SPGP ETF Review

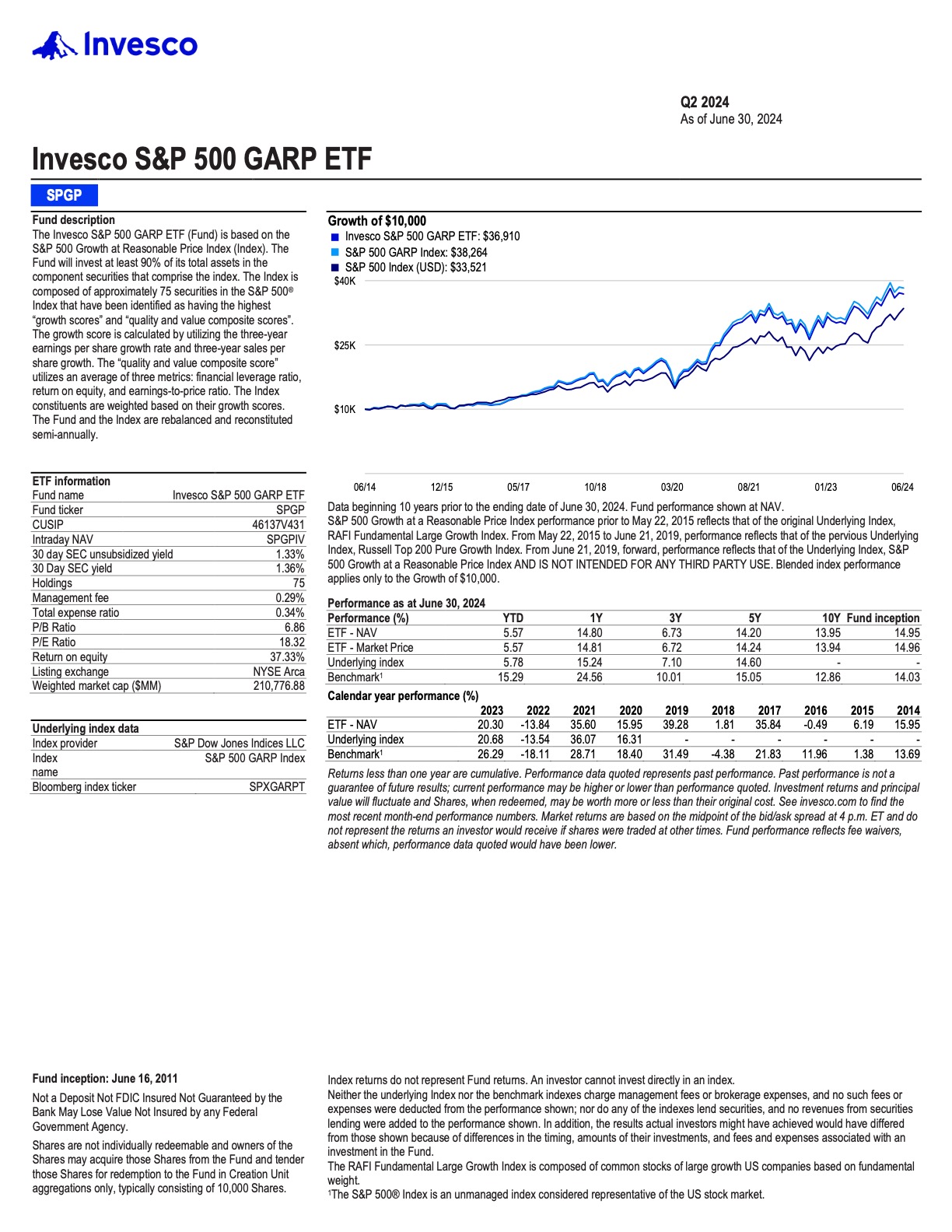

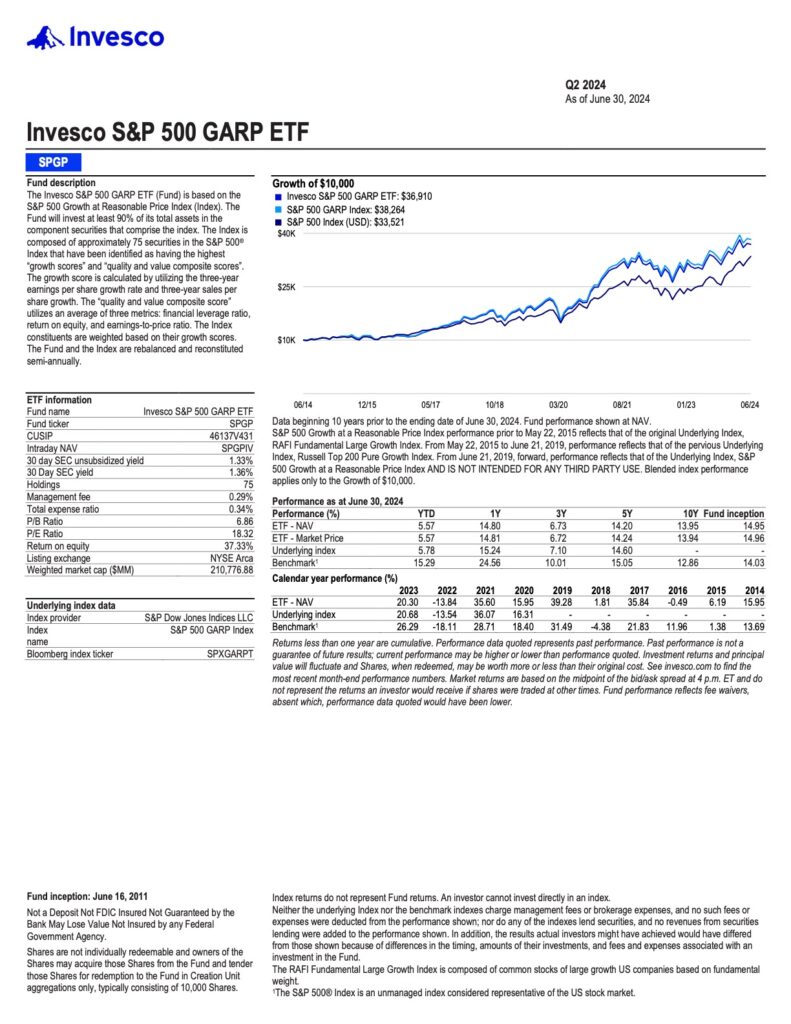

Invesco S&P 500 GARP ETF (SPGP) is based on the S&P 500 Growth at a Reasonable Price Index. The Fund will invest at least 90% of its total assets in the component securities that comprise the Index. The Index is composed of approximately 75 securities in the S&P 500 Index that have been identified as having the highest “growth scores” and “quality and value composite scores,” calculated according to the index methodology. The Index constituents are weighted based on their growth scores. The Fund and the Index are rebalanced and reconstituted semi-annually.

