VDY: Vanguard FTSE Canadian High Dividend Yield Index ETF

VDY ETF Review

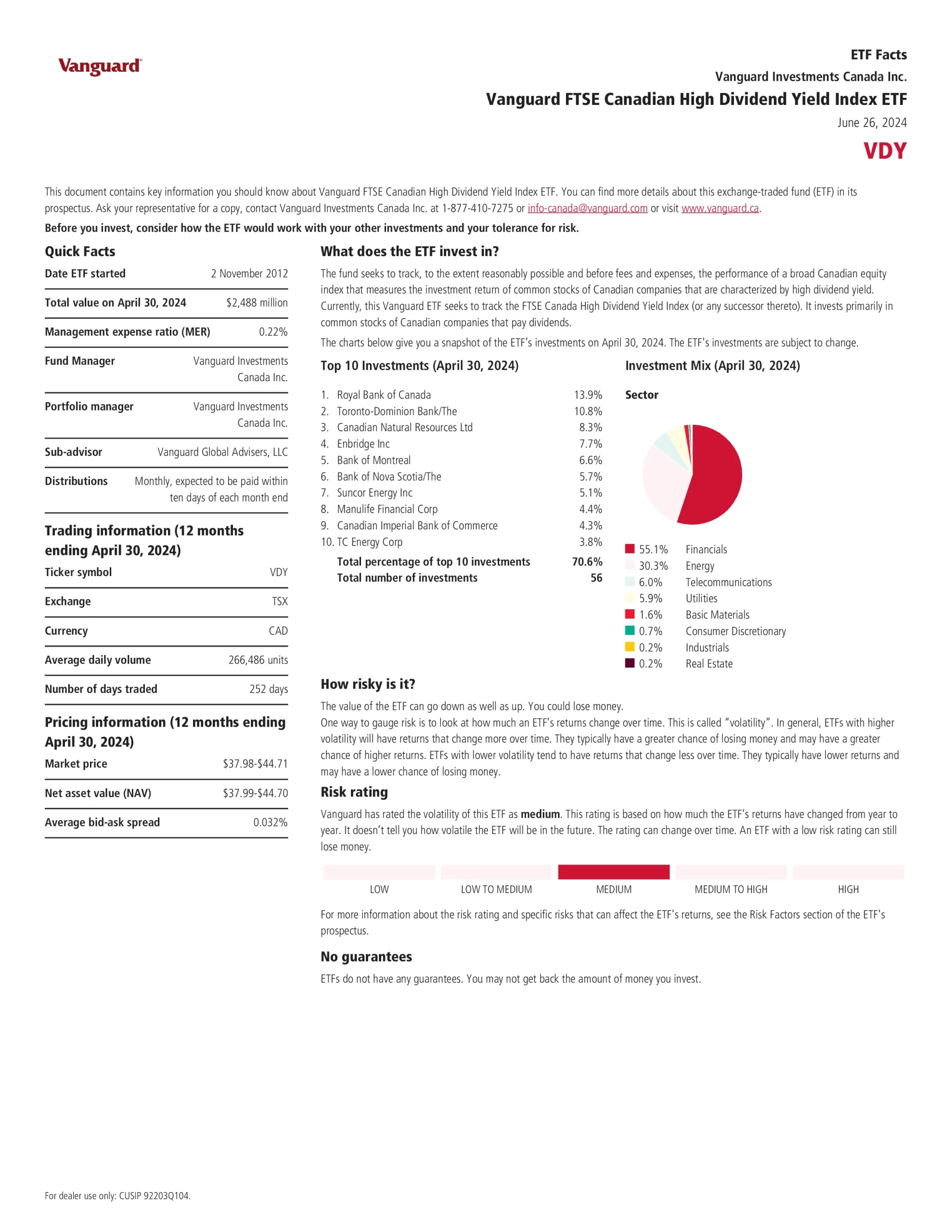

The Vanguard FTSE Canadian High Dividend Yield Index ETF (VDY) seeks to track the performance of a broad Canadian equity index that measures the investment return of common stocks of Canadian companies that are characterized by high dividend yield. VDY employs a passively managed, full-replicated index strategy to provide exposure to Canadian large-, mid-, and small-cap stocks, diversified across all industries.

