Small-cap ETFs offer an effective means of tapping into the favourable returns of this asset class while simultaneously diversifying and mitigating risk. This selection of top small-cap ETFs encompasses actively and passively managed funds, catering to various investment preferences such as general, value, and growth strategies.

Investing in small-cap stocks can provide significant benefits to your portfolio. These agile, smaller companies often exhibit faster growth rates compared to larger counterparts, potentially yielding higher returns during market upswings. However, it’s essential to acknowledge that along with the potential for outperformance, small-cap investments typically entail increased volatility and risk.

What is a Small Cap ETF?

A small-cap ETF is an exchange-traded fund that focuses on investing in small companies with a market capitalization typically below $2 billion. Despite the seemingly substantial figure, these companies are relatively modest compared to mid-cap or large-cap companies, which often start at $10 billion in value. By investing in a small-cap ETF, you’re essentially gaining exposure to a diversified portfolio of small companies through a single investment vehicle.

What is the Best Small Cap ETF?

- CALF: Pacer US Small Cap Cash Cows 100 ETF

- XSVM: Invesco S&P SmallCap Value with Momentum ETF

- RWJ: Invesco S&P SmallCap 600 Revenue ETF

- OUSM: ALPS O’Shares U.S. Small-Cap Quality Dividend ETF Shares

- SQLV: Royce Quant Small-Cap Quality Value ETF

- FNDA: Schwab Fundamental U.S. Small Company Index ETF

- JPSE: JPMorgan Diversified Return U.S. Small Cap Equity ETF

- FESM: Fidelity Enhanced Small Cap ETF

- ROSC: Hartford Multifactor Small Cap ETF

- DGRS: WisdomTree U.S. SmallCap Quality Dividend Growth Fund

| ETF | Inception | MER | AUM | P/E | Yield | Distributions | 5Y |

|---|---|---|---|---|---|---|---|

| FNDA | 2013-08-15 | 0.25% | $7,756,229,133 | 14.93 | 1.43% | Quarterly | 9.36% |

| FESM | 2007-12-20 | 0.28% | $484,890,000 | N/A | 0.85% | Annually | 8.97% |

| SQLV | 2017-07-12 | 0.60% | $30,340,000 | 7.30 | 1.12% | Quarterly | 9.69% |

| ROSC | 2015-03-23 | 0.34% | $32,433,310 | 7.98 | 2.08% | N/A | 8.81% |

| RWJ | 2008-02-19 | 0.39% | $1,481,100,000 | 3.85 | 1.40% | Quarterly | 14.03% |

| XSVM | 2005-03-03 | 0.36% | $722,100,000 | 8.26 | 1.35% | Quarterly | 14.05% |

| JPSE | 2016-11-15 | 0.29% | $466,670,000 | 11.62 | 1.83% | Quarterly | 9.11% |

| OUSM | 2016-12-30 | 0.48% | $519,182,329 | 18.27 | 1.68% | Monthly | 10.79% |

| CALF | 2017-06-16 | 0.59% | $8,362,017,702 | 7.17 | 1.20% | Quarterly | 14.58% |

| DGRS | 2006-06-16 | 0.38% | $329,832,670 | 12.02 | 2.46% | Monthly | 8.71% |

10. WisdomTree U.S. SmallCap Quality Dividend Growth Fund

WisdomTree U.S. SmallCap Quality Dividend Growth Fund (DGRS) seeks to track the investment results of dividend-paying small-cap companies with growth characteristics in the U.S. equity market.

- Gain access to the current investment landscape of U.S. small cap dividend growing companies by applying quality and growth screens

- Use as a complement to high yielding dividend strategies or as a replacement for small cap quality strategies