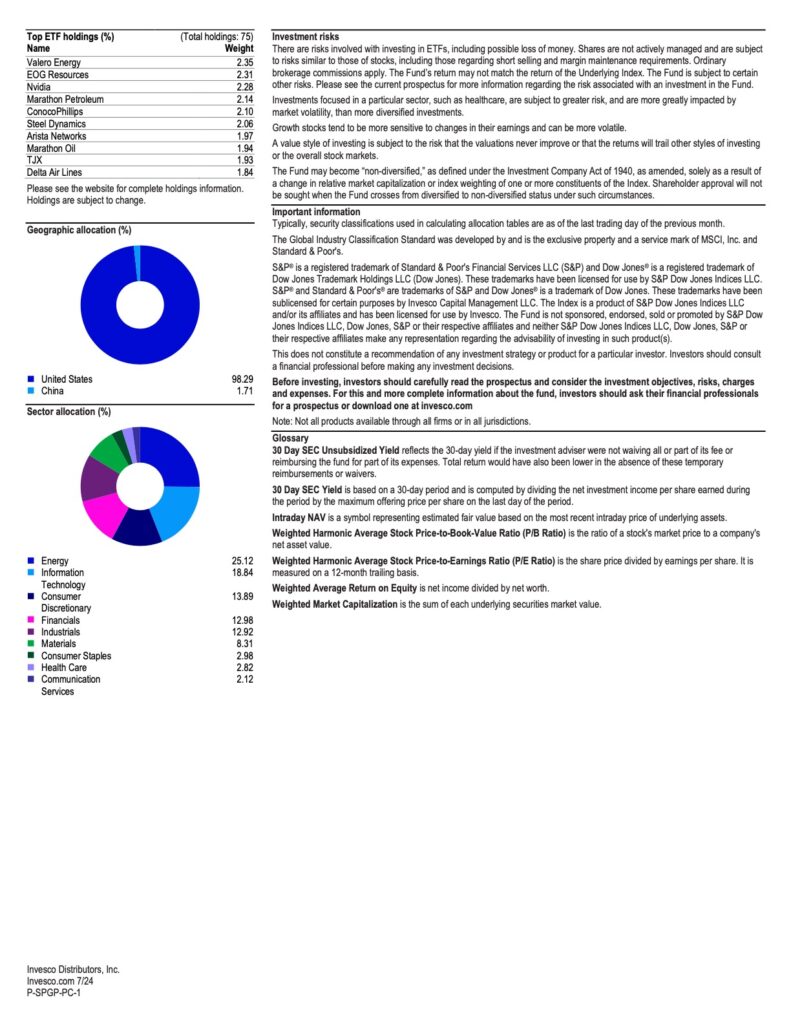

Top 10 SPGP Holdings

The top 10 investments of SPGP account for 20.26% of the 77 holdings. This table shows the investment names of the individual holdings that are subject to change.

| Ticker | Name | Weight |

|---|---|---|

| VLO | Valero Energy Corp | 2.43% |

| EOG | EOG Resources Inc | 2.29% |

| MPC | Marathon Petroleum Corp | 2.18% |

| STLD | Steel Dynamics Inc | 2.04% |

| COP | ConocoPhillips | 2.00% |

| TJX | TJX Cos Inc/The | 1.97% |

| NVDA | NVIDIA Corp | 1.90% |

| NUE | Nucor Corp | 1.81% |

| MRO | Marathon Oil Corp | 1.85% |

| ROST | Ross Stores Inc | 1.79% |

SPGP Dividend History

SPGP currently has a yield of 1.42% and pays distributions quarterly. Most ETFs will distribute net taxable income to investors at least once a year. This is taxable income if generated from interest, dividends and capital gains by the securities within the ETF. The distributions will either be paid in cash or reinvested in the ETF at the discretion of the manager. This information will be reported in an official tax receipt provided to investors by their broker.

| Ex-Dividend Date | Record Date | Payable Date | Dividend |

|---|---|---|---|

| 06/24/2024 | 06/24/2024 | 06/28/2024 | $0.33607 |

| 03/18/2024 | 03/19/2024 | 03/22/2024 | $0.38163 |

| 12/18/2023 | 12/19/2023 | 12/22/2023 | $0.40311 |

| 09/18/2023 | 09/19/2023 | 09/22/2023 | $0.34019 |

| 06/20/2023 | 06/21/2023 | 06/23/2023 | $0.21598 |

| 03/20/2023 | 03/21/2023 | 03/24/2023 | $0.25560 |

| 12/19/2022 | 12/20/2022 | 12/23/2022 | $0.25862 |

| 09/19/2022 | 09/20/2022 | 09/23/2022 | $0.28962 |

| 06/21/2022 | 06/22/2022 | 06/30/2022 | $0.23090 |

| 03/21/2022 | 03/22/2022 | 03/31/2022 | $0.22598 |

Is SPGP a Good Investment?

