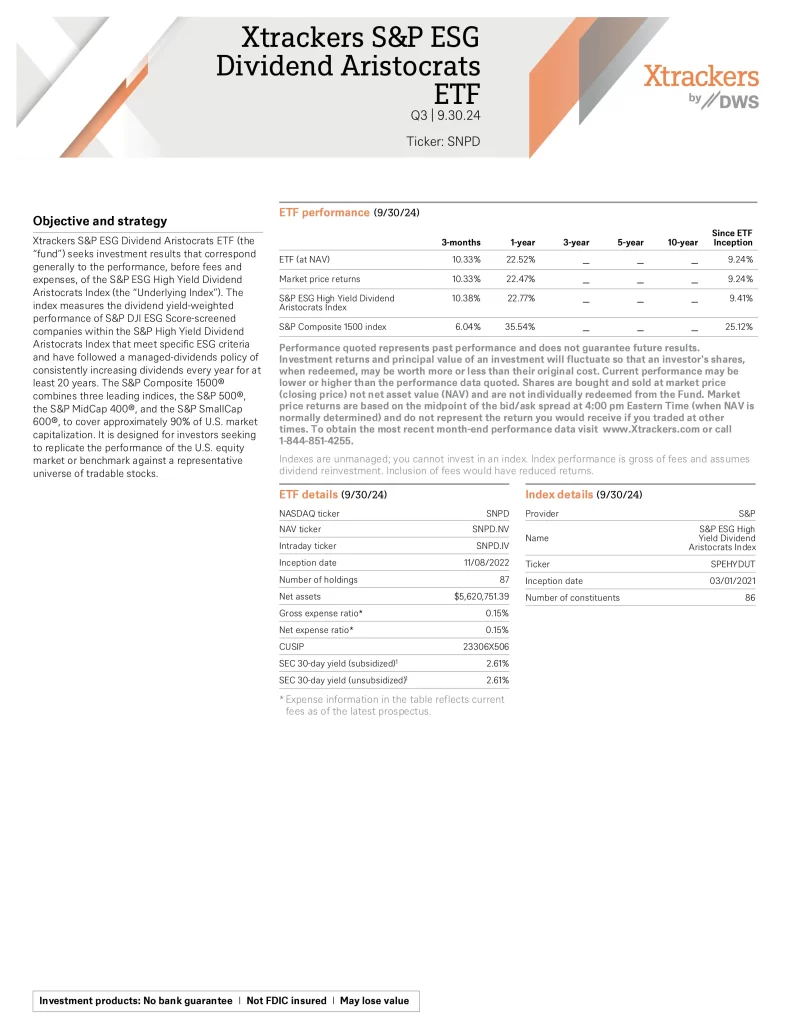

33. Xtrackers S&P ESG Dividend Aristocrats ETF

Xtrackers S&P ESG Dividend Aristocrats ETF (SNPD) seeks investment results that correspond generally to the performance, before fees and expenses, of the S&P ESG High Yield Dividend Aristocrats Index.

32. Invesco S&P 500 High Dividend Growers ETF

Invesco S&P 500 High Dividend Growers ETF (DIVG) seeks to track the investment results of the S&P 500 High Dividend Growth Index. The Fund will generally invest at least 90% of its total assets in the securities that comprise the Index. The Index selects the 100 constituents with the highest forecasted dividend yield growth from the eligible stocks in the index universe subject to a 20% buffer to reduce turnover.

- Securities that are a part of the S&P 500 are eligible for inclusion

- Securities must have a forecasted dividend yield greater than zero and maintained a dividend yield every year for at least five consecutive years

- Rebalances semi-annually in April and October

31. Franklin U.S. Low Volatility High Dividend Index ETF

Franklin U.S. Low Volatility High Dividend Index ETF (LVHD) seeks to track the investment results of an underlying index composed of equity securities of U.S. companies with relatively high yield and low price and earnings volatility. LVHD may benefit investors who want income but are concerned about the volatility that can come from traditional equity income investments.

30. Invesco S&P 500 High Dividend Low Volatility ETF

Invesco S&P 500 High Dividend Low Volatility ETF (SPHD) is based on the S&P 500 Low Volatility High Dividend Index. The Fund will invest at least 90% of its total assets in common stocks that comprise the Index. Standard & Poor’s compiles, maintains and calculates the Index, which is composed of 50 securities traded on the S&P 500 Index that historically have provided high dividend yields and low volatility. The Fund and the Index are rebalanced and reconstituted semi-annually, in January and July.

29. iShares Core High Dividend ETF (HDV)

iShares Core High Dividend ETF (HDV) seeks to track the investment results of an index composed of relatively high dividend paying U.S. equities.

- Exposure to established, high-quality U.S. companies

- Access to 75 dividend-paying domestic stocks that have been screened for financial health

- Use at the core of your portfolio to seek income

28. SPDR Portfolio S&P 500 High Dividend ETF

SPDR Portfolio S&P 500 High Dividend ETF (SPYD) is designed to measure the performance of the top 80 high dividend-yielding companies within the S&P 500 Index. To determine dividend yield: (i) an indicated dividend is measured by taking the latest dividend paid (excluding special payments) multiplied by the annual frequency of the payment; and (ii) the indicated dividend is then divided by the company’s share price at the date of rebalancing.