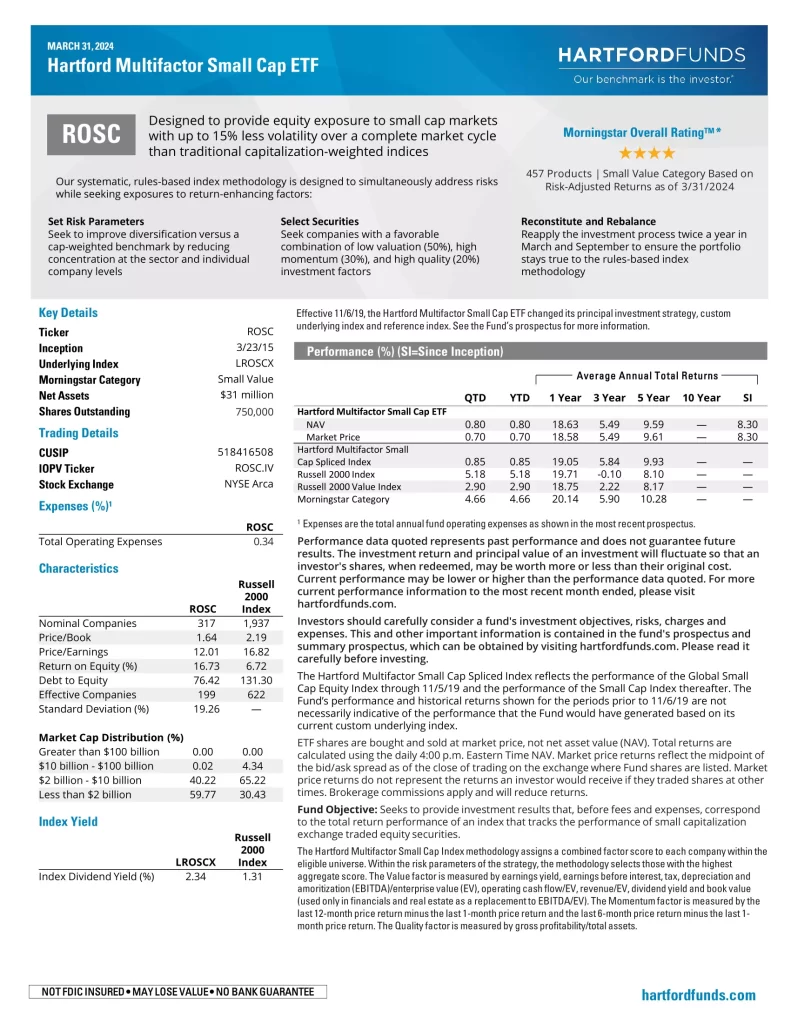

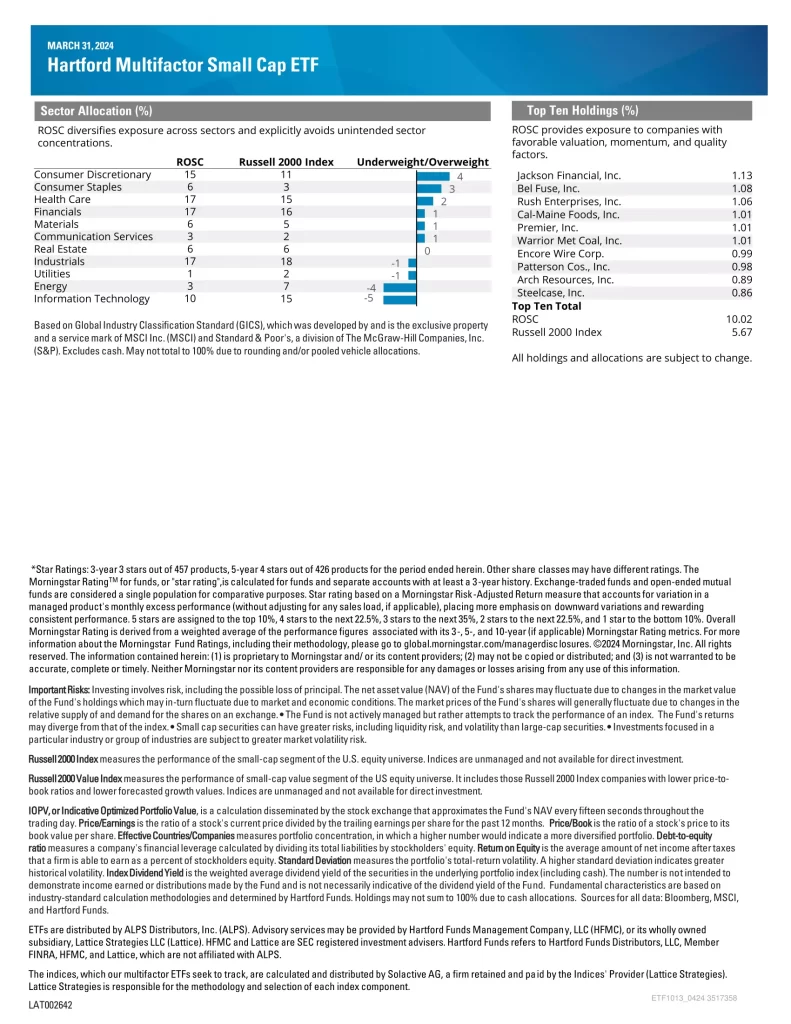

9. Hartford Multifactor Small Cap ETF

Hartford Multifactor Small Cap ETF (ROSC) seeks to provide investment results that, before fees and expenses, correspond to the total return performance of an index that tracks the performance of small capitalization exchange traded equity securities. Designed to provide equity exposure to small cap markets with potentially less volatility over a complete market cycle than traditional capitalization-weighted indices.