SPGP is an unpopular US large-cap ETF with reasonable fees, diverse holdings, average volatility and great performance making it a strong buy. Quickly compare this ETF to similar investments by numerous metrics to decide if this investment will fit into your portfolio.

| Manager | ETF | Inception | MER | AUM | Holdings | Beta | P/E | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| SPDV | 2017-11-28 | 0.29% | $62,489,748 | 53 | 0.80 | 12.94 | 3.95% | Monthly | 5.61% | 6.50% | 6.77% | N/A | N/A |

| LRGC | 2023-09-19 | N/A | $73,520,000 | 73 | N/A | N/A | N/A | Annually | N/A | N/A | N/A | N/A | N/A |

| QGRO | 2018-09-10 | 0.29% | $879,726,671 | 192 | 1.11 | 32.59 | 0.39% | Quarterly | 26.43% | 8.59% | 16.45% | N/A | N/A |

| DIVO | 2016-12-14 | 0.55% | $2,905,158,096 | 32 | 0.68 | 15.74 | 4.57% | Monthly | 13.05% | 10.16% | 11.69% | N/A | N/A |

| AVUS | 2019-09-24 | 0.15% | $6,094,210,827 | 2308 | 1.00 | 17.04 | 1.40% | Quarterly | 14.35% | 10.52% | N/A | N/A | N/A |

| IWY | 2009-09-22 | 0.20% | $11,959,388,471 | 110 | 1.15 | 42.39 | 0.58% | Quarterly | 35.22% | 12.87% | 20.95% | 16.87% | N/A |

| BKLC | 2020-04-07 | 0.00% | $2,418,000,077 | 506 | 1.01 | 28.17 | 1.35% | Quarterly | 29.45% | 9.87% | N/A | N/A | N/A |

| CDEI | 2023-01-30 | 0.14% | $35,840,000 | 357 | N/A | 28.02 | 1.32% | Quarterly | 22.64% | N/A | N/A | N/A | N/A |

| CGGR | 2022-02-22 | 0.39% | $4,642,000,000 | 125 | N/A | 28.64 | 0.40% | Semi-Annually | 30.39% | N/A | N/A | N/A | N/A |

| SCHX | 2009-11-03 | 0.03% | $38,141,469,714 | 751 | 1.01 | 25.06 | 1.37% | Quarterly | 20.80% | 9.87% | 14.06% | 12.39% | N/A |

| ESGS | 2016-06-13 | 0.35% | $6,514,616 | 100 | 0.85 | 18.95 | 2.32% | Quarterly | 16.78% | 8.96% | 11.74% | N/A | N/A |

| JEPY | 2023-09-18 | 0.99% | $129,540,000 | 6 | N/A | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| DFAC | 2021-06-14 | 0.17% | $26,400,000,000 | 2667 | 0.99 | 19.18 | 1.14% | Quarterly | 22.79% | 9.87% | 13.03% | 10.72% | 15.58% |

| FDVV | 2016-09-12 | 0.15 | $2,520,000,000 | 123 | 0.90 | 11.85 | 3.31% | Quarterly | 17.80% | 9.96% | 11.65% | N/A | N/A |

| FTHI | 2014-01-06 | 0.75% | $539,790,667 | 185 | 0.66 | 18.80 | 8.36% | Monthly | 21.01% | 10.61% | 6.87% | 6.72% | N/A |

| ESG | 2016-07-13 | 0.32% | $199,340,000 | N/A | 1.02 | 24.12 | 1.09% | Quarterly | 21.31% | 10.29% | 14.54% | N/A | N/A |

| LRGE | 2017-05-22 | 0.59% | $206,650,000 | 42 | 1.15 | 46.59 | N/A | N/A | 31.53% | 6.95% | 13.37% | N/A | N/A |

| AUSF | 2018-08-24 | 0.27% | $222,150,000 | 191 | 0.76 | 20.96 | 1.80% | Semi-Annually | 29.67% | 12.22% | 12.53% | N/A | N/A |

| JUST | 2018-06-07 | 0.20% | $331,530,000 | 466 | 0.99 | 24.68 | 1.34% | Quarterly | 20.12% | 10.33% | 14.08% | N/A | N/A |

| SPGP | 2011-06-16 | 0.34% | $4,758,400,000 | 77 | 0.96 | 15.96 | 1.42% | Quarterly | 14.81% | 6.73% | 14.21% | 13.95% | N/A |

| JEPI | 2020-05-20 | 0.35% | $33,000,000,000 | 130 | 0.60 | 24.98 | 7.85% | Monthly | 15.02% | 10.62% | N/A | N/A | N/A |