27. Invesco High Yield Equity Dividend Achievers ETF

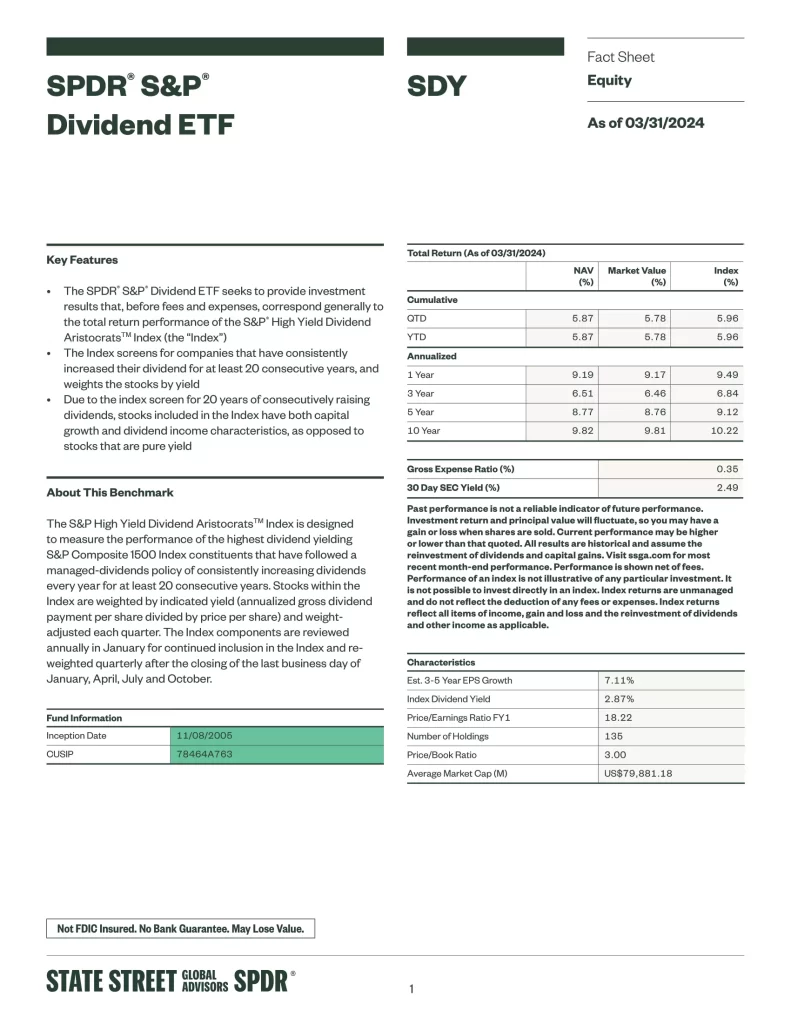

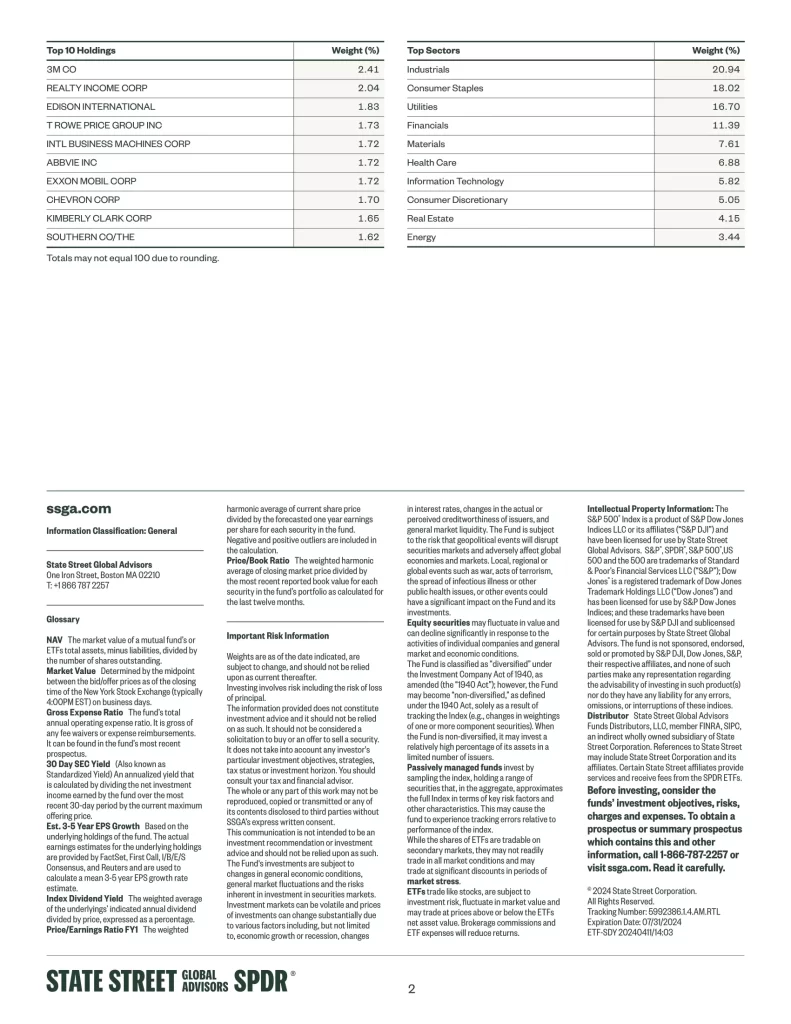

Invesco High Yield Equity Dividend Achievers ETF (PEY) is based on the NASDAQ US Dividend Achievers 50 Index. The Fund will normally invest at least 90% of its total assets in dividend paying common stocks that comprise the Index. The Index is comprised of 50 stocks selected principally on the basis of dividend yield and consistent growth in dividends. The Fund and the Index are reconstituted annually in March and rebalanced quarterly in March, June, September and December.

26. SPDR S&P Dividend ETF

SPDR S&P Dividend ETF (SDY) is designed to measure the performance of the highest dividend-yielding S&P Composite 1500 Index constituents that have followed a managed dividends polic y of consistently increasing dividends every year for at least 20 consecutive years. Stocks within the Index are weighted by indicated yield (annualized gross dividend payment per share divided by price per share) and weight-adjusted each quarter. The Index components are reviewed annually in January for continued inclusion in the Index and re-weighted quarterly after the closing of the last business day of January, April, July and October.

- The SPDR S&P Dividend ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P High Yield Dividend Aristocrats Index

- The Index screens for companies that have consistently increased their dividend for at least 20 consecutive years, and weights the stocks by yield

- Due to the index screen for 20 years of consecutively raising dividends, stocks included in the Index have both capital growth and dividend income characteristics, as opposed to stocks that are pure yield

Top 10 SDY Holdings

| Name | Weight |

|---|---|

| 3M CO | 2.79% |

| REALTY INCOME CORP | 2.54% |

| SOUTHERN CO/THE | 1.83% |

| XCEL ENERGY INC | 1.79% |

| CHEVRON CORP | 1.77% |

| EDISON INTERNATIONAL | 1.76% |

| T ROWE PRICE GROUP INC | 1.73% |

| KENVUE INC | 1.66% |

| CONSOLIDATED EDISON INC | 1.65% |

| WEC ENERGY GROUP INC | 1.62% |

25. WisdomTree U.S. High Dividend Fund

WisdomTree U.S. High Dividend Fund (DHS) seeks to track the investment results of high-dividend-yielding companies in the U.S. equity market.

- Gain targeted exposure to U.S. equity from high dividend yielding companies

- Use to complement or replace large cap value and dividend oriented active and passive strategies

- Use to satisfy demand for growth potential and income focus

24. ALPS Sector Dividend Dogs ETF

ALPS Sector Dividend Dogs ETF (SDOG) applies the ‘Dogs of the Dow Theory’ on a sector-by-sector basis using the S-Network US Equity WR Large-Cap 500 Index (SNR 500) as its starting universe of eligible securities. This strategy provides the following potential benefits:

- High Dividend Yield Relative to US Large Cap Indices: Starting with a large-cap universe such as the SNR 500 diminishes the likelihood of troubled and financially distressed companies entering the Index and allows dividend yield to be the primary selection criterion for the Index.

- Sector and Stock Diversification: SDOG provides high dividend exposure across all 10 sectors of the market by selecting the five highest yielding securities in each sector and equally weighting them. This provides diversification at both the stock and sector level.

- Dogs Theory: SDOG isolates the SNR 500 constituents with the highest dividend yield in their respective sectors providing the potential for price appreciation as market forces bring their yield into line with the overall market.

23. iShares Select Dividend ETF (DVY)

iShares Select Dividend ETF (DVY) seeks to track the investment results of an index composed of relatively high dividend paying U.S. equities.

- Exposure to broad-cap U.S. companies with a consistent history of dividends

- Access 100 U.S. stocks with 5-year records of paying dividends

- Use to seek income

22. Timothy Plan High Dividend Stock ETF (TPHD)

Timothy Plan High Dividend Stock ETF (TPHD) employs a proprietary volatility weighting methodology for a broader exposure among blue chip stocks. It is a fund aiming to reduce exposure to market volatility while striving to generate higher returns than major market indices, while also placing an emphasis on dividend producing companies.

TPHD seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets directly or indirectly in the securities included in the Victory US Large Cap High Dividend Volatility Weighted BRI Index, an unmanaged, volatility weighted index created by the Sub-Advisor. A volatility weighted index assigns percentage values to each security in the Index based on the volatility of that security in the market. More volatile stocks have a lower weighting, and less volatile stocks are assigned a higher weighting.