- SET RISK PARAMETERS: Seek to improve diversification versus a cap-weighted benchmark by reducing concentration at the sector and individual company levels

- SELECT SECURITIES: Seek companies with a favorable combination of low valuation (50%), high momentum (30%), and high quality (20%) investment factors

- RECONSTITUTE & REBALANCE: Reapply the investment process twice a year in March and September to ensure the portfolio stays true to the rules-based index methodology

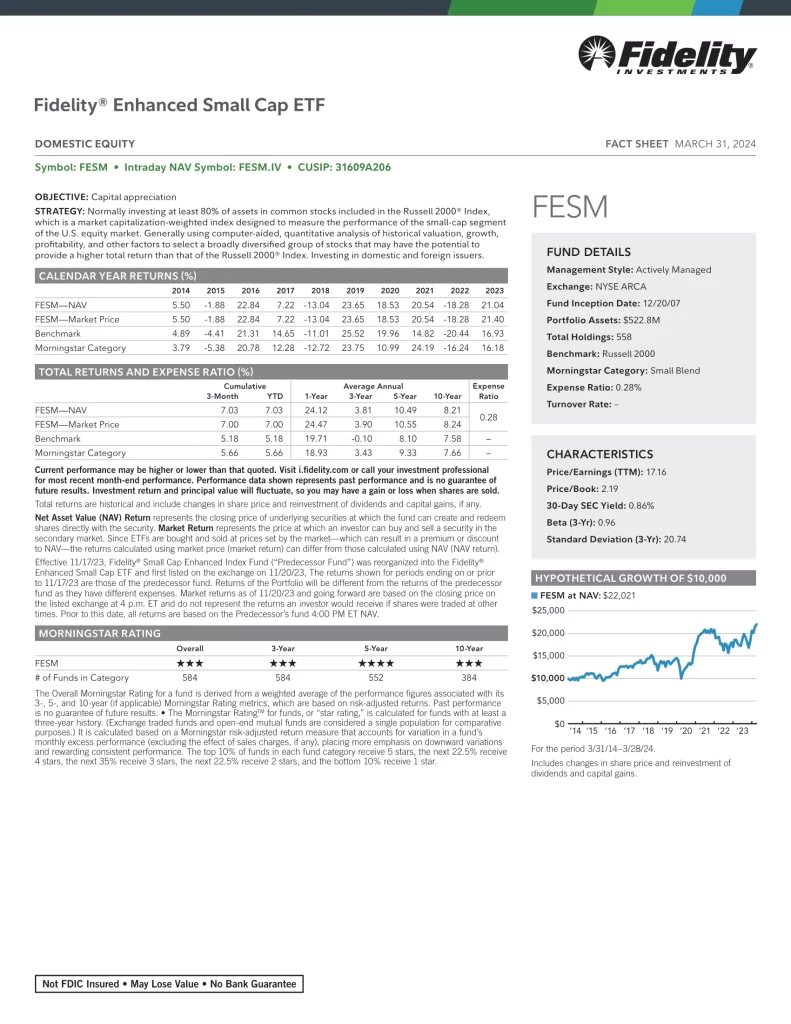

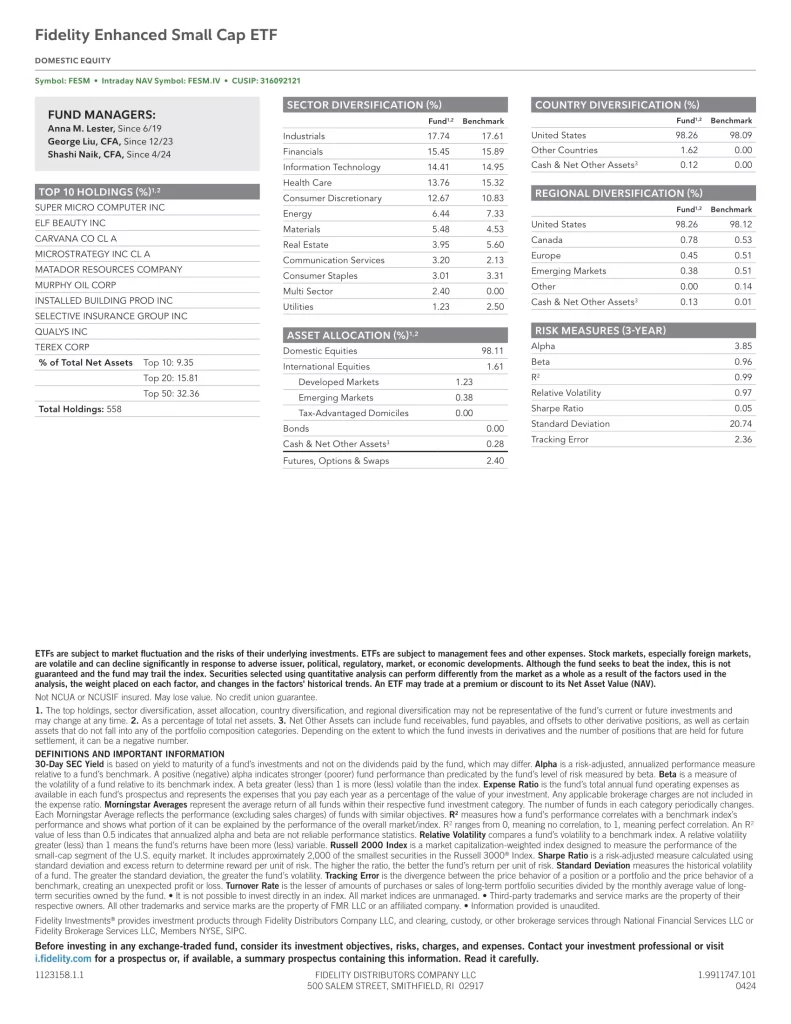

8. Fidelity Enhanced Small Cap ETF

Fidelity Enhanced Small Cap ETF (FESM) seeks capital appreciation. Normally investing at least 80% of assets in common stocks included in the Russell 2000 Index, which is a market