Are you interested in kick-starting an exchange-traded fund (ETF) portfolio in Canada? This comprehensive guide will bring you up to speed on the most popular Canadian ETFs currently available. ETFs represent funds that can be traded and track specific indexes. Instead of investing in a single stock, you gain access to a bundle of assets that can be bought and sold during market hours.

The world’s oldest ETF, iShares S&P/TSX 60 ETF (XIU), was listed on the Toronto Stock Exchange on March 9, 1990. As of March 31, 2023, the Canadian ETF industry’s AUM has surged to $365.2 billion, providing Canadian investors with ample opportunities to invest in low-cost, transparent, and accessible ETFs.

Despite potential market turbulence, ETFs have been a preferred choice for Canadian investors since their introduction in 2011, enabling the creation of cost-effective, diversified portfolios spanning various assets and countries. We have compiled a list of ETFs to consider in preparation for potential economic challenges, regardless of their severity. If you decide to make a move, it’s advisable to use a trading platform with low fees.

What is the Best ETF in Canada?

- FXM: CI Morningstar Canada Value Index ETF

- MCSM: Manulife Multifactor Canadian SMID Cap Index ETF

- FST: First Trust Canadian Capital Strength ETF

- DRFC: Desjardins RI Canada Multifactor – Net-Zero Emissions Pathway ETF

- PXC: Invesco FTSE RAFI Canadian Index ETF

- DRMC: Desjardins RI Canada – Net-Zero Emissions Pathway ETF

- CRQ: iShares Canadian Fundamental Index ETF

- DXC: Dynamic Active Canadian Dividend ETF

- VDY: Vanguard FTSE Canadian High Dividend Yield Index ETF

- FLCD: Franklin FTSE Canada All Cap Index ETF

| Manager | ETF | Name | MER | Dividend Yield | Distributions | 5Y |

|---|---|---|---|---|---|---|

| BlackRock | CRQ | iShares Canadian Fundamental Index ETF | 0.72% | 2.76% | Quarterly | 10.14% |

| CI | FXM | CI Morningstar Canada Value Index ETF | 0.65% | 2.78% | Quarterly | 11.60% |

| Desjardins | DRFC | Desjardins RI Canada Multifactor – Net-Zero Emissions Pathway ETF | 0.47% | 1.76% | Quarterly | 10.47% |

| Desjardins | DRMC | Desjardins RI Canada – Net-Zero Emissions Pathway ETF | 0.17% | 2.07% | Quarterly | 10.28% |