21. Invesco Dow Jones Industrial Average Dividend ETF (DJD)

Invesco Dow Jones Industrial Average Dividend ETF (DJD) is based on the Dow Jones Industrial Average Yield Weighted. The Fund will invest at least 90% of its total assets in common stocks that comprise the Index. The Index is designed to provide exposure to dividend-paying equity securities in the Dow Jones Industrial Average by their 12-month dividend yield over the prior 12 months. Only securities with consistent dividend payments over the previous 12 months are included in the Index. The Fund and the Index are rebalanced semiannually.

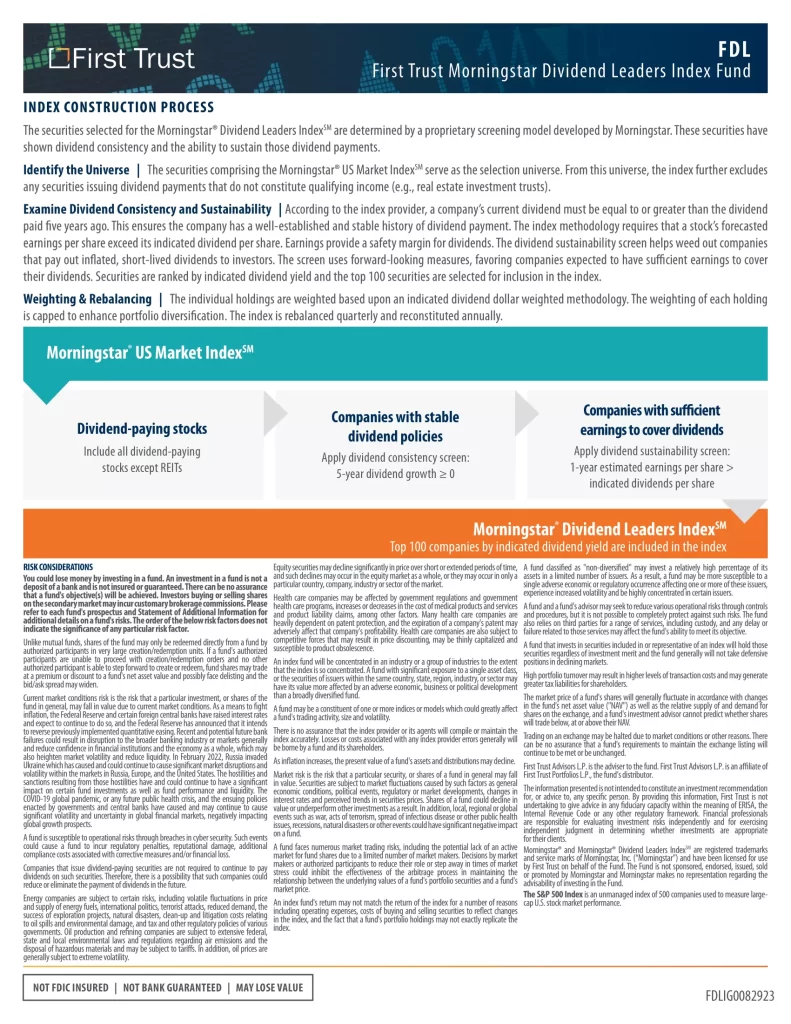

20. First Trust Morningstar Dividend Leaders Index Fund

The investment objective of First Trust Morningstar Dividend Leaders Index Fund (FDL) is to replicate as closely as possible, before fees and expenses, the price and yield of the Morningstar Dividend Leaders Index.

- Securities selected for the Morningstar Dividend Leaders Index are determined by a proprietary screening model developed by Morningstar that has historically maintained consistent and sustainable dividend policies

- The selection universe for this index is based on the Morningstar US Market Index of securities issuing dividend payments that do not constitute qualifying income (e.g., real estate investment trusts) are excluded

- The remaining stocks are ranked by indicated dividend yield. The top 100 are selected for inclusion in the index

- Index constituents are weighted based on the dollar value of indicated dividend payments. Weightings are adjusted so that no individual security has greater than 10% weight, and securities with greater than 5% weight do not collectively exceed 50% of the index

- The index is rebalanced quarterly and reconstituted annually

- Based on forward looking earnings estimates and indicated dividends, stocks are eliminated from consideration if:

- The five-year indicated dividend per share growth is less than zero

- One year estimated earnings per share divided by its indicated dividend per share is less than or equal to one

Top 10 FDL Holdings

| Ticker | Name | Weight |

|---|---|---|

| CVX | Chevron Corporation | 10.00% |

| VZ | Verizon Communications Inc. | 8.57% |

| ABBV | AbbVie Inc. | 7.59% |

| PFE | Pfizer Inc. | 7.59% |

| PM | Philip Morris International Inc. | 6.72% |

| MO | Altria Group, Inc. | 5.85% |

| IBM | International Business Machines Corporation | 4.00% |

| C | Citigroup Inc. | 3.39% |

| MMM | 3M Company | 2.89% |

| DUK | Duke Energy Corporation | 2.66% |

19. VictoryShares Dividend Accelerator ETF (VSDA)

VictoryShares Dividend Accelerator ETF (VSDA) offers exposure to large-cap U.S. stocks, that feature not only a history of increasing dividends, but which also possess the highest probability of future dividend growth. It seeks to provide exposure to dividend growth, rather than yielding, offering a potential diversification benefit to high dividend yielding alternatives, particularly in a rising rate environment.

- VSDA addresses an investor’s need for potentially higher income through the sustainability of future dividend growth

- VSDA provides a further layer of risk awareness by beginning with a broad investible universe and investing in high quality companies with stable earnings’ patterns

18. ALPS O’Shares U.S. Quality Dividend ETF Shares

ALPS O’Shares U.S. Quality Dividend ETF Shares (OUSA) is designed to provide cost efficient access to a portfolio of large-cap and mid-cap high quality, low volatility, dividend paying companies in the United States selected based on fundamental metrics including quality, low volatility and dividend growth.

17. Vanguard High Dividend Yield Index Fund

Vanguard High Dividend Yield Index Fund ETF Shares (VYM) seeks to track the performance of the FTSE High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high dividend yields.

- Provides a convenient way to track the performance of stocks that are forecasted to have above-average dividend yields