capitalization-weighted index designed to measure the performance of the small-cap segment of the U.S. equity market. Generally using computer-aided, quantitative analysis of historical valuation, growth, profitability, and other factors to select a broadly diversified group of stocks that may have the potential to provide a higher total return than that of the Russell 2000 Index. Investing in domestic and foreign issuers. Lending securities to earn income for the fund.

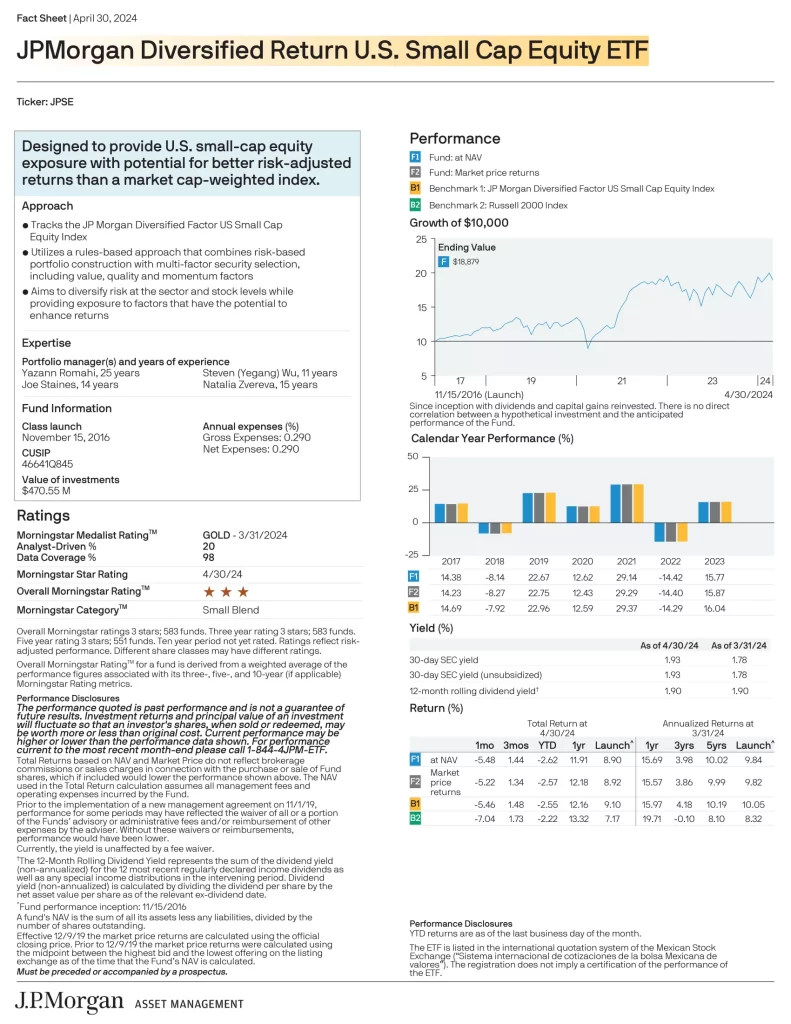

7. JPMorgan Diversified Return U.S. Small Cap Equity ETF

JPMorgan Diversified Return U.S. Small Cap Equity ETF (JPSE) is designed to provide U.S. small-cap equity exposure with the potential for better risk-adjusted returns than a market cap-weighted index.

