Gold exchange-traded funds (ETFs) offer a straightforward way to invest in gold, providing instant exposure to the gold market. This simplicity makes gold ETFs ideal for anyone looking to invest in gold. Gold is a popular choice for investors seeking to hedge against stock market volatility. The spot price for gold bullion is set by market forces in the 24-hour global over-the-counter (OTC) market, which handles most global gold trading and reflects current market information.

What is the Best Gold ETF?

- GLDM: SPDR Gold MiniShares

- SGOL: abrdn Physical Gold Shares ETF

- AAAU: Goldman Sachs Physical Gold ETF

- IAU: iShares Gold Trust

- GLD: SPDR Gold Shares

- OUNZ: VanEck Merk Gold Trust

- PHYS: Sprott Physical Gold Trust

- IAUF: iShares Gold Strategy ETF

- BAR: GraniteShares Gold Trust

- IAUM: iShares Gold Trust Micro

| Manager |  |  |  |  |  |  |  |  |  |

| ETF | SGOL | IAU | IAUF | IAUM | AAAU | PHYS | GLD | GLDM | OUNZ |

| Inception | 2009-09-09 | 2005-01-21 | 2018-06-06 | 2021-06-15 | 2018-07-26 | 2010-02-25 | 2004-11-18 | 2018-06-25 | 2014-05-16 |

| MER | 0.17% | 0.25% | 0.25% | 0.07% | 0.18% | 0.41% | 0.40% | 0.10% | 0.25% |

| AUM | $2,582,221,218 | $25,492,357,576 | $48,894,631 | $931,025,618 | $576,500,000 | $6,241,615,967 | $54,793,020,000 | $5,878,620,000 | $744,950,000 |

| 1Y | 21.63% | 21.54% | 15.54% | 21.75% | 21.57% | 20.87% | 21.35% | 21.72% | 20.81% |

| 3Y | 1.82% | 1.74% | 3.79% | N/A | 1.81% | 1.28% | 1.59% | 1.86% | 1.54% |

| 5Y | 10.26% | 10.18% | 9.43% | N/A | 10.24% | 9.59% | 10.00% | 10.27% | 9.99% |

| 10Y | 3.90% | 3.94% | N/A | N/A | N/A | 3.56% | 3.78% | N/A | N/A |

10. iShares Gold Trust Micro

iShares Gold Trust Micro (IAUM) seeks to reflect generally the performance of the price of gold. The iShares Gold Trust Micro is not an investment company registered under the Investment Company Act of 1940 and therefore is not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940. The Trust is not a commodity pool for purposes of the Commodity Exchange Act. Before making an investment decision, you should carefully consider the risk factors and other information included in the prospectus.