- Follows a passively managed, full-replication approach

Top 10 VYM Holdings

| Ticker | Name | Weight |

|---|---|---|

| AVGO | Broadcom Inc. | 3.46% |

| JPM | JPMorgan Chase & Co. | 3.42% |

| XOM | Exxon Mobil Corp. | 2.92% |

| PG | Procter & Gamble Co. | 2.37% |

| JNJ | Johnson & Johnson | 2.15% |

| HD | Home Depot Inc. | 2.06% |

| MRK | Merck & Co. Inc. | 2.03% |

| ABBV | AbbVie Inc. | 1.77% |

| CVX | Chevron Corp. | 1.66% |

| BAC | Bank of America Corp. | 1.58% |

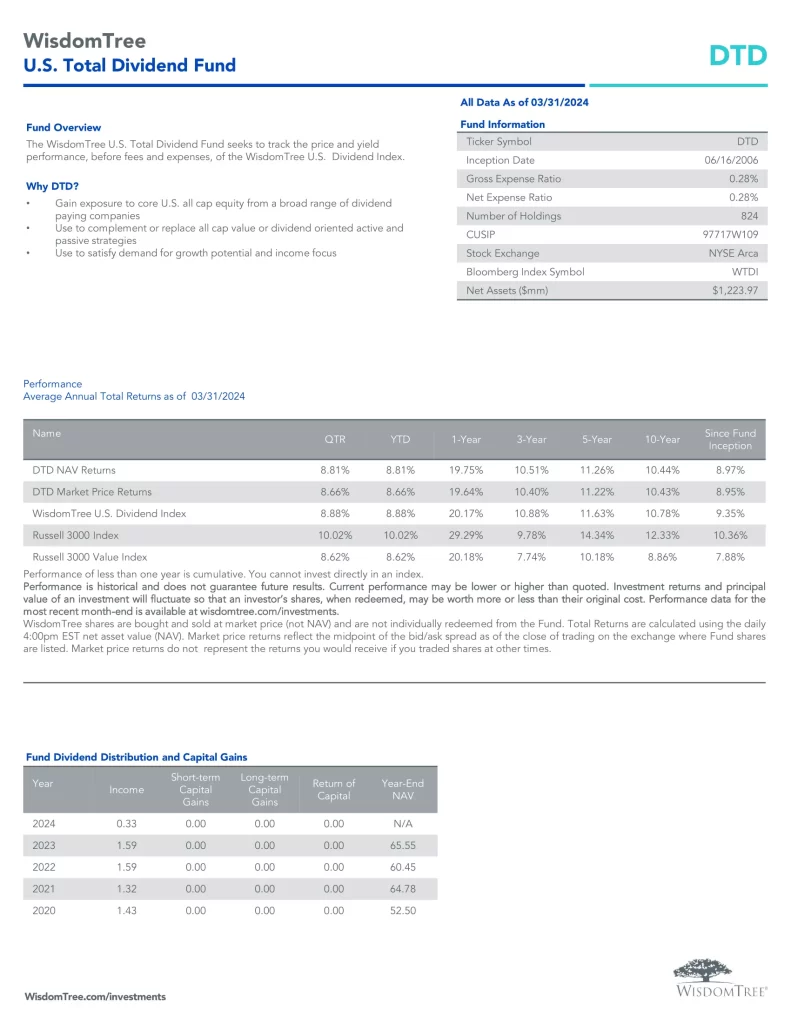

16. WisdomTree U.S. Total Dividend Fund

WisdomTree U.S. Total Dividend Fund (DTD) seeks to track the investment results of broad dividend-paying companies in the U.S. equity market.

- Gain exposure to core U.S. all cap equity from a broad range of dividend paying companies

- Use to complement or replace all cap value or dividend oriented active and passive strategies

- Use to satisfy demand for growth potential and income focus

Top 10 DTD Holdings

| Ticker | Name | Weight |

|---|---|---|

| MSFT | Microsoft Corp | 3.24% |

| AAPL | Apple Inc | 3.00% |

| JPM | JPMorgan Chase & Co | 2.85% |

| XOM | Exxon Mobil Corp | 2.66% |

| AVGO | Broadcom Inc | 2.33% |

| ABBV | AbbVie Inc | 2.21% |

| JNJ | Johnson & Johnson | 2.03% |

| NVDA | Nvidia Corp | 1.98% |

| PG | Procter & Gamble Co/The | 1.86% |

| CVX | Chevron Corp | 1.64% |

15. FlexShares Quality Dividend Index Fund

FlexShares Quality Dividend Index Fund (QDF) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust Quality Dividend Index.

14. iShares Core Dividend Growth ETF

iShares Core Dividend Growth ETF (DGRO) invests in the stocks of U.S. companies that have a history of growing dividends. This has been a key historical driver of returns and an attractive source of income for investors. The fund has also delivered competitive performance, kept costs low and been tax efficient for investors.

- DGRO offers low-cost exposure to U.S. stocks focused on dividend growth

- Access companies that have a history of sustained dividend growth and that are broadly diversified across industries

- Use at the core of your portfolio to seek income

Top 10 DGRO Holdings

| Ticker | Name | Weight |

|---|---|---|

| AAPL | APPLE INC | 3.18% |

| XOM | EXXON MOBIL CORP | 3.14% |

| MSFT | MICROSOFT CORP | 3.06% |

| CVX | CHEVRON CORP | 3.03% |

| JPM | JPMORGAN CHASE & CO | 2.88% |

| JNJ | JOHNSON & JOHNSON | 2.52% |

| AVGO | BROADCOM INC | 2.38% |

| ABBV | ABBVIE INC | 2.30% |

| PG | PROCTER & GAMBLE | 2.15% |

| MRK | MERCK & CO INC | 1.91% |

13. Invesco Dividend Achievers ETF

Invesco Dividend Achievers ETF (PFM) seeks to replicate, before fees and expenses, the NASDAQ US Broad Dividend Achievers Index, which is designed to identify a diversified group of dividend-paying companies. The Fund will normally invest at least 90% of its total assets in dividend paying common stocks that comprise Index. These companies have increased their annual dividend for 10 or more consecutive fiscal years. The Fund and the Index are reconstituted annually in March and rebalanced quarterly in March, June, September and December.

12. FlexShares Quality Dividend Defensive Index Fund

FlexShares Quality Dividend Defensive Index Fund (QDEF) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Northern Trust Quality Dividend Defensive Index.

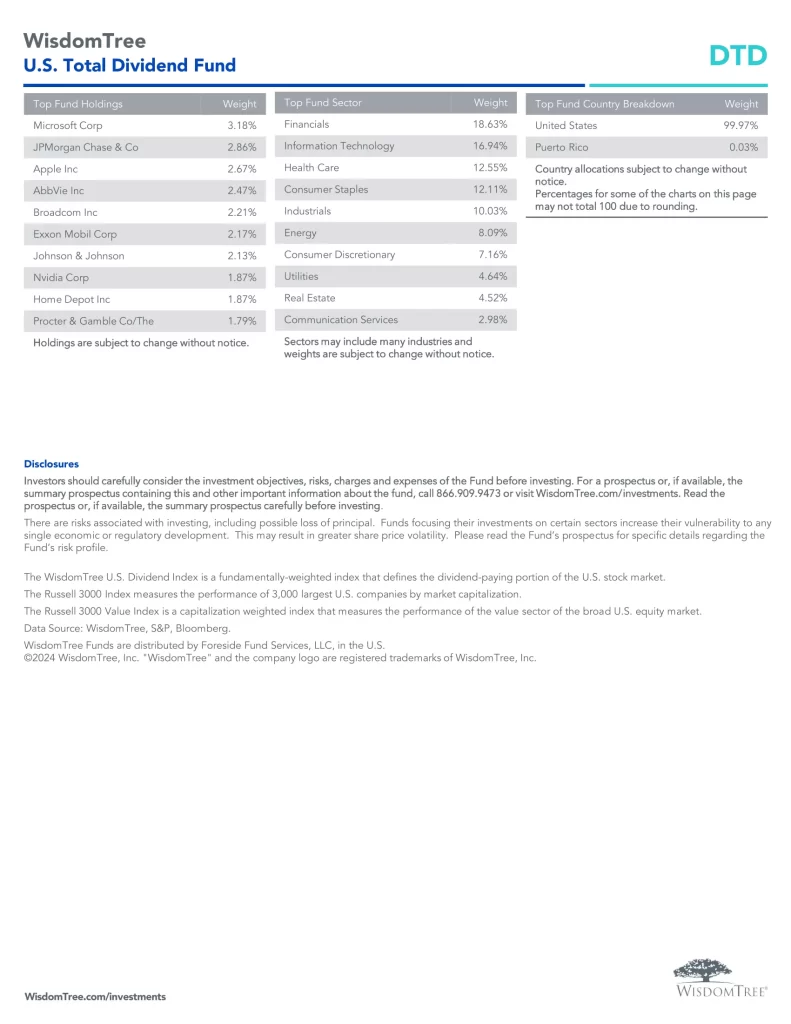

11. WisdomTree U.S. LargeCap Dividend Fund

WisdomTree U.S. LargeCap Dividend Fund (DLN) seeks to track the investment results of dividend-paying large-cap companies in the U.S. equity market.