- Tracks the JP Morgan Diversified Factor US Small Cap Equity Index

- Utilizes a rules-based approach that combines risk-based portfolio construction with multi-factor security selection, including value, quality and momentum factors

- Aims to diversify risk at the sector and stock levels while providing exposure to factors that have the potential to enhance returns

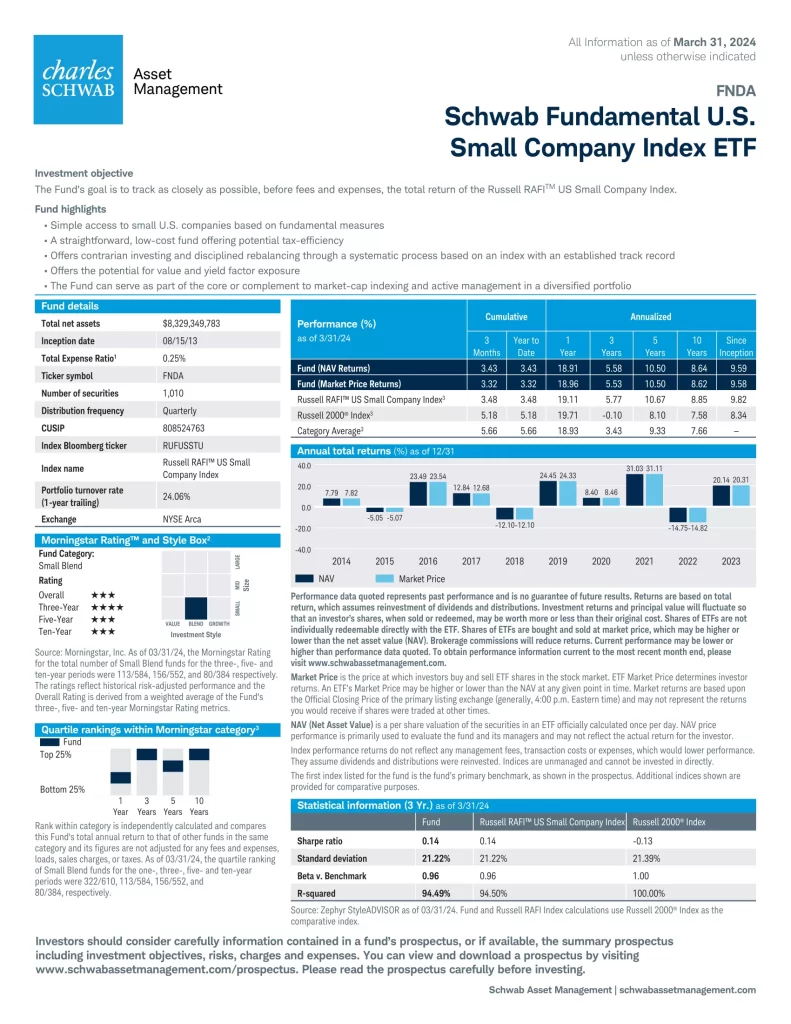

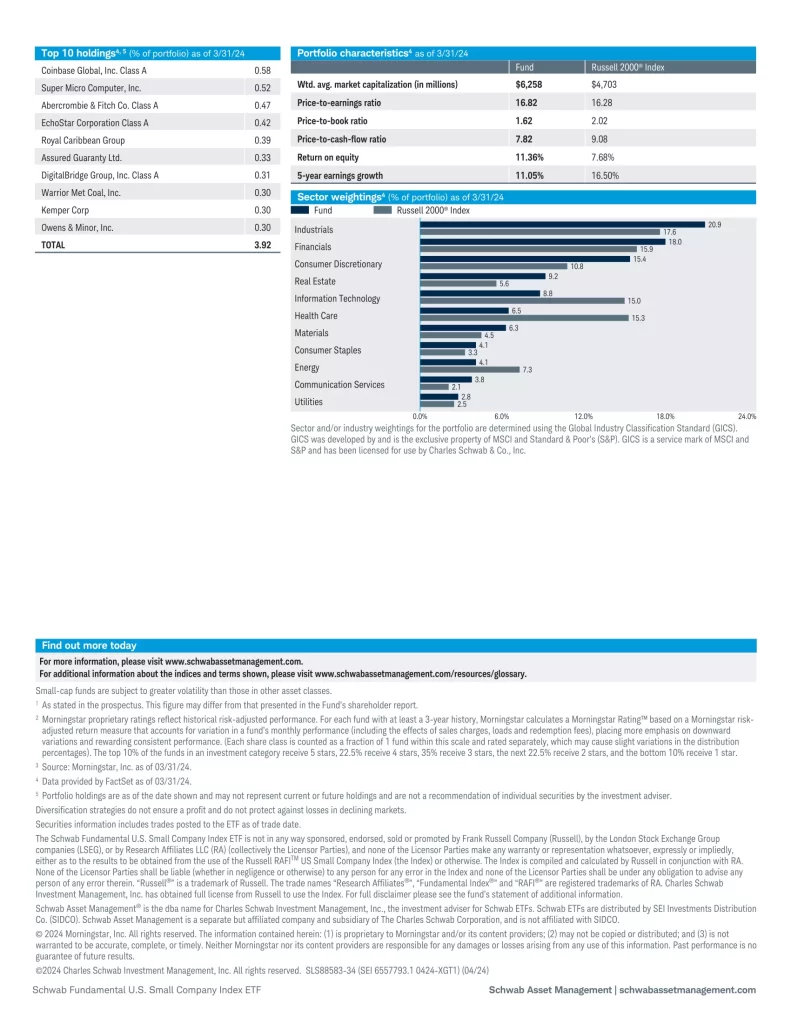

6. Schwab Fundamental U.S. Small Company Index ETF

Schwab Fundamental U.S. Small Company Index ETF (FNDA) goal is to track as closely as possible, before fees and expenses, the total return of the Russell RAFI™ US Small Company Index.