- The lowest cost physical gold ETF currently on the market

- Exposure to the day-to-day movement of the price of gold bullion

- Use to diversify your portfolio and help protect against inflation

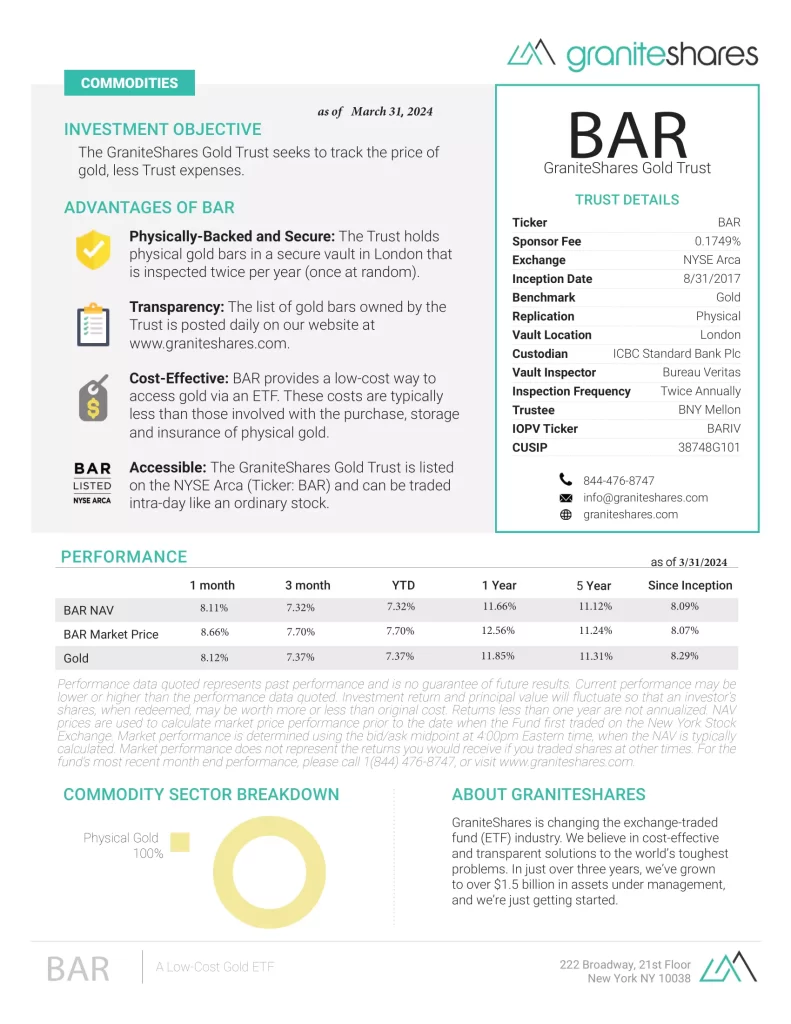

9. GraniteShares Gold Trust

The GraniteShares Gold Trust (BAR) is designed to seek the performance of the price of gold, less trust expenses.

- Physically Backed: The Trust holds only LBMA good delivery bars stored in a vault domiciled in London, UK

- Transparent and Secured: The list of gold bars held by the Trust is published daily. The vault is audited twice a year. Lending of metal is not permitted, and the Trust cannot hold derivatives

- Cost Effective: BAR is among the lowest-cost gold ETFs on the market

- Easy to Access: BAR is listed on NYSE Arca and can be traded through a normal brokerage account

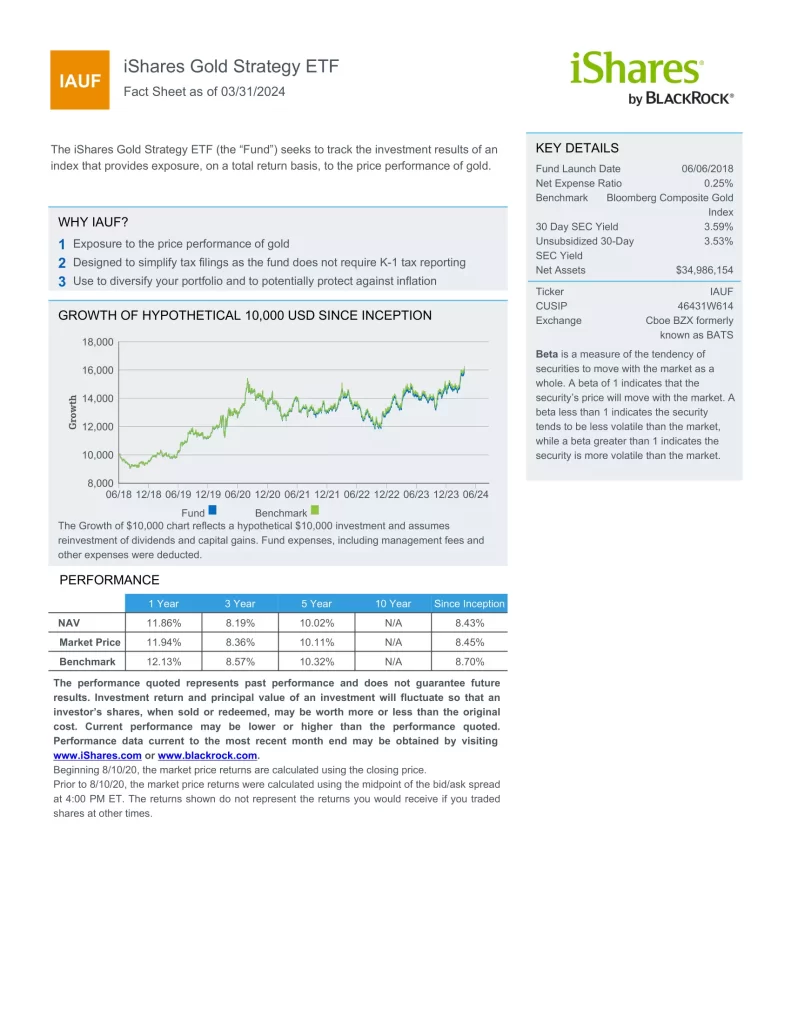

8. iShares Gold Strategy ETF

The iShares Gold Strategy ETF (IAUF) seeks to track the investment results of an index that provides exposure, on a total return basis, to the price performance of gold.