- Gain exposure to core U.S. large cap equity from dividend paying companies

- Use to complement or replace large cap value or dividend oriented active and passive strategies

- Use to satisfy demand for growth potential and income focus

Top 10 DLN Holdings

| Ticker | Name | Weight |

|---|---|---|

| MSFT | Microsoft Corp | 3.77% |

| AAPL | Apple Inc | 3.47% |

| JPM | JPMorgan Chase & Co | 3.29% |

| XOM | Exxon Mobil Corp | 3.05% |

| AVGO | Broadcom Inc | 2.70% |

| ABBV | AbbVie Inc | 2.55% |

| JNJ | Johnson & Johnson | 2.38% |

| NVDA | Nvidia Corp | 2.20% |

| PG | Procter & Gamble Co/The | 2.16% |

| CVX | Chevron Corp | 1.91% |

10. Schwab U.S. Dividend Equity ETF

Schwab U.S. Dividend Equity ETF (SCHD) goal is to track as closely as possible the total return of the Dow Jones U.S. Dividend 100 Index.

- A straightforward, low-cost fund offering potential tax-efficiency

- The Fund can serve as part of the core or complement in a diversified portfolio

- Tracks an index focused on the quality and sustainability of dividends

- Invests in stocks selected for fundamental strength relative to their peers, based on financial ratios

Top 10 SCHD Holdings

| Symbol | Name | Weight |

|---|---|---|

| TXN | TEXAS INSTRUMENT INC | 4.71% |

| AMGN | AMGEN INC | 4.37% |

| LMT | LOCKHEED MARTIN CORP | 4.17% |

| PEP | PEPSICO INC | 4.17% |

| CVX | CHEVRON CORP | 4.08% |

| PFE | PFIZER INC | 4.07% |

| KO | COCA-COLA | 4.00% |

| VZ | VERIZON COMMUNICATIONS INC | 3.86% |

| UPS | UNITED PARCEL SERVICE INC CLASS B | 3.85% |

| BLK | BLACKROCK INC | 3.84% |

9. Fidelity Dividend ETF for Rising Rates

Fidelity Dividend ETF for Rising Rates (FDRR) seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the Fidelity Dividend Index for Rising RatesSM. Normally investing at least 80% of assets in securities included in the Fidelity Dividend Index for Rising Rates and in depository receipts representing securities included in the index. The Fidelity Dividend Index for Rising Rates is designed to reflect the performance of stocks of large and mid-capitalization dividend-paying companies that are expected to continue to pay and grow their dividends and have a positive correlation of returns to increasing 10-year U.S. Treasury yields.

8. ClearBridge Dividend Strategy ESG ETF

ClearBridge Dividend Strategy ESG ETF (YLDE) is an actively managed strategy that seeks attractive income growth and capital appreciation over time by seeking to invest in dividend paying stocks with positive ESG attributes.

YLDE may benefit investors targeting dividend income, growth of dividend income and long-term capital appreciation—along with engaged, impactful investing—all in an active, tax-efficient structure.

7. Franklin U.S. Core Dividend Tilt Index ETF

Franklin U.S. Core Dividend Tilt Index ETF (UDIV) seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the Morningstar US Dividend Enhanced Select Index. The Underlying Index starts from the Parent Index, which targets large- and mid-capitalization stocks representing the top 85% of the float-adjusted market capitalization of U.S. equity markets.

- Offers low-cost U.S. equity exposure

- Underlying Index aims to deliver a higher dividend yield while limiting expected tracking error relative to the broad-based Parent Index

- Could be used as a core portfolio holding

6. Amplify CWP Enhanced Dividend Income ETF

Amplify CWP Enhanced Dividend Income ETF (DIVO) seeks investment results that correspond generally to an existing strategy called the Enhanced Dividend Income Portfolio (EDIP). The strategy is managed by DIVO’s sub-adviser, Capital Wealth Planning (CWP).

- Income Potential: comprised of high-quality dividend-oriented stocks, along with covered calls on individual stocks.

- Active Management: allows the portfolio manager (CWP) to identify opportunities and risks, and act on those decisions in real time.

- Seeks to Lower Volatility: dividend and option income may provide lower share price volatility vs. the overall market during times of broad-based market declines.