Companies that pay dividends are signs of maturity and strength. Dividends can ease the effects of market volatility if they are reinvested. They have better valuation metrics and a higher dividend yield than the broader Canadian market. These companies tend to have proven management, solid balance sheets and strong cash flow.

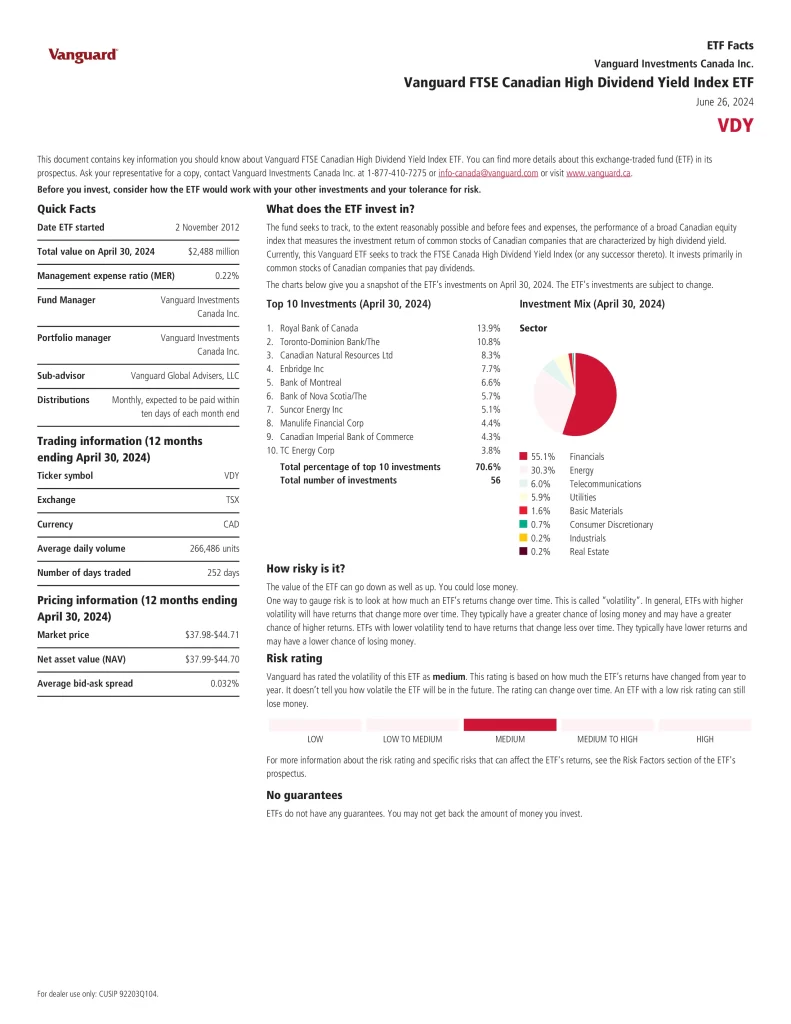

Top 10 VDY Holdings

The top 10 investments of VDY account for 69.4% of the total holdings.

| Ticker | Name | Weight |

|---|---|---|

| RY | Royal Bank of Canada | 15.15% |

| TD | Toronto-Dominion Bank | 9.80% |

| CNQ | Canadian Natural Resources Ltd. | 8.11% |

| ENB | Enbridge Inc. | 7.63% |

| BMO | Bank of Montreal | 6.35% |

| BNS | Bank of Nova Scotia | 5.64% |

| SU | Suncor Energy Inc. | 5.24% |

| MFC | Manulife Financial Corp. | 4.67% |

| CM | Canadian Imperial Bank of Commerce | 4.43% |

| TRP | TC Energy Corp. | 3.92% |

Is VDY a Good ETF?