- Exposure to the price performance of gold

- Designed to simplify tax filings as the fund does not require K-1 tax reporting

- Use to diversify your portfolio and to potentially protect against inflation

7. Sprott Physical Gold Trust

Sprott Physical Gold Trust (PHYS) was created to invest and hold substantially all of its assets in physical gold bullion. Provide a secure, convenient and exchange-traded investment alternative for investors who want to hold physical gold without the inconvenience that is typical of a direct investment in physical gold bullion.

- Fully Allocated Gold

- Redeemable for Metals

- Trustworthy Storage

- Potential Tax Advantage

- Easy to Buy, Sell and Own

- A Liquid Investment

6. VanEck Merk Gold Trust

VanEck Merk Gold Trust (OUNZ) seeks to provide investors with a convenient and cost-efficient way to buy and hold gold through an exchange traded product with the option to take physical delivery of gold.

- Deliverability: VanEck Merk Gold Trust differentiates itself by providing investors with the option to take physical delivery of gold bullion in exchange for their shares.

- Convertibility: To facilitate delivery, Merk has developed a proprietary process for the conversion of London Bars into gold coins and bars in denominations investors may desire

- Tax Efficiency: Taking delivery of gold is not a taxable event as investors merely take possession of what they already own: the gold

5. SPDR Gold Shares

The investment objective of SPDR Gold Shares (GLD) is to reflect the performance of the price of gold bullion.

- The first US traded gold ETF and the first US-listed ETF backed by a physical asset

- For many investors, the costs associated with buying GLD shares in the secondary market and the payment of the Trust’s ongoing expenses may be lower than the costs associated with buying, storing and insuring physical gold in a traditional allocated gold bullion account

4. iShares Gold Trust

iShares Gold Trust (IAU) seeks to reflect generally the performance of the price of gold. IAU is not an investment company registered under the Investment Company Act of 1940, and therefore is not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940. The Trust is not a commodity pool for purposes of the Commodity Exchange Act. Before making an investment decision, you should carefully consider the risk factors and other information included in the prospectus.

- Exposure to the day-to-day movement of the price of gold bullion

- Convenient, cost-effective access to physical gold

- Use to diversify your portfolio and help protect against inflation

3. Goldman Sachs Physical Gold ETF

Goldman Sachs Physical Gold ETF (AAAU) provides exposure to gold without the complexities of gold delivery, through an exchange-traded fund. Gold serves as a hedge against inflation, and its low correlation with other asset classes makes it a key portfolio diversifier. These attributes give gold the potential to contribute to steady long-term returns, particularly when volatility and uncertainty are high.

2. SGOL: abrdn Physical Gold Shares ETF

abrdn Physical Gold Shares ETF (SGOL) reflects the performance of the price of gold bullion, less the expenses of the Trust’s operations. The Shares are designed for investors who want a cost-effective and convenient way to invest in physical gold.

1. SPDR Gold MiniShares

The investment objective of SPDR Gold MiniShares Trust (GLDM) is for the Shares of GLDM to reflect the performance of the price of gold bullion, less GLDM’s expenses

- Shares of GLDM are designed for investors who want a cost-effective and convenient way to invest in gold

- For many investors, costs associated with buying and selling the Shares in the secondary market and the payment of GLDM’s ongoing expenses will be lower than the costs associated with buying and selling gold bullion and storing and insuring gold bullion in a traditional allocated gold bullion account

What are Gold ETFs?

Gold ETFs are exchange-traded funds that allow investors to gain exposure to gold without directly purchasing, storing, or reselling the precious metal. Some gold ETFs track the price of gold, while others invest in gold mining companies. The issuing company either buys stocks in these gold-related companies or purchases and stores gold bullion. Investors then buy shares in the fund, and the value of these shares fluctuates with the price of gold or the stock values of the related companies.

Gold is considered a safe haven investment, often increasing in value when stock markets decline. Gold reached its all-time high of nearly $1,900 per ounce in September 2011, following the Great Recession. Recently, gold prices have been approaching that record level.