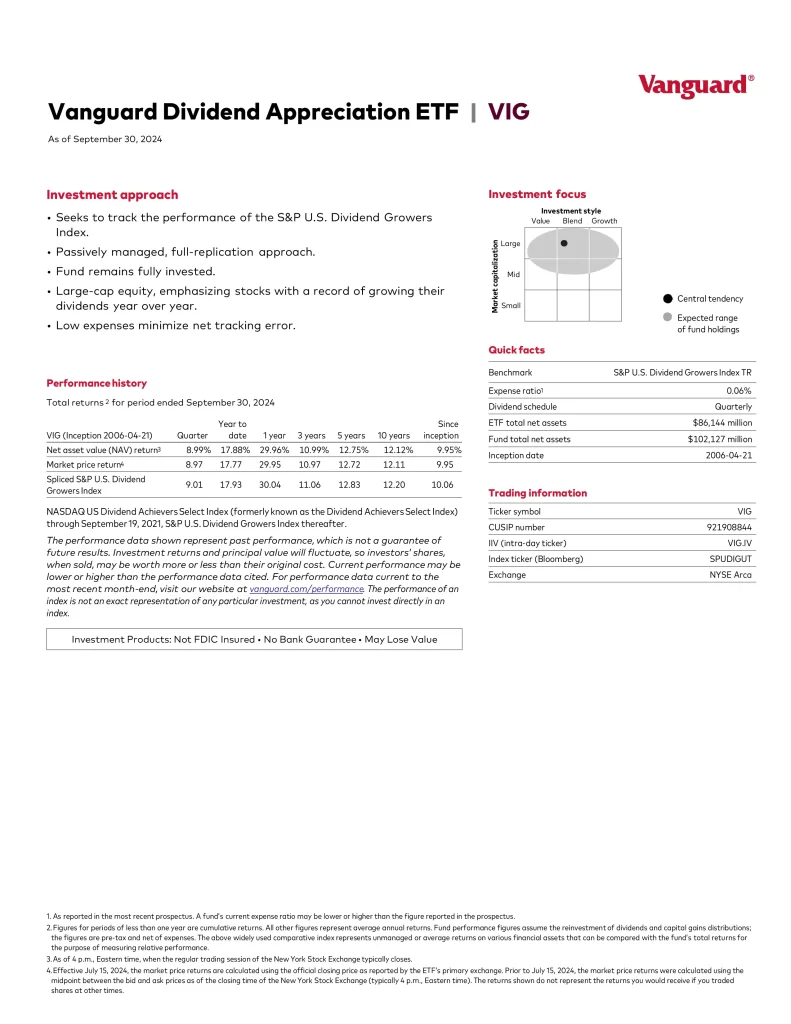

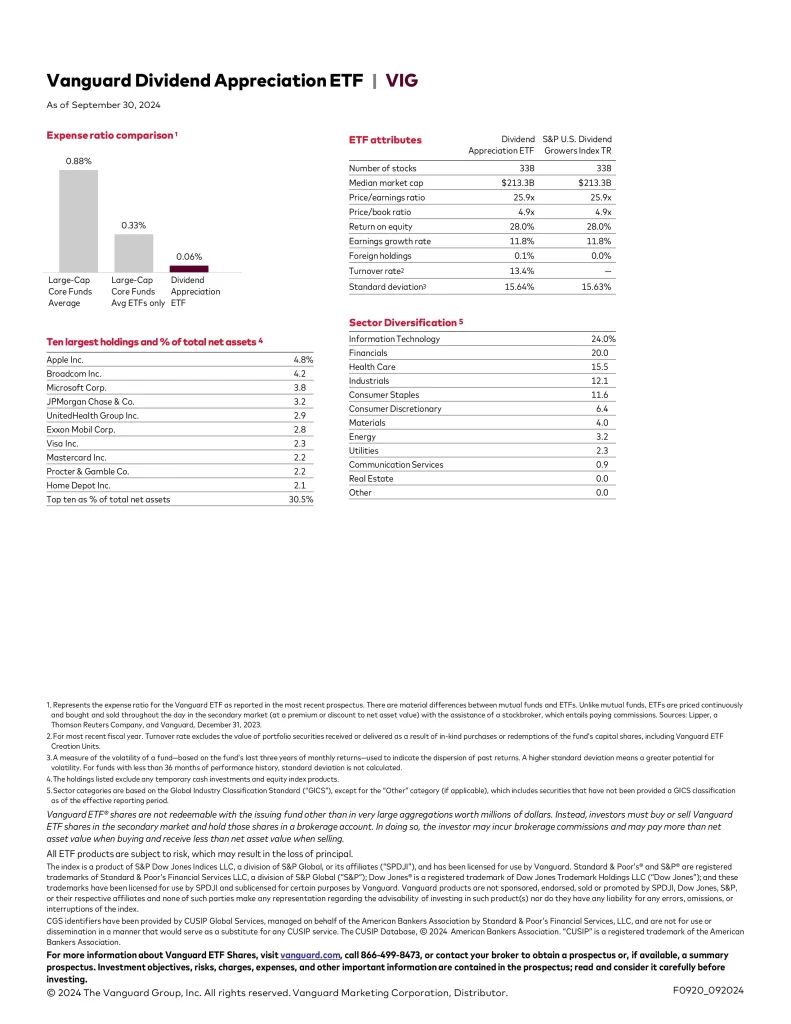

5. Vanguard Dividend Appreciation Index Fund

Vanguard Dividend Appreciation Index Fund ETF Shares (VIG) seeks to track the performance of the S&P U.S. Dividend Growers Index

- Passively managed, full-replication approach

- Fund remains fully invested

- Large-cap equity, emphasizing stocks with a record of growing their dividends year over year

- Low expenses minimize net tracking error

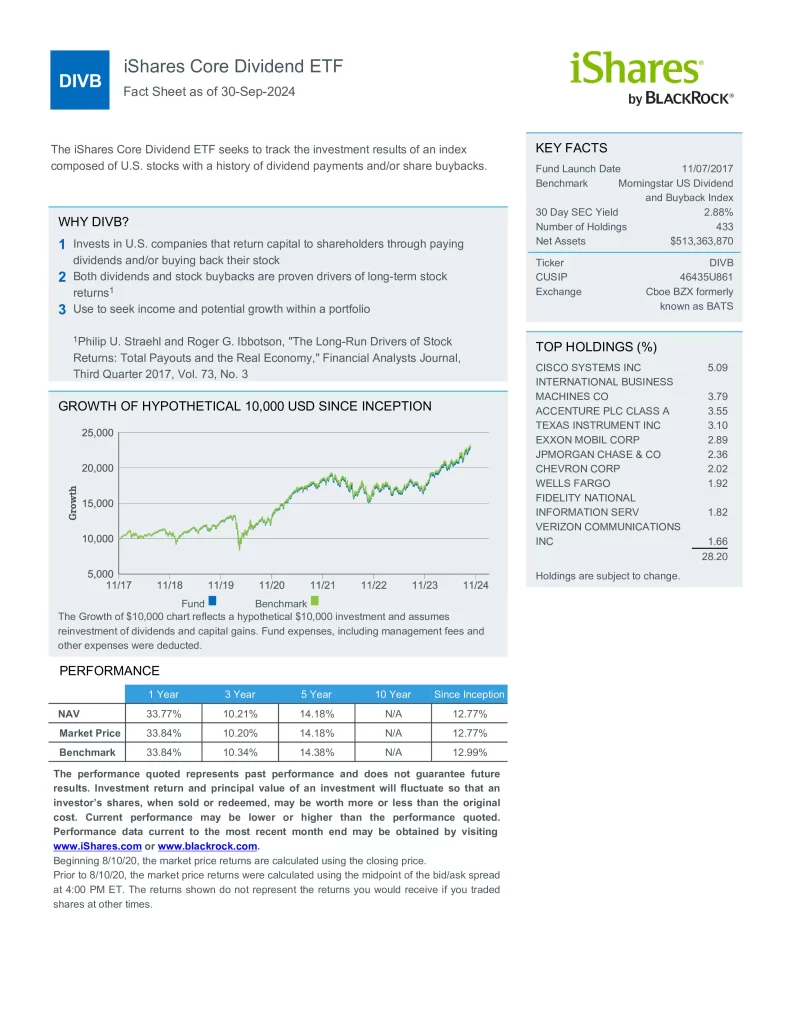

4. iShares Core Dividend ETF

iShares Core Dividend ETF (DIVB) seeks to track the investment results of an index composed of U.S. stocks with a history of dividend payments and/or share buybacks.

- Invests in U.S. companies that return capital to shareholders through paying dividends and/or buying back their stock

- Both dividends and stock buybacks are proven drivers of long-term stock returns