Quickly compare VDY to other investments focused on Canadian equities by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager | ETF | Name | Risk | Inception | MER | AUM | Holdings | Beta | P/E | Yield | Distributions | 1Y | 3Y | 5Y | 10Y | 15Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

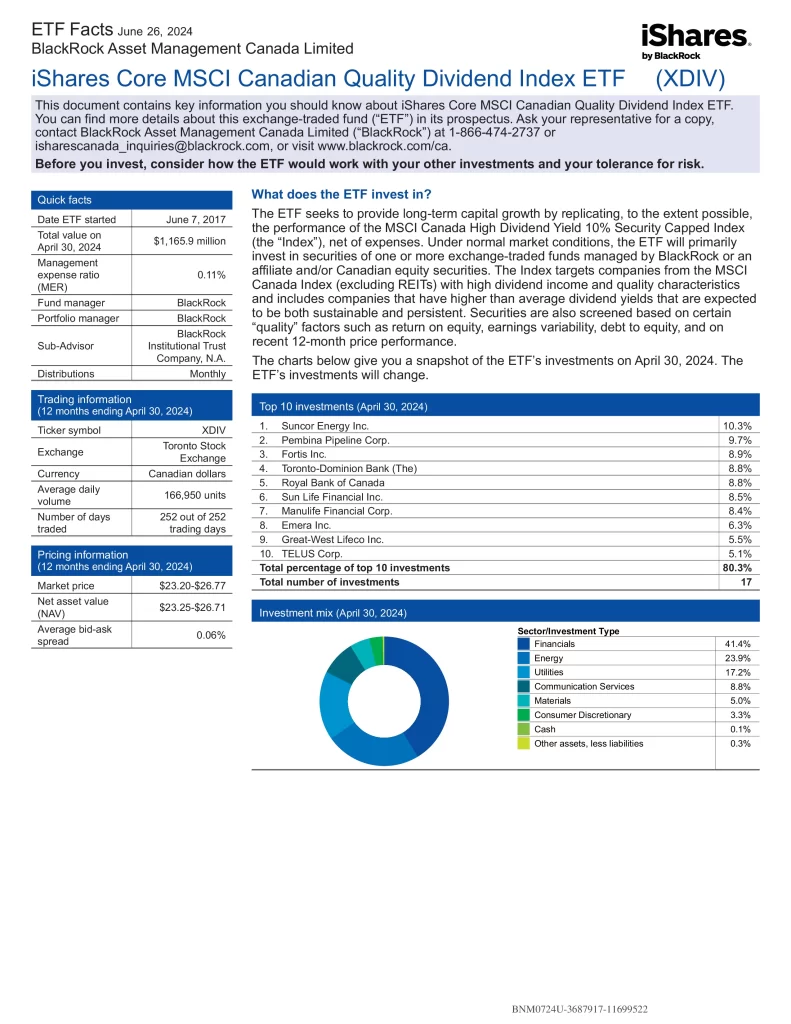

| BlackRock | XDIV | iShares Core MSCI Canadian Quality Dividend Index ETF | Medium | 2017-06-07 | 0.11% | $1,928,253,700 | 20 | 0.79 | 15.01 | 4.24% | Monthly | 23.01% | 11.45% | 11.29% | N/A | N/A |

| BlackRock | XEI | iShares S&P/TSX Composite High Dividend Index ETF | Medium | 2011-04-12 | 0.22% | $1,730,180,828 | 75 | 0.91 | 15.53 | 4.87% | Monthly | 15.34% | 7.34% | 9.17% | 7.37% | N/A |

| BlackRock | XIC | iShares Core S&P/TSX Capped Composite Index ETF | Medium | 2001-02-16 | 0.06% | $15,068,652,638 | 224 | 1.00 | 18.97 | 2.41% | Quarterly | 21.52% | 8.51% | 11.04% | 8.62% | 8.17% |

