More information about iShares Core MSCI Canadian Quality Dividend Index ETF (XDIV) is in its prospectus. Before investing, assess how the Exchange Traded Fund (ETF) aligns with your portfolio and risk tolerance. Remember that the value of ETFs can fluctuate, meaning you might lose money. They do not offer guarantees, and you may not recover the full amount of your investment. Additionally, purchasing or selling ETF units may incur commission fees, which can vary between brokerage firms. ETF market prices can also experience higher volatility, especially during the opening and closing of trading sessions. Even ETFs rated as low-risk may experience losses under certain market conditions.

When trading ETFs, it’s essential to understand the bid, ask, and bid-ask spread. The bid represents the highest price a buyer is willing to pay for ETF units, while the ask is the lowest price a seller is willing to accept. The bid-ask spread is the difference between these two prices. A narrower spread generally indicates higher liquidity, meaning you’re more likely to execute trades at expected prices. Always consider these factors carefully when making investment decisions.

XDIV ETF Review

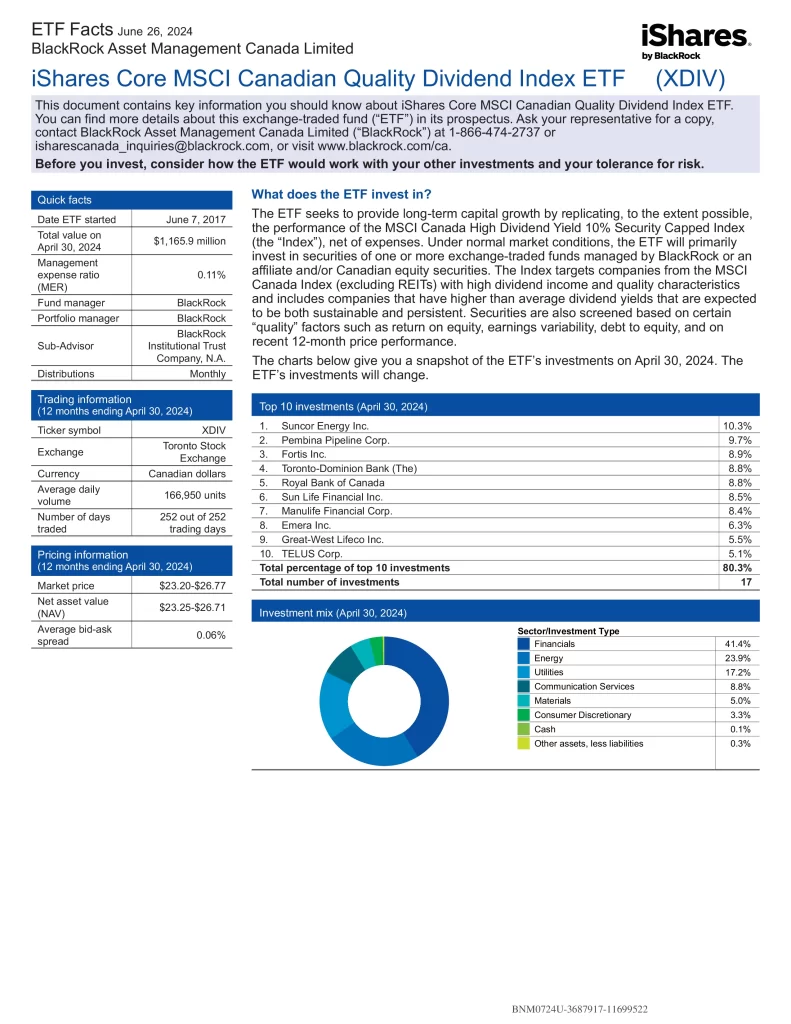

iShares Core MSCI Canadian Quality Dividend Index ETF (XDIV) seeks to provide long-term capital growth by replicating the performance of the MSCI Canada High Dividend Yield 10% Security Capped Index. The Index targets companies from the MSCI Canada Index (excluding REITs) with high dividend income and quality characteristics. It includes companies that have higher-than-average dividend yields that are expected to be both sustainable and persistent. Securities are also screened based on certain “quality” factors such as return on equity, earnings variability, debt to equity, and recent 12-month price performance.