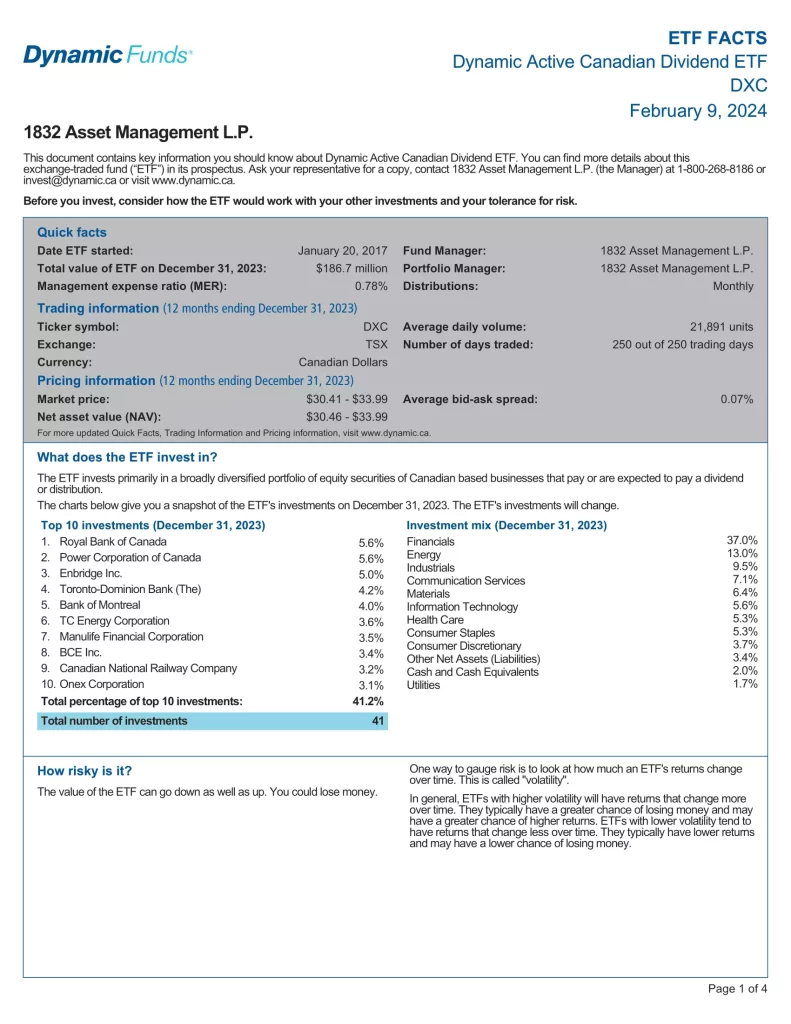

| Dynamic | DXC | Dynamic Active Canadian Dividend ETF | 0.72% | 2.53% | Monthly | 10.11% |

| First Trust | FST | First Trust Canadian Capital Strength ETF | 0.66% | 1.32% | Quarterly | 11.05% |

| Franklin | FLCD | Franklin FTSE Canada All Cap Index ETF | 0.06% | 2.70% | Quarterly | 9.93% |

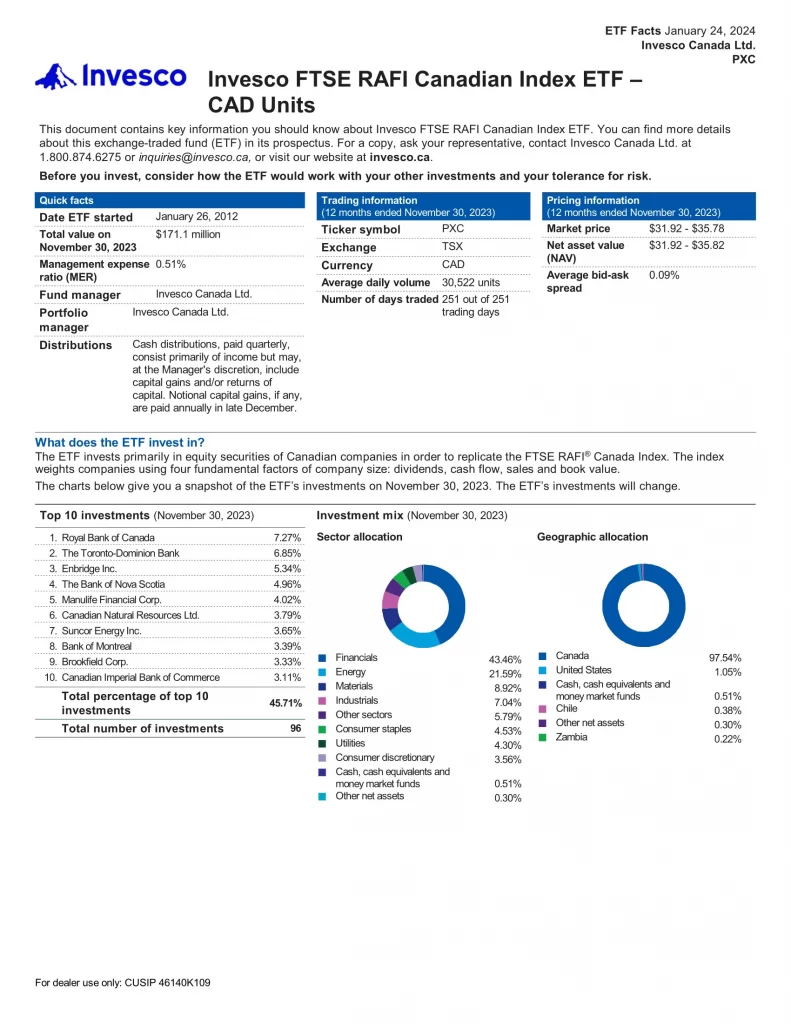

| Invesco | PXC | Invesco FTSE RAFI Canadian Index ETF | 0.51% | 3.40% | Quarterly | 10.40% |

| Manulife | MCSM | Manulife Multifactor Canadian SMID Cap Index ETF | 0.57% | 2.06% | Semi-Annually | 11.06% |