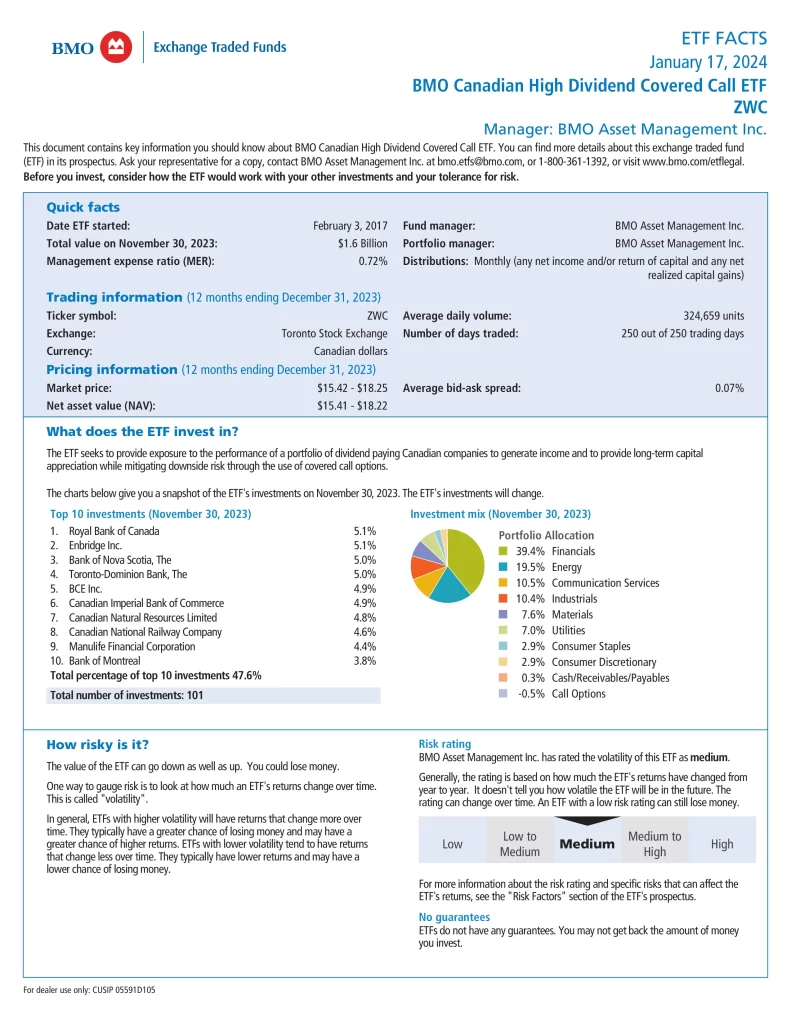

| BMO | ZWC | BMO Canadian High Dividend Covered Call ETF | Medium | 2017-02-03 | 0.72% | $1,605,920,000 | 95 | 0.88 | 18.35 | 6.48% | Monthly | 11.97% | 5.12% | 6.29% | N/A | N/A |

| Vanguard | VCN | Vanguard FTSE Canada All Cap Index ETF | Medium | 2013-08-02 | 0.05% | $8,390,000,000 | 165 | 1.00 | 19.23 | 2.47% | Quarterly | 22.27% | 8.95% | 11.24% | 8.56% | N/A |

| Vanguard | VDY | Vanguard FTSE Canadian High Dividend Yield Index ETF | Medium | 2012-11-02 | 0.22% | $2,360,000,000 | 52 | 0.95 | N/A | 2.64% | Monthly | 5.82% | 8.92% | 9.34% | 7.47% | N/A |

VDY vs XEI

VDY is the superior performing, less volatile, better value, more popular ETF than XEI which is older, more diversified and costs the same.

VDY vs VFV

VFV is the superior performing, less volatile, better value, more popular ETF than VDY which is older, more diversified and costs the same

VDY vs XDIV

VDY is the superior performing, less volatile, better value, more popular ETF than XDIV which is older, more diversified and costs the same.

VDY vs XIU

XIU is the superior performing, less volatile, better value, more popular ETF than VDY which is older, more diversified and costs the same.

VDY vs VCN

VDY is the superior performing, less volatile, better value, more popular ETF than VCN which is older, more diversified and costs the same.

VDY vs XDV

VDY is the superior performing, less volatile, better value, more popular ETF than XDV which is older, more diversified and costs the same.

VDY vs VCE

VDY is the superior performing, less volatile, better value, more popular ETF than VCE which is older, more diversified and costs the same.

VDY vs ZWC

VDY is the superior performing, less volatile, better value, more popular ETF than ZWC which is older, more diversified and costs the same.

VDY vs CDZ

VDY is the superior performing, less volatile, better value, more popular ETF than CDZ which is older, more diversified and costs the same.

VDY vs ZDV

VDY is the superior performing, less volatile, better value, more popular ETF than ZDV which is older, more diversified and costs the same.