- Low-cost portfolio of Canadian stocks with above-average dividend yields and steady or increasing dividends

- Selects securities with strong overall financials, including solid balance sheets and less volatile earnings

- Designed to be a long-term core holding

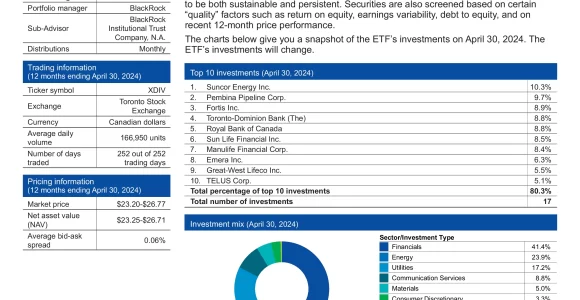

Top 10 XDIV Holdings

The top 10 holdings of XDIV account for 80.3% of the total fund which consists of 17 diversified investments. This table shows the investment names of the individual holdings that are subject to change.

| Ticker | Name | Weight |

|---|---|---|

| RY | Royal Bank of Canada | 9.30% |

| SLF | Sun Life Financial Inc. | 9.17% |

| ENB | Enbridge Inc. | 9.06% |

| MFC | Manulife Financial Corporation | 8.77% |

| TD | The Toronto-Dominion Bank | 8.73% |

| SU | Suncor Energy Inc. | 8.55% |

| PPL | Pembina Pipeline Corporation | 7.26% |

| FTS | Fortis Inc. | 6.84% |

| POW | Power Corporation of Canada | 5.97% |

| TOU | Tourmaline Oil Corp. | 5.13% |

XDIV Dividend History

XDIV currently has a yield of 4.24% and pays distributions monthly. Most ETFs will distribute net taxable income to investors at least once a year. This is taxable income if generated from interest, dividends and capital gains by the securities within the ETF. The distributions will either be paid in cash or reinvested in the ETF at the discretion of the manager. This information will be reported in an official tax receipt provided to investors by their broker.

| Ex-Dividend Date | Record Date | Payable Date | Dividend |

|---|---|---|---|

| Nov 21, 2024 | Nov 21, 2024 | Dec 2, 2024 | $0.10400 |

| Oct 28, 2024 | Oct 28, 2024 | Oct 31, 2024 | $0.10400 |

| Sep 24, 2024 | Sep 24, 2024 | Sep 27, 2024 | $0.10600 |

| Aug 27, 2024 | Aug 27, 2024 | Aug 30, 2024 | $0.10600 |

| Jul 26, 2024 | Jul 26, 2024 | Jul 31, 2024 | $0.10600 |

| Jun 25, 2024 | Jun 25, 2024 | Jun 28, 2024 | $0.10000 |

| May 22, 2024 | May 23, 2024 | May 31, 2024 | $0.10000 |

| Apr 24, 2024 | Apr 25, 2024 | Apr 30, 2024 | $0.10000 |

Is XDIV a Good ETF?

Quickly compare and contrast XDIV to other investments focused on Canadian equities by fees, performance, yield, and other metrics to decide which ETF fits in your portfolio.

| Manager | ETF | Name | Risk | Inception | AUM | MER | P/E | Yield | Beta | Distributions | Holdings | 5Y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BlackRock | XDIV | iShares Core MSCI Canadian Quality Dividend Index ETF | Medium | 2017-06-07 | $1,871,598,476 | 0.11% | 14.90 | 4.24% | 0.79 | Monthly | 17 | 11.92% |

| BlackRock | XDV | iShares Canadian Select Dividend Index ETF | Medium | 2005-12-19 | $1,788,221,831 | 0.55% | 11.82 | 4.25% | 0.92 | Monthly | 31 | 9.71% |

| BlackRock | XEI | iShares S&P/TSX Composite High Dividend Index ETF | Medium | 2011-04-12 | $1,730,180,828 | 0.22% | 11.72 | 4.87% | 0.91 | Monthly | 75 | 10.22% |

| BlackRock | XIC | iShares Core S&P/TSX Capped Composite Index ETF | Medium | 2001-02-16 | $14,888,189,750 | 0.06% | 19.11 | 2.41% | 1.00 | Quarterly | 220 | 11.88% |

| BlackRock | XIU | iShares S&P/TSX 60 Index ETF | Medium | 1999-09-28 | $15,103,481,727 | 0.18% | 20.07 | 2.82% | 1.00 | Quarterly | 61 | 12.02% |

| BMO | ZDV | BMO Canadian Dividend ETF | Medium | 2011-11-21 | $1,134,600,000 | 0.39% | 19.36 | 3.76% | 0.93 | Monthly | 53 | 10.02% |