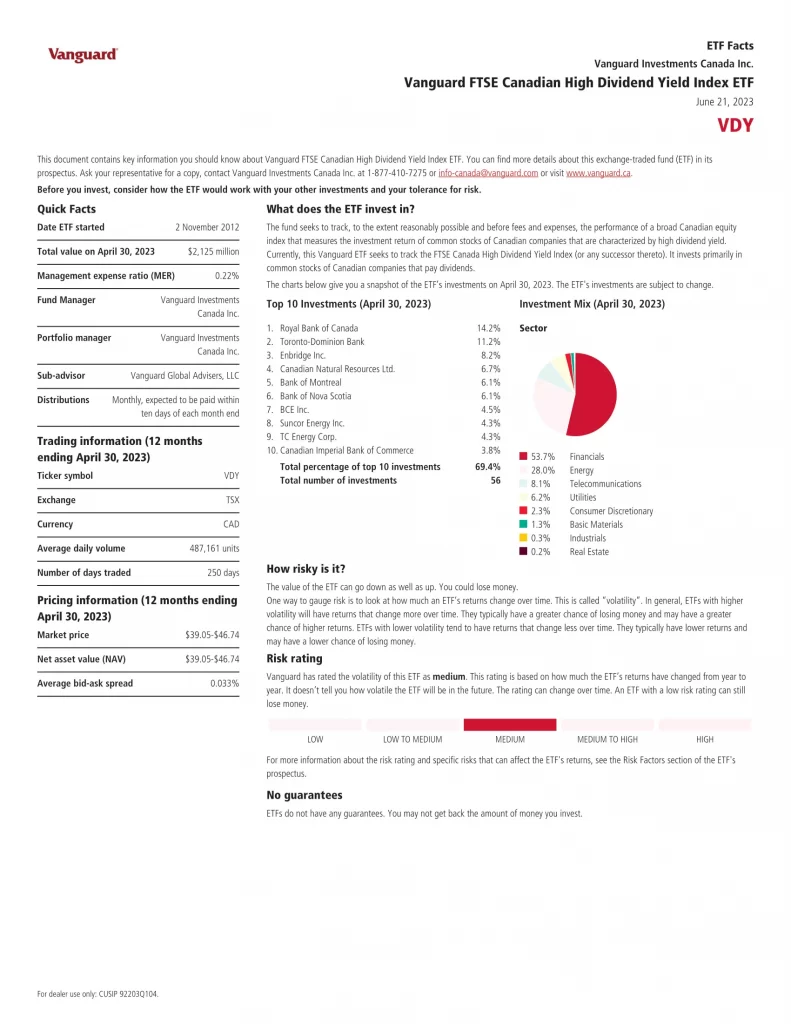

| Vanguard | VDY | Vanguard FTSE Canadian High Dividend Yield Index ETF | 0.22% | 4.61% | Monthly | 9.97% |

10. Franklin FTSE Canada All Cap Index ETF

Franklin FTSE Canada All Cap Index ETF (FLCD) seeks to replicate, to the extent reasonably possible before fees and expenses, the performance of the FTSE Canada All Cap Domestic Index, or any successor thereto. It invests primarily in equity securities of Canadian issuers.

9. Vanguard FTSE Canadian High Dividend Yield Index ETF

Vanguard FTSE Canadian High Dividend Yield Index ETF (VDY) seeks to track the performance of a broad Canadian equity index that measures the investment return of common stocks of Canadian companies that are characterized by high dividend yield. Currently, this Vanguard ETF seeks to track the FTSE Canada High Dividend Yield Index (or any successor thereto). It invests primarily in common stocks of Canadian companies that pay dividends.