- Simple access to small U.S. companies based on fundamental measures

- A straightforward, low-cost fund offering potential tax-efficiency

- Offers contrarian investing and disciplined rebalancing through a systematic process based on an index with an established track record

- Offers the potential for value and yield factor exposure

- The Fund can serve as part of the core or complement to market-cap indexing and active management in a diversified portfolio

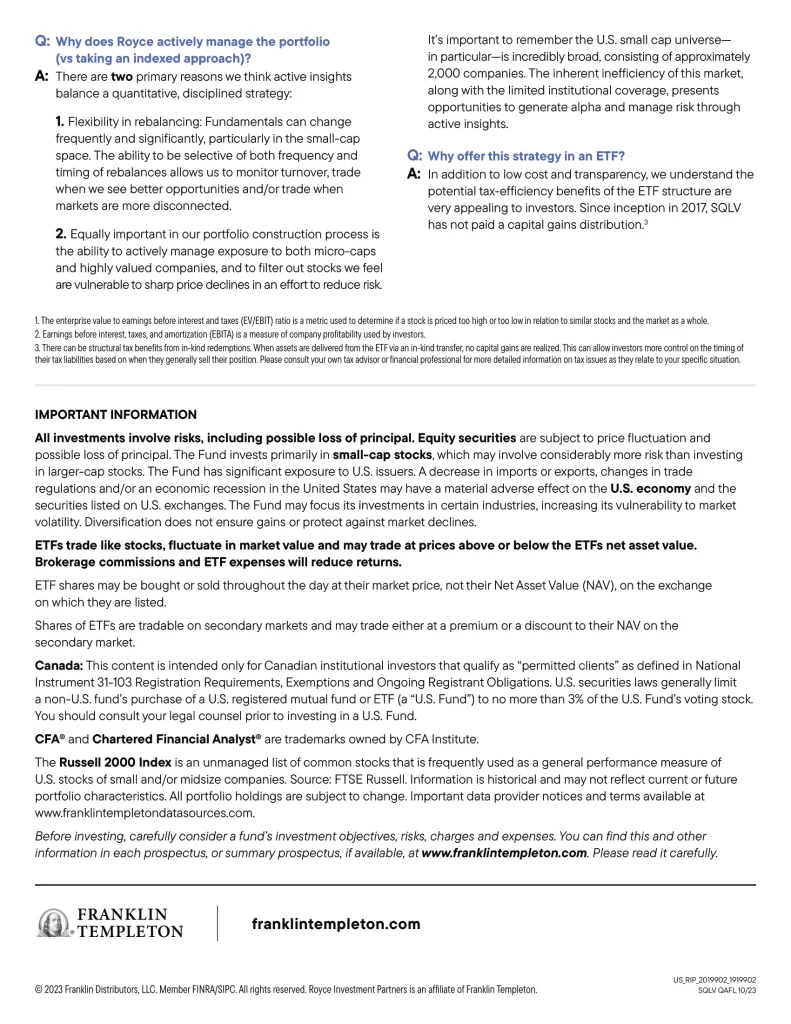

5. Royce Quant Small-Cap Quality Value ETF

Royce Quant Small-Cap Quality Value ETF (SQLV) is designed for investors seeking growth of capital through strategic multi-factor, small-cap exposure.

- Focuses on high quality, US-traded small-cap stocks with relatively low valuations

- Uses a proprietary, multi-factor scoring system that emphasizes high profitability companies (Quality) selling at attractive valuations (Value)

- Thoughtfully combines strategic factors –based on decades of insights from highly-regarded small-cap practitioners