| JHML | 2015-09-28 | 0.29% | $878,100,000 | 770 | 0.98 | 22.63 | 1.33% | Semi-Annually | 26.16% | 7.46% | 14.30% | N/A | N/A |

| PAPI | 2023-10-16 | 0.29% | $ 30,010,000 | 191 | N/A | N/A | N/A | Monthly | N/A | N/A | N/A | N/A | N/A |

| SPYI | 2022-08-29 | 0.68% | $1,540,712,551 | 506 | N/A | 21.72 | 11.88% | Monthly | 14.01% | N/A | N/A | N/A | N/A |

| NULG | 2016-12-13 | 0.26% | $1,500,000,000 | 64 | 1.21 | 44.81 | 0.39% | Annually | 33.46% | 10.24% | 19.55% | N/A | N/A |

| OUSA | 2015-07-14 | 0.48% | $736,478,089 | 102 | 0.79 | 24.16 | 1.78% | Quarterly | 13.26% | 10.03% | 10.50% | N/A | N/A |

| COWZ | 2016-12-16 | 0.49% | $19,893,341,895 | 103 | 0.91 | 8.47 | 1.93% | Quarterly | 19.70% | 11.45% | 15.56% | N/A | N/A |

| NOBL | 2013-10-09 | 0.35% | $11,760,000,000 | 67 | 0.88 | N/A | 2.05% | Quarterly | 9.55% | 8.72% | 10.14% | 10.50% | N/A |

| PVAL | 2021-05-25 | 0.56% | $487,580,000 | 44 | N/A | 16.40 | 1.52% | Quarterly | 35.54% | 13.65% | N/A | N/A | N/A |

| DIA | 1998-01-13 | 0.16% | $34,227,230,000 | 30 | 0.87 | 23.25 | 1.74% | Monthly | 21.81% | 10.08% | 10.70% | 11.46% | 14.63% |

| STXG | 2022-11-09 | 0.18% | $52,710,000 | 699 | N/A | 35.79 | 0.54% | Quarterly | 29.22% | N/A | N/A | N/A | N/A |

| TEQI | 2020-08-04 | 0.54% | $144,600,000 | 112 | 0.80 | N/A | 2.12% | Quarterly | 4.15% | 10.37% | N/A | N/A | N/A |

| MOAT | 2012-04-24 | 0.46% | $12,040,000,000 | 55 | 1.02 | 27.48 | 0.87% | Annually | 15.75% | 11.80% | 14.46% | 12.98% | N/A |

| MGK | 2007-12-17 | 0.07% | $13,700,000,000 | 79 | 1.20 | 42.03 | 0.49% | Quarterly | 32.15% | 7.81% | 16.80% | 15.28% | 16.57% |

| VSDA | 2017-04-18 | 0.40% | $238,560,735 | 74 | 0.89 | 21.99 | 2.03% | Monthly | 16.08% | 5.62% | 11.42% | N/A | N/A |

| JOET | 2020-11-17 | 0.29% | $89,927,599 | 125 | 1.04 | 19.32 | 1.30% | Quarterly | 12.38% | 7.97% | N/A | N/A | N/A |

| DGRW | 2013-05-22 | 0.28% | $11,953,527,700 | 299 | 0.84 | 24.49 | 1.72% | Monthly | 17.16% | 9.81% | 12.83% | 12.29% | N/A |

| USSG | 2019-03-06 | 0.10% | $982,980,000 | 310 | 1.03 | 29.75 | 1.43% | Quarterly | 30.94% | 10.15% | 16.39% | N/A | N/A |

Conclusion

There are risks involved with investing in ETFs, including possible loss of money. Ordinary brokerage commissions apply. The Fund’s return may not match the return of the Underlying Index. Growth stocks tend to be more sensitive to changes in their earnings and can be more volatile. Investments focused on a particular sector, such as healthcare, are subject to greater risk, and are more greatly impacted by market volatility than more diversified investments. A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets. Beta is a measure of risk representing how a security is expected to respond to general market movements.