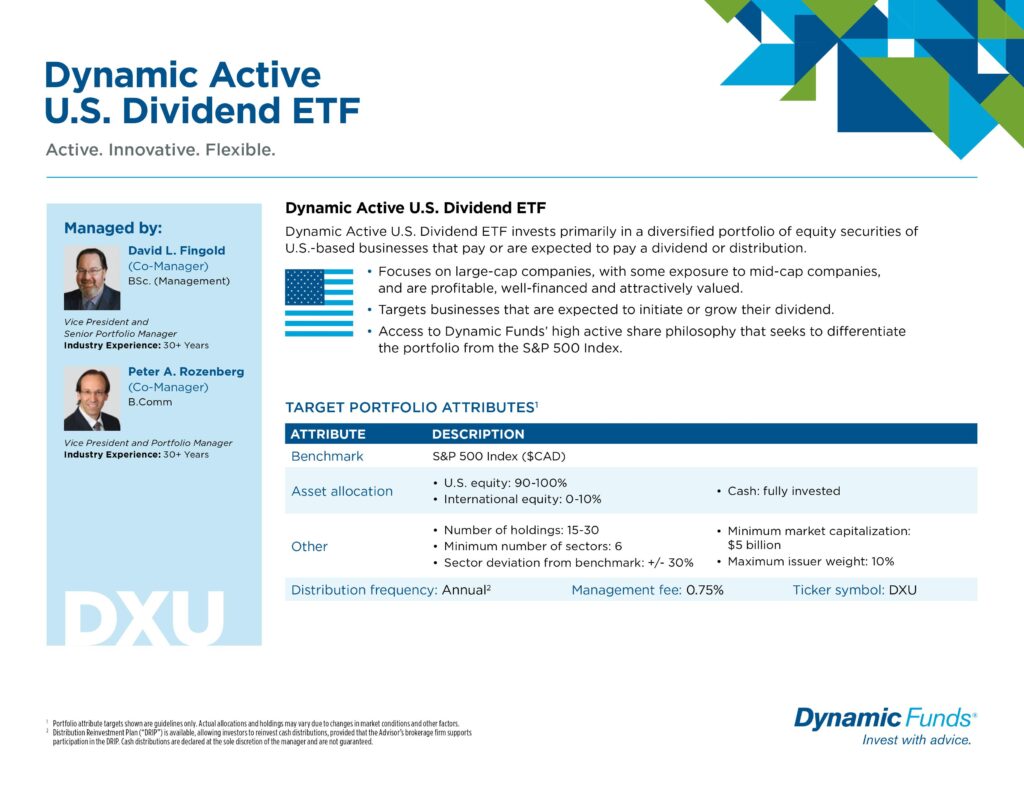

8. Dynamic Active Canadian Dividend ETF

Dynamic Active Canadian Dividend ETF (DXC) invests primarily in a broadly diversified portfolio of equity securities of Canadian based businesses that pay or are expected to pay a dividend or distribution.

7. iShares Canadian Fundamental Index ETF

iShares Canadian Fundamental Index ETF (CRQ) seeks to replicate the performance of the FTSE RAFI Canada Index.

- Tracks an index that selects companies based on fundamental factors including dividends, free cash flow, sales and book value

- Methodology seeks to avoid overweighting overvalued stocks and underweighting undervalued stocks

- Diversified exposure to a fundamentally weighted portfolio of Canadian stocks

6. Desjardins RI Canada – Net-Zero Emissions Pathway ETF

Desjardins RI Canada – Net-Zero Emissions Pathway ETF (DRMC) follows a responsible approach to investing that incorporates environmental, social and governance (ESG) factors into the selection and management of investments for the long term.

5. Invesco FTSE RAFI Canadian Index ETF

Invesco FTSE RAFI Canadian Index ETF (PXC) invests in equity securities of Canadian companies in order to replicate the FTSE RAFI Canada Index. The index weights companies using four fundamental factors of company size: dividends, cash flow, sales and book value.

4. Desjardins RI Canada Multifactor – Net-Zero Emissions Pathway ETF

Desjardins RI Canada Multifactor – Net-Zero Emissions Pathway ETF (DRFC) follows a responsible approach to investing that incorporates environmental, social and governance (ESG) factors into the selection and management of investments for the long term.

3. First Trust Canadian Capital Strength ETF

First Trust Canadian Capital Strength ETF (FST) seeks to provide unitholders with long term capital appreciation by investing primarily in securities traded on a Canadian exchange or market. The First Trust ETF seeks to achieve its investment objective by investing in securities of issuers that are based in Canada or have significant business operations in the Canadian market. Securities invested in by the First Trust ETF include common shares of public companies that are traded on a Canadian exchange or market.