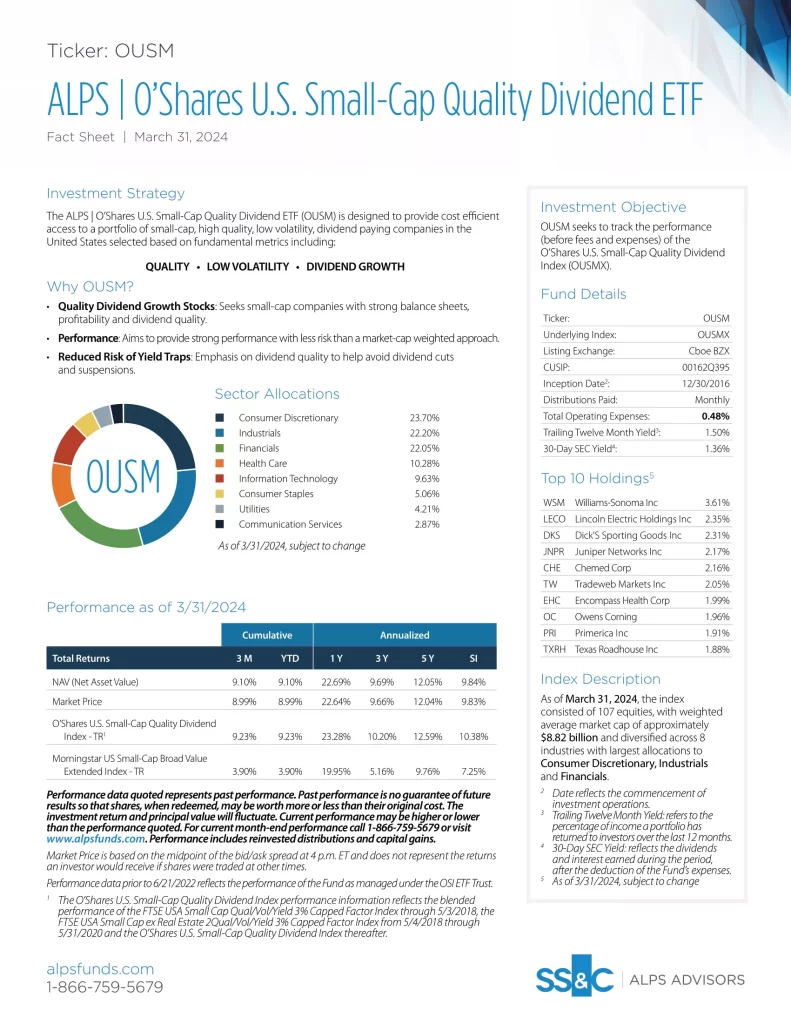

4. ALPS O’Shares U.S. Small-Cap Quality Dividend ETF Shares

ALPS O’Shares U.S. Small-Cap Quality Dividend ETF Shares (OUSM) seeks to track the performance (before fees and expenses) of the O’Shares U.S. Small-Cap Quality Dividend Index (OUSMX). OUSM is designed to provide cost efficient access to a portfolio of small-cap, high quality, low volatility, dividend paying companies in the United States selected based on fundamental metrics including quality, low volatility and dividend growth.

3. Invesco S&P SmallCap 600 Revenue ETF

Invesco S&P SmallCap 600 Revenue ETF (RWJ) is based on the S&P SmallCap 600 Revenue-Weighted Index (Index). The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index is constructed using a rules-based approach that re-weights securities of the S&P SmallCap 600 Index according to the revenue earned by the companies, with a maximum 5% per company weighting. The Fund and Index are rebalanced quarterly.