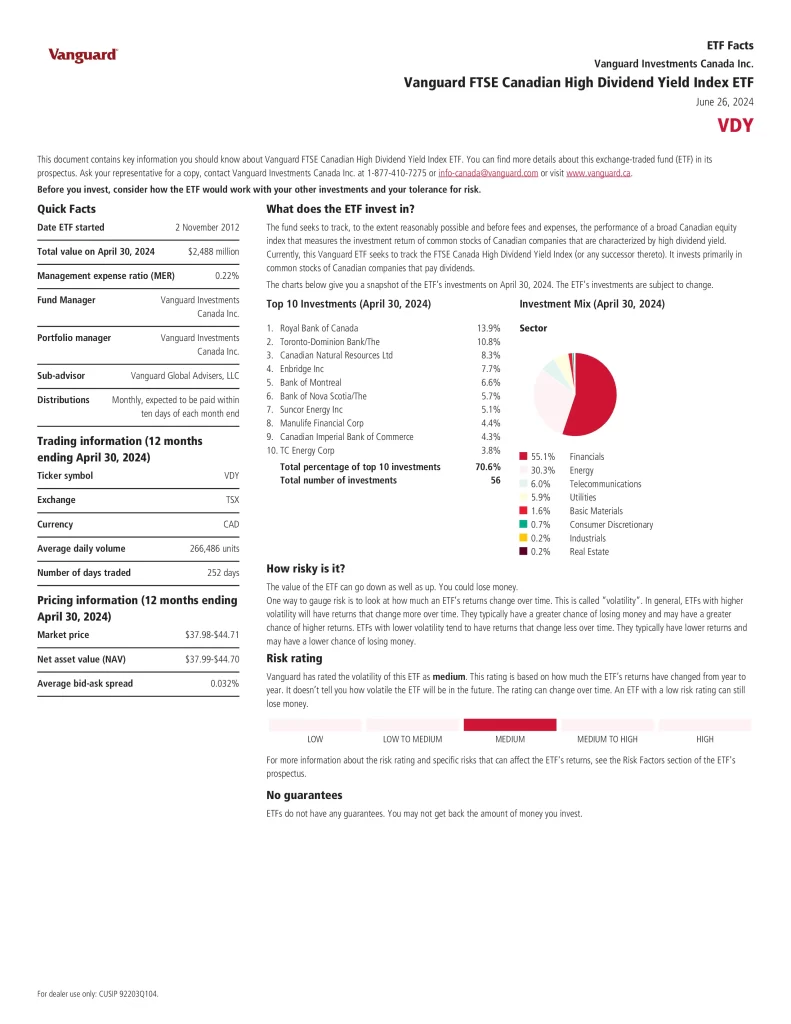

| Vanguard | VDY | Vanguard FTSE Canadian High Dividend Yield Index ETF | Medium | 2012-11-02 | $3,320,000,000 | 0.22% | 12.45 | 4.25% | 0.94 | Monthly | 56 | 12.47% |

XDIV vs VDY

VDY is the superior performing, older, more popular, better value, higher yielding, more diversified ETF than XDIV which is less expensive and less volatile.

XDIV vs XEI

XDIV is the superior performing, more popular, less expensive, less volatile ETF than XEI which is older, better value, higher yielding, and more diversified.

XDIV vs XDV

XDIV is the superior performing, more popular, less expensive, less volatile ETF than XDV which is older, better value, higher yielding, and more diversified.

XDIV vs XIU

XIU is the superior performing, older, more popular, less expensive, less volatile and more diversified ETF than XDIV which is better value and higher yielding.

XDIV vs XIC

XDIV is the superior performing, better value, less volatile ETF than XIC which is older, more popular, less expensive, higher yielding, and more diversified.

XDIV vs ZDV

XDIV is the superior performing, more popular, less expensive, better value, higher yielding, less volatile ETF than ZDV which is older and more diversified.

Conclusion

iShares Core MSCI Canadian Quality Dividend Index ETF (XDIV) is a convenient, low-cost way to invest in Canadian large-cap value stocks. The Fund’s return may not match the return of the underlying index. Growth stocks tend to be more sensitive to changes in their earnings and can be more volatile. Investments focused on a particular sector, such as healthcare, are subject to greater risk, and are more greatly impacted by market volatility than more diversified investments. A value style of investing is subject to the risk that the valuations never improve or that the returns will trail other styles of investing or the overall stock markets. Beta is a measure of risk representing how a security is expected to respond to general market movements.