2. Manulife Multifactor Canadian SMID Cap Index ETF

Manulife Multifactor Canadian SMID Cap Index ETF (MCSM) seeks to replicate, to the extent reasonably possible and before fees and expenses, the performance of the John Hancock Dimensional Canadian SMID Cap Equity Index. The ETF invests directly or indirectly primarily in mid and small-capitalization equities. The Index is designed to comprise a subset of equity securities in the Canadian universe issued by companies whose market capitalizations are between the 75th and 251st largest Canadian companies at the time of rebalancing.

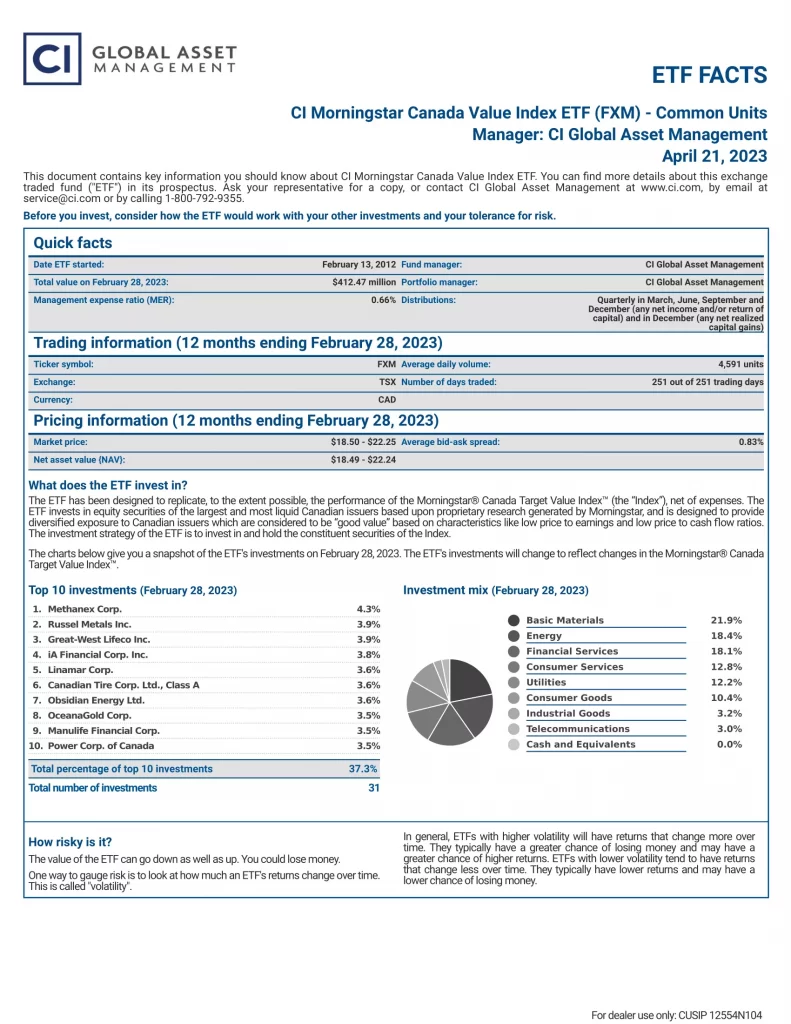

1. CI Morningstar Canada Value Index ETF

CI Morningstar Canada Value Index ETF (FXM) has been designed to replicate, to the extent possible, the performance of the Morningstar Canada Target Value Index. The Fund invests in equity securities of the largest and most liquid Canadian public issuers based upon proprietary research generated by Morningstar and is designed to provide diversified exposure to Canadian issuers which are considered to be “good value” based on characteristics like low price to earnings and low price to cash flow ratios. The investment strategy of the Fund is to invest in and hold the constituent securities of the Index.

Conclusion

ETFs typically come with very low or even no minimum investment requirements. Given that diversification, as discussed in this article, is one of the most effective strategies for maximizing gains while minimizing losses. The key distinction among them lies in the index they aim to replicate through their portfolio of stocks.

Despite the potential for an impending recession, it’s essential not to succumb to panic. It’s advisable to consult your financial advisor to assess whether these ETFs are a suitable addition to your investment portfolio and align with your financial objectives.