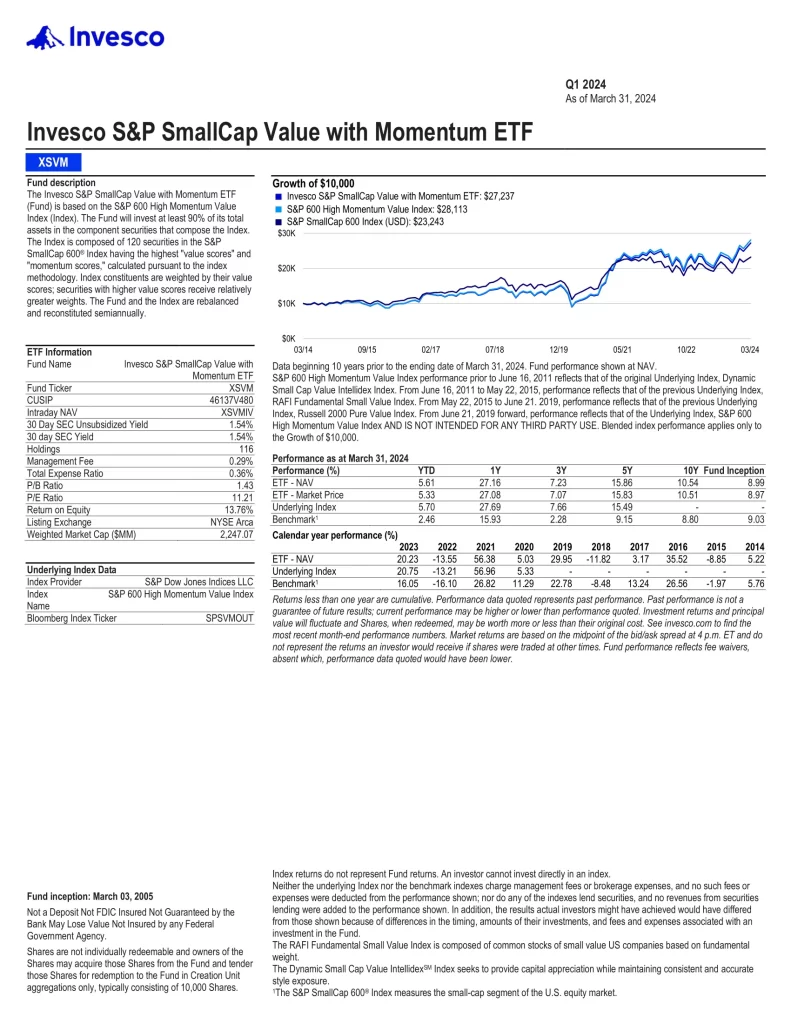

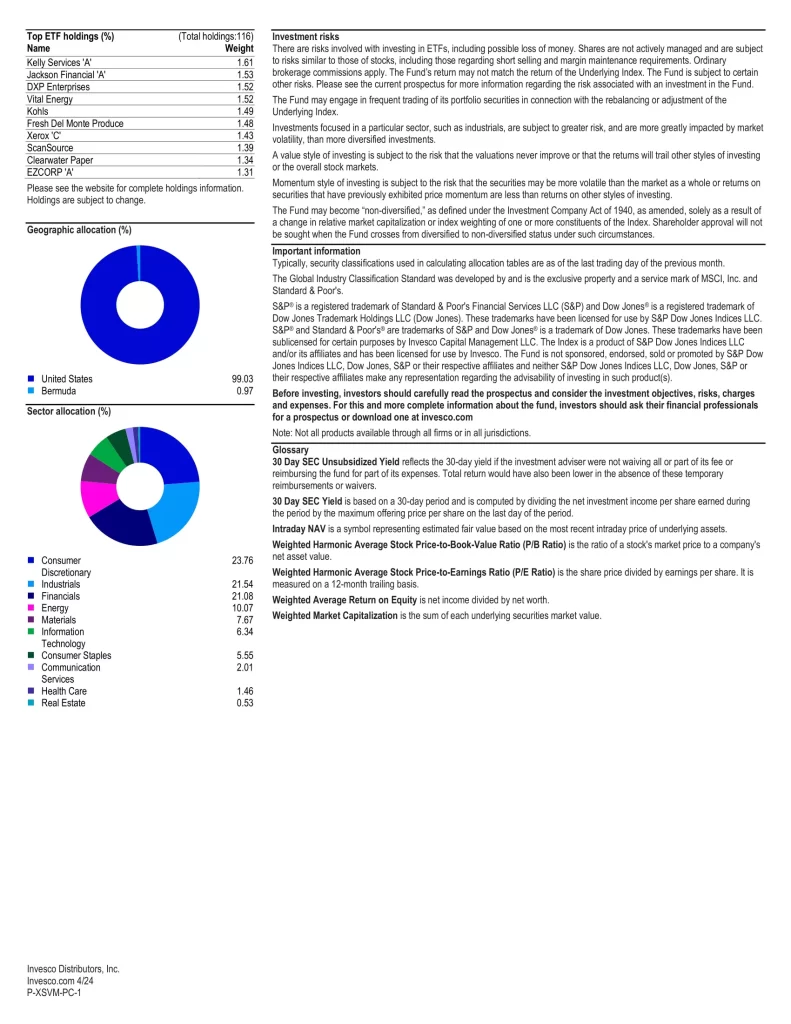

2. Invesco S&P SmallCap Value with Momentum ETF

Invesco S&P SmallCap Value with Momentum ETF (XSVM) is based on the S&P 600 High Momentum Value Index (Index). The Fund will invest at least 90% of its total assets in the component securities that comprise the Index. The Index is composed of 120 securities in the S&P SmallCap 600 Index having the highest “value scores” and “momentum scores,” calculated according to the index methodology. Index constituents are weighted by their value scores; securities with higher value scores receive relatively greater weights. The Fund and the Index are rebalanced and reconstituted semi-annually.

1. Pacer US Small Cap Cash Cows 100 ETF

Pacer US Small Cap Cash Cows 100 ETF (CALF) is a strategy driven exchange traded fund that aims to provide capital appreciation over time by screening the S&P SmallCap 600 for the top 100 companies based on free cash flow yield.

- Free cash flow is the cash remaining after a company has paid expenses, interest, taxes, and long-term investments that can be used to buy back stock, pay dividends, or participate in mergers and acquisitions

- The ability to generate a high free cash flow yield indicates a company is producing more cash than it needs to run the business and can invest in growth opportunities

- Small-cap companies offer a variety of opportunities including exposure to companies with higher growth that are often under-researched