- Use to seek income and potential growth within a portfolio

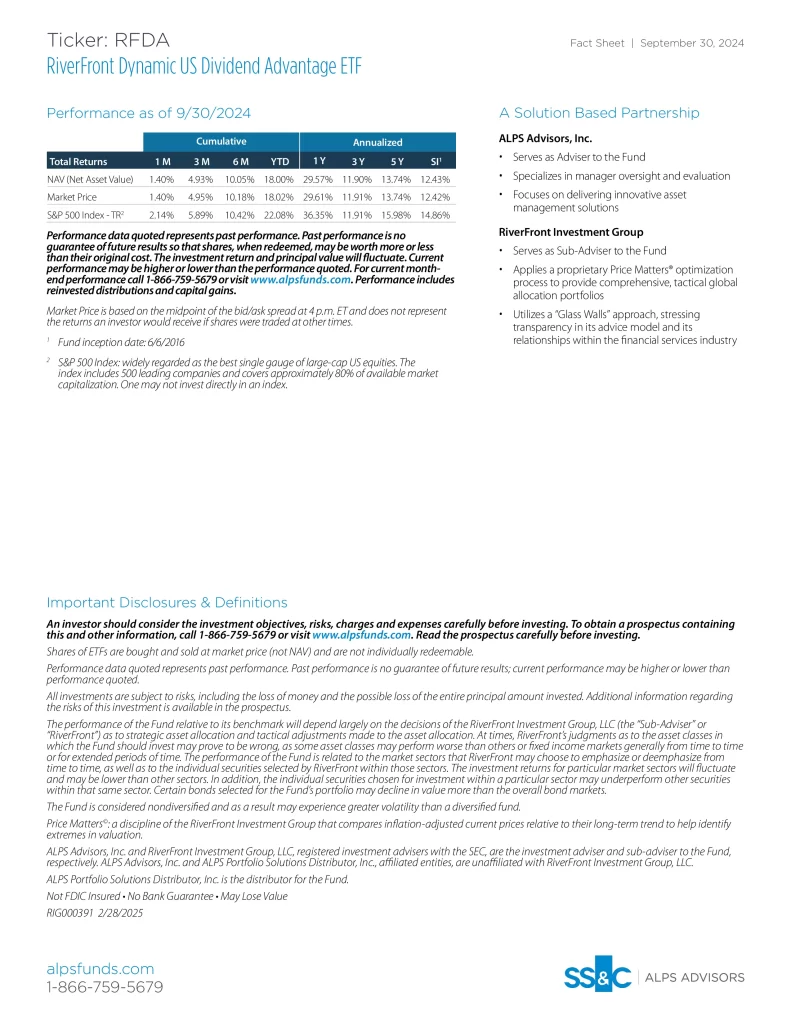

3. RiverFront Dynamic US Dividend Advantage ETF

The RiverFront Dynamic US Dividend Advantage ETF (RFDA) seeks to provide capital appreciation and dividend income. Under normal market conditions, RFDA seeks to achieve its investment objective by investing at least 65% of its net assets in a portfolio of equity securities of publicly traded US companies with the potential for dividend income. Equity securities include common stocks and common or preferred shares of Real Estate Investment Trusts (REITs).

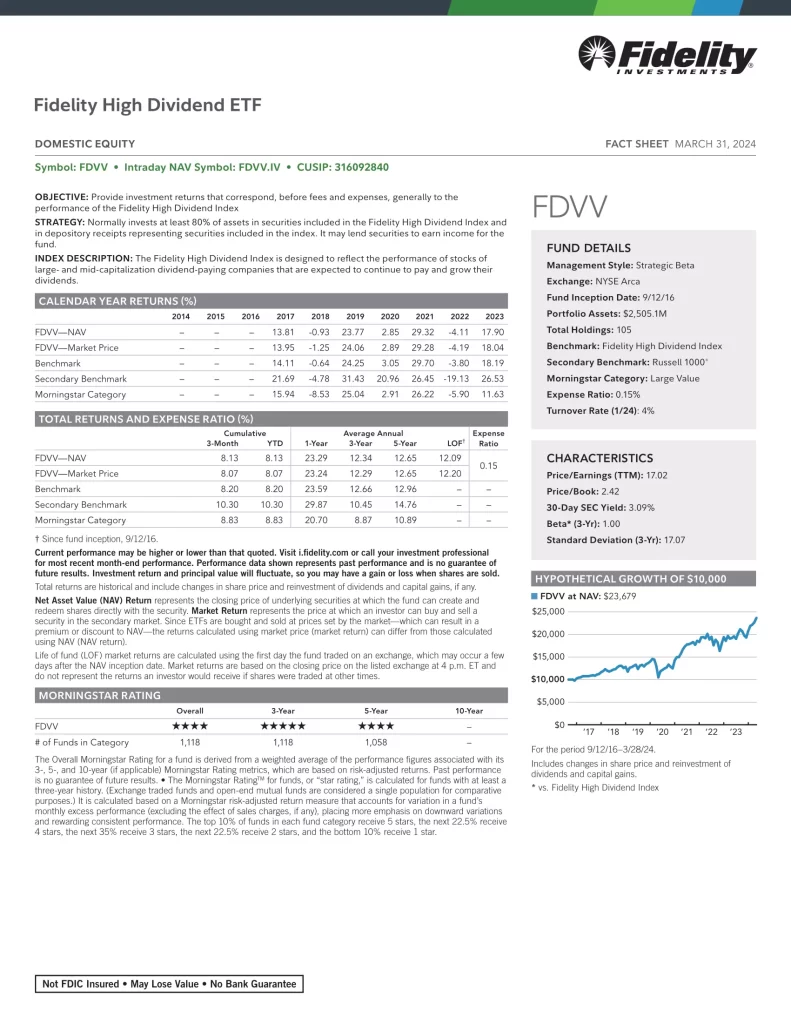

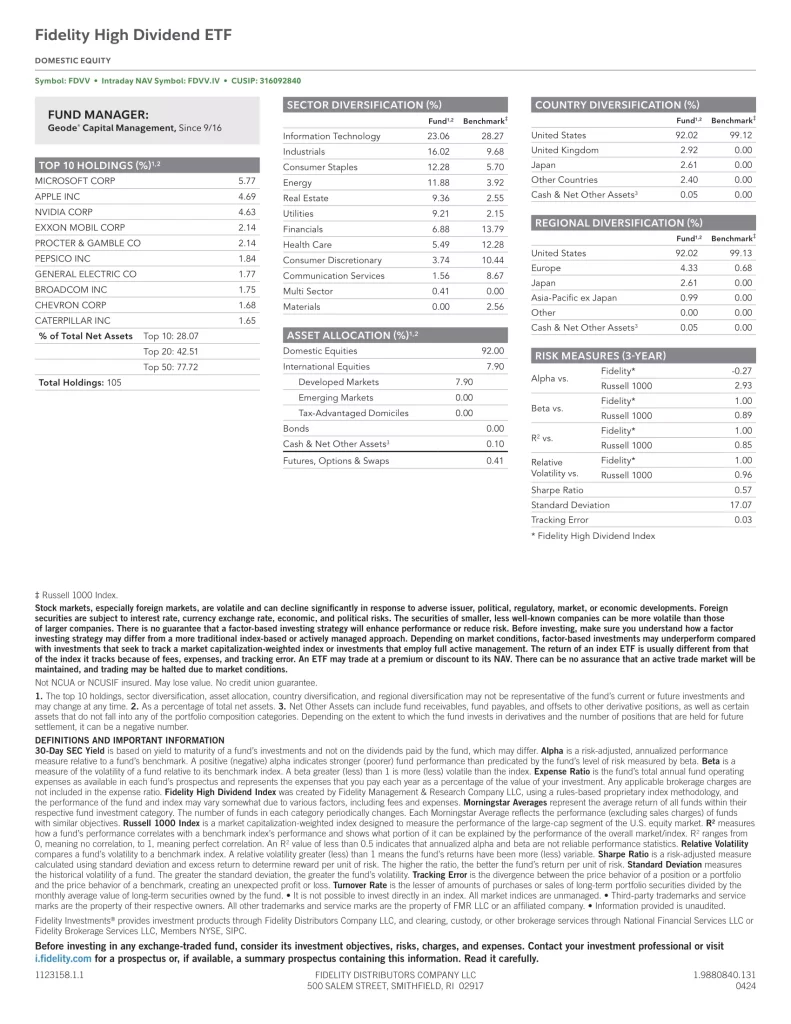

2. Fidelity High Dividend ETF

Fidelity High Dividend ETF (FDVV) normally invests at least 80% of assets in securities included in the Fidelity High Dividend Index. It may lend securities to earn income for the fund. The Fidelity High Dividend Index is designed to reflect the performance of stocks of large- and mid-capitalization dividend-paying companies that are expected to continue to pay and grow their dividends.

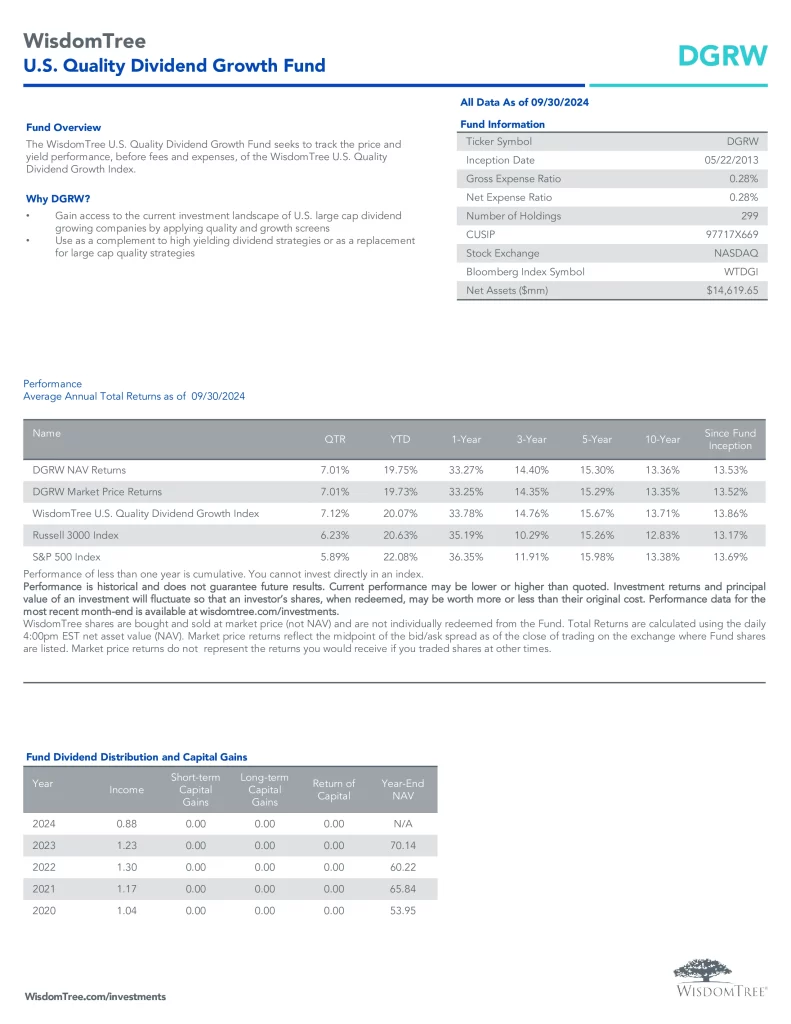

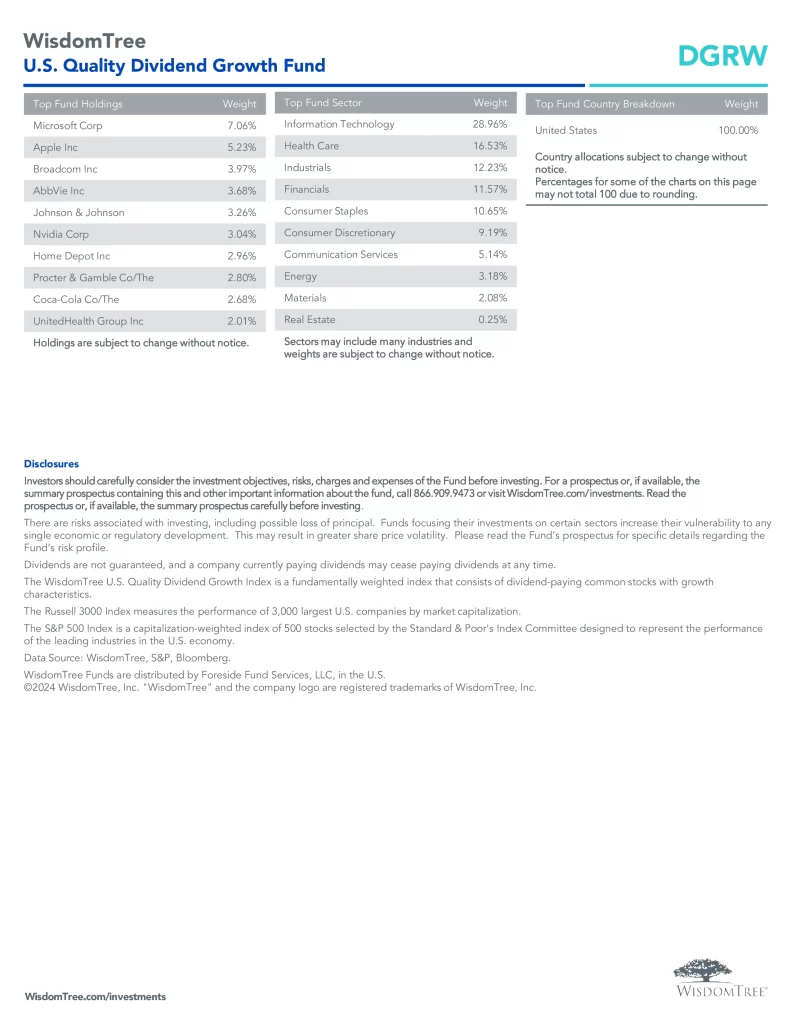

1. WisdomTree U.S. Quality Dividend Growth Fund

WisdomTree U.S. Quality Dividend Growth Fund (DGRW) seeks to track the investment results of dividend-paying large-cap companies with growth characteristics in the U.S. equity market.

- Gain access to the current investment landscape of U.S. large-cap dividend growing companies by applying quality and growth screens

- Use as a complement to high-yielding dividend strategies or as a replacement for large-cap quality strategies

Do ETFs Pay Dividends?

For beginners, using ETFs to target dividend stocks is a practical strategy, providing exposure to dividend investing while maintaining diversification. These dividend ETFs track indexes composed of dividend-paying stocks, employing various dividend strategies based on yield, market capitalization, or location.

Investors approaching retirement often favour dividend ETFs for their consistent income, diversification benefits, risk mitigation, and inflation hedging. With the number of dividend ETFs growing, it’s essential to align your choice with your specific goals, considering factors like investment style, past performance, sector diversity, and fees.

Is a Dividend ETF a Good Investment?

Dividend ETFs bring together a proven investment strategy with the benefits of ETF investing: low costs, tax efficiency and transparency that includes daily disclosure of holdings.

Most dividend-oriented ETFs distribute income to investors quarterly, a frequency that can help investors meet their current spending needs. Fixed bond payments are also regular but tend to be more exposed to inflation than equities. Because stocks may grow their dividends and realize capital appreciation, they can be better positioned to keep pace with or exceed inflation over the long term. In recent years, dividends have come to represent a greater proportion of income than bonds in a typical blended portfolio.

Conclusion

Investing in dividend ETFs comes with instant diversification in dividends that a single dividend ETF offers. The best-performing dividend ETF is WisdomTree U.S. Quality Dividend Growth Fund (DGRW) which offers superior diversification and reliable income, but it’s crucial to note that not all dividend ETFs are equal. This is an active ETF strategy and has outperformed the passive index strategies